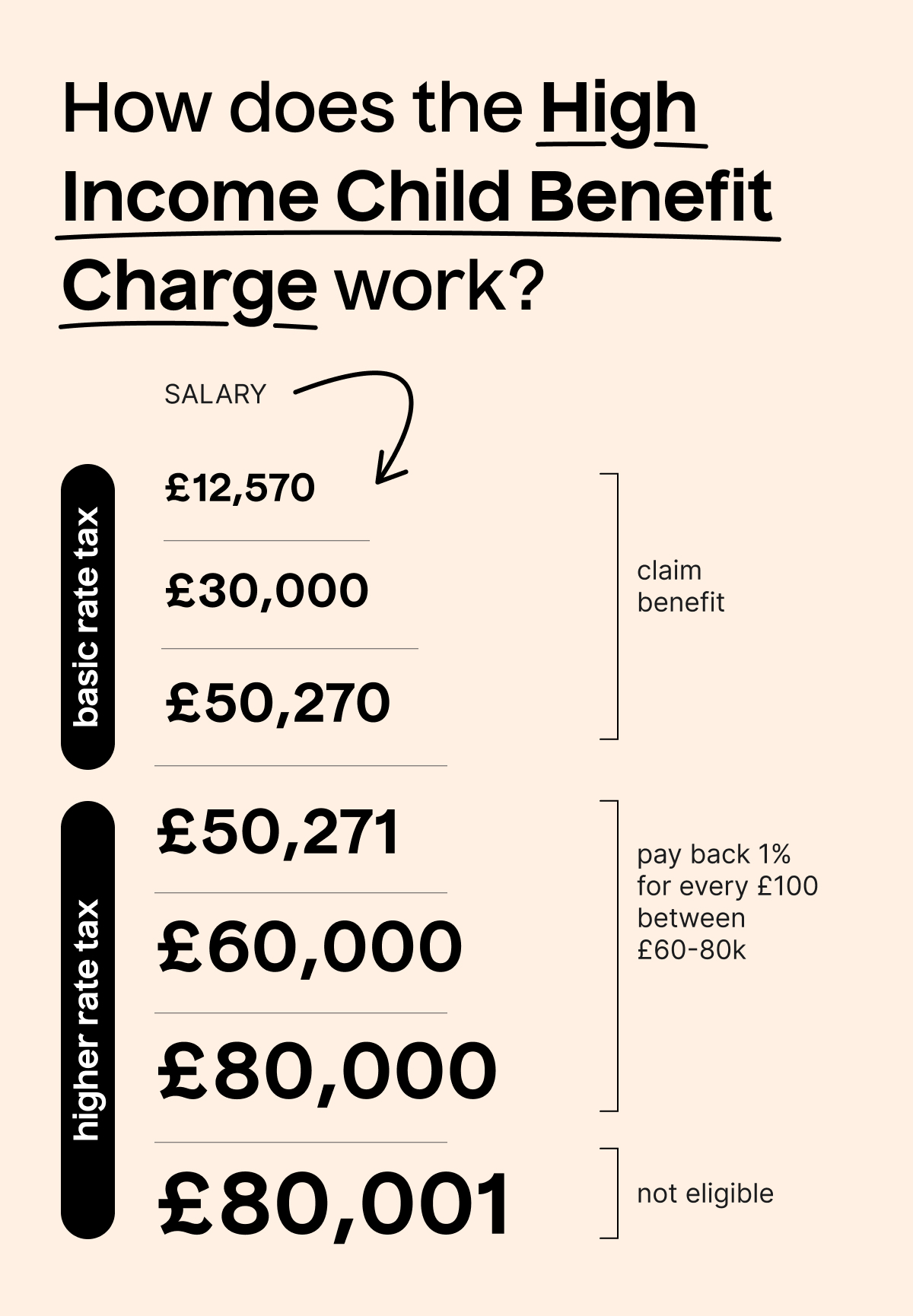

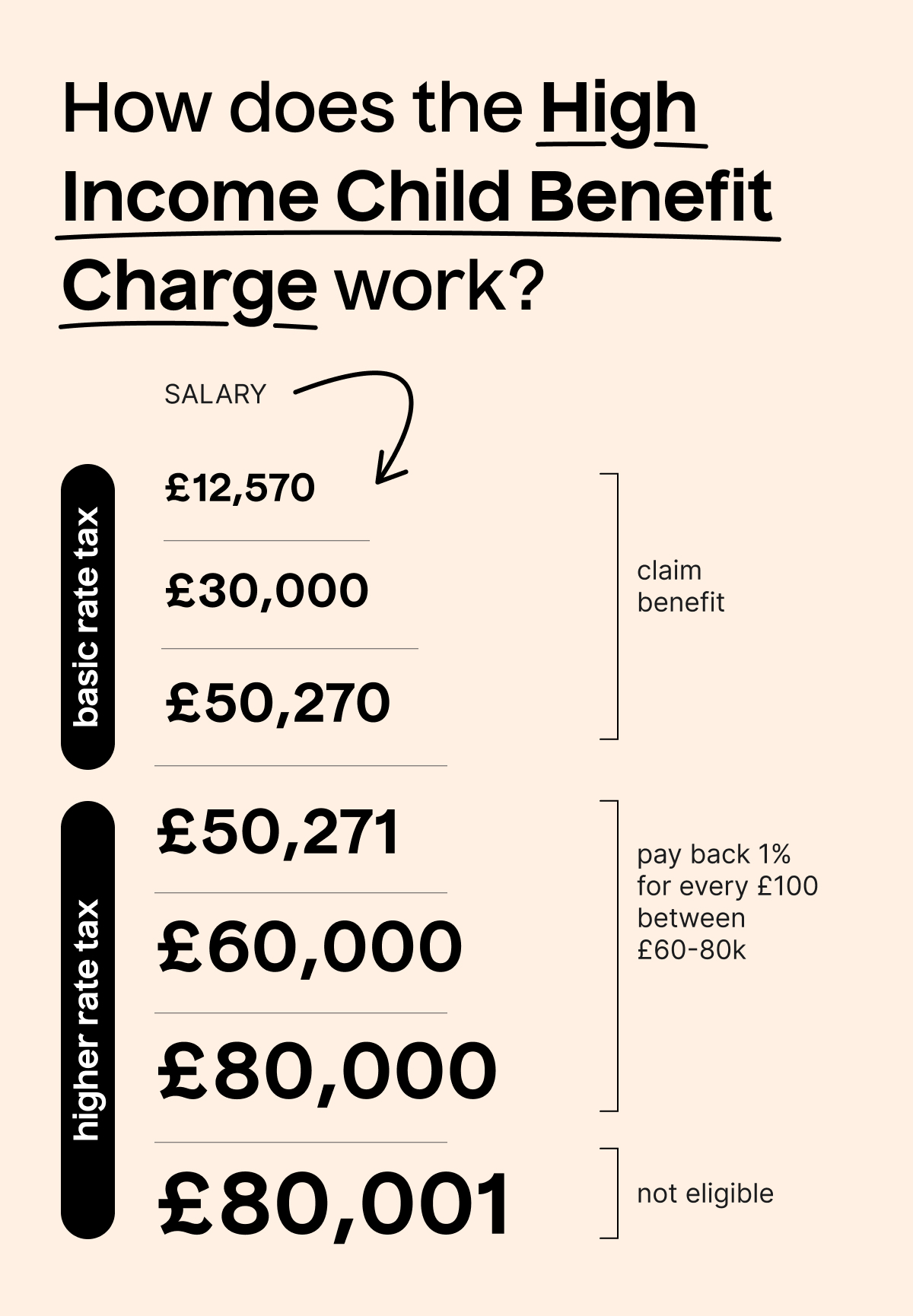

The High Income Child Benefit Charge (HICBC) is a special tax charge that you have to pay if either you or your partner earn over £60,000 (in the 2024/25 tax year) and you’ve also been claiming Child Benefit.

You also have to pay HICBC if someone else gets Child Benefit for a child living with you and they contribute at least an equal amount towards the child’s upkeep. It doesn’t matter if the child living with you is not your own.

How do I know if I’ll be charged?

The best way to work out whether you need to pay the high-income child benefit charge is to see if your income is over the threshold. To do this, you need to work out your ‘adjusted net income.’ Your adjusted net income is your total taxable income. Included in this are things like your salary, rental income, and any additional income from side gigs.

Still unsure if you have to pay the HICBC? Don’t worry! You can use our Child Benefit tax calculator to work out if you need to do anything.

Working out who pays the High Income Child Benefit Charge

If both you and your partner have incomes that are over the £50,000 threshold, then whoever has the higher income is responsible for paying the tax charge.

The term ‘partner’ can mean multiple types of relationships in the eyes of HMRC. To them, your partner means someone you’re not permanently separated from, who you’re married to, in a civil partnership with or living with as if you were.

If your income is over the threshold

If you are affected by the High Income Child Benefit Charge, you can either:

- Stop receiving the benefit altogether

- Fill in a Self Assessment tax return to pay what you owe

- Continue claiming the benefit but choose to not have it paid to your account. This way you will still get the other advantages (like State Pension credits, etc.) but without having to do a Self Assessment