The Child Benefit is a tax-free payment available for parents or anyone responsible for bringing up a child. You’re eligible to claim it if you bring up a child who’s either under 16 or under 20 and in education/training. Be aware though that only one parent/guardian can claim the benefit per child.

What counts as education/training?

Here’s a list of HMRC’s approved education and training programmes:

- A levels, Pre-U, International Baccalaureate

- T levels

- Scottish Highers

- NVQs and other vocational qualifications up to level 3

- Home education – if it started before your child turned 16

- Home education – if your child has special needs

- Traineeships in England

- Foundation Apprenticeships or Traineeships in Wales

- Employability Fund programmes in Scotland

- United Youth Pilot (if started before 1 June 2017)

- PEACE IV Children and Young People 2.1

- Training for Success in Northern Ireland

How much is Child Benefit

The amount that you get is subject to change depending on the tax year. In the 2023/24 tax year, you could claim £24 a week for your first child, and £15.90 a week for each of your other children. In 2024/25, the figures are £25.60 per week for your first child, £16.95 for each of your other children.

You also get National Insurance credits that count towards your state pension.

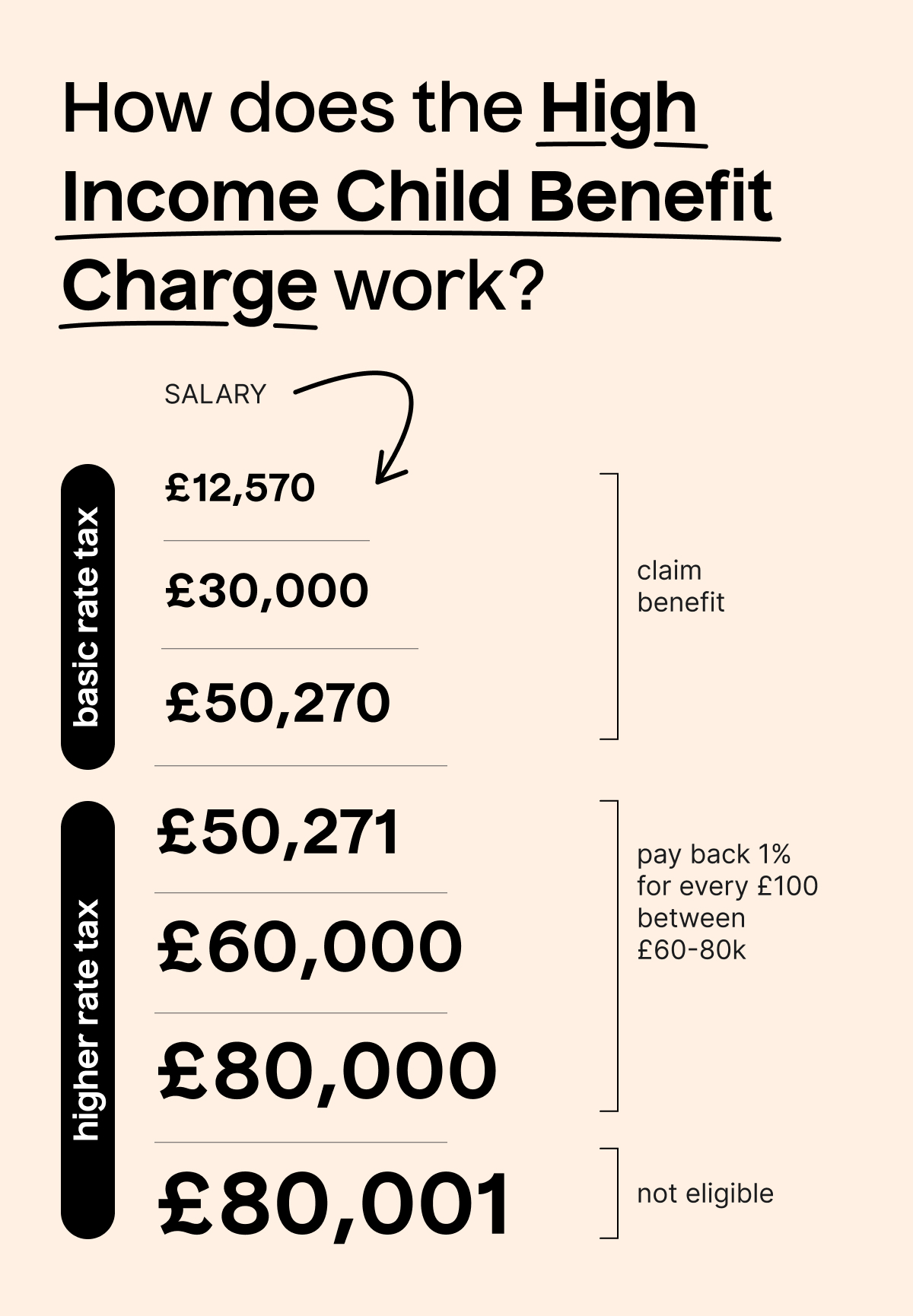

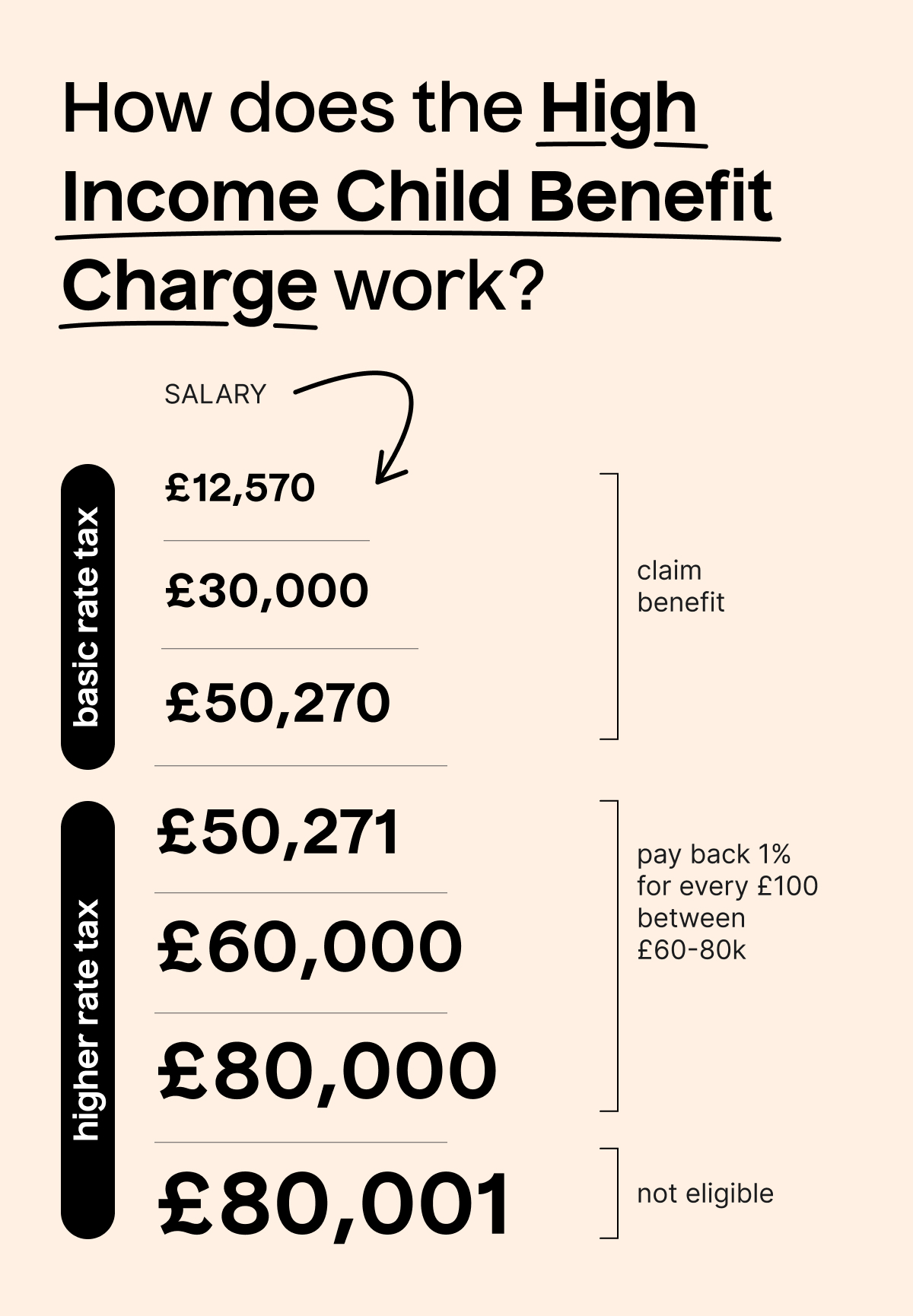

If you (or your partner) earn over £60,000 a year, you will need to pay some of it back. If you earn £80,000+, you’ll need to pay the whole thing back. Sob.

This charge is called the High Income Child Benefit Charge. To calculate how much you might owe back, use our Child Benefit calculator.

How do I claim Child Benefit?

To claim child benefit, you need to fill in this form and send it to the Child Benefit Office.

What if my situation changes?

You should contact the Child Benefit Office if any of the following things happen to your child:

- Name change

- Gender records change

- Starts 24-hours per week or more in paid work

- Claims benefits

- Moves away for at least 8 weeks

- Moves abroad for more than 12 weeks

- Is admitted to hospital for 12 weeks or more

- Goes to prison for 8 weeks or more

- Gets hitched (married or civil partnership)

This list isn’t exhaustive so take a look at the HMRC website for more details of Child Benefit change of circumstances.