What is the High Income Child Benefit Tax Charge?

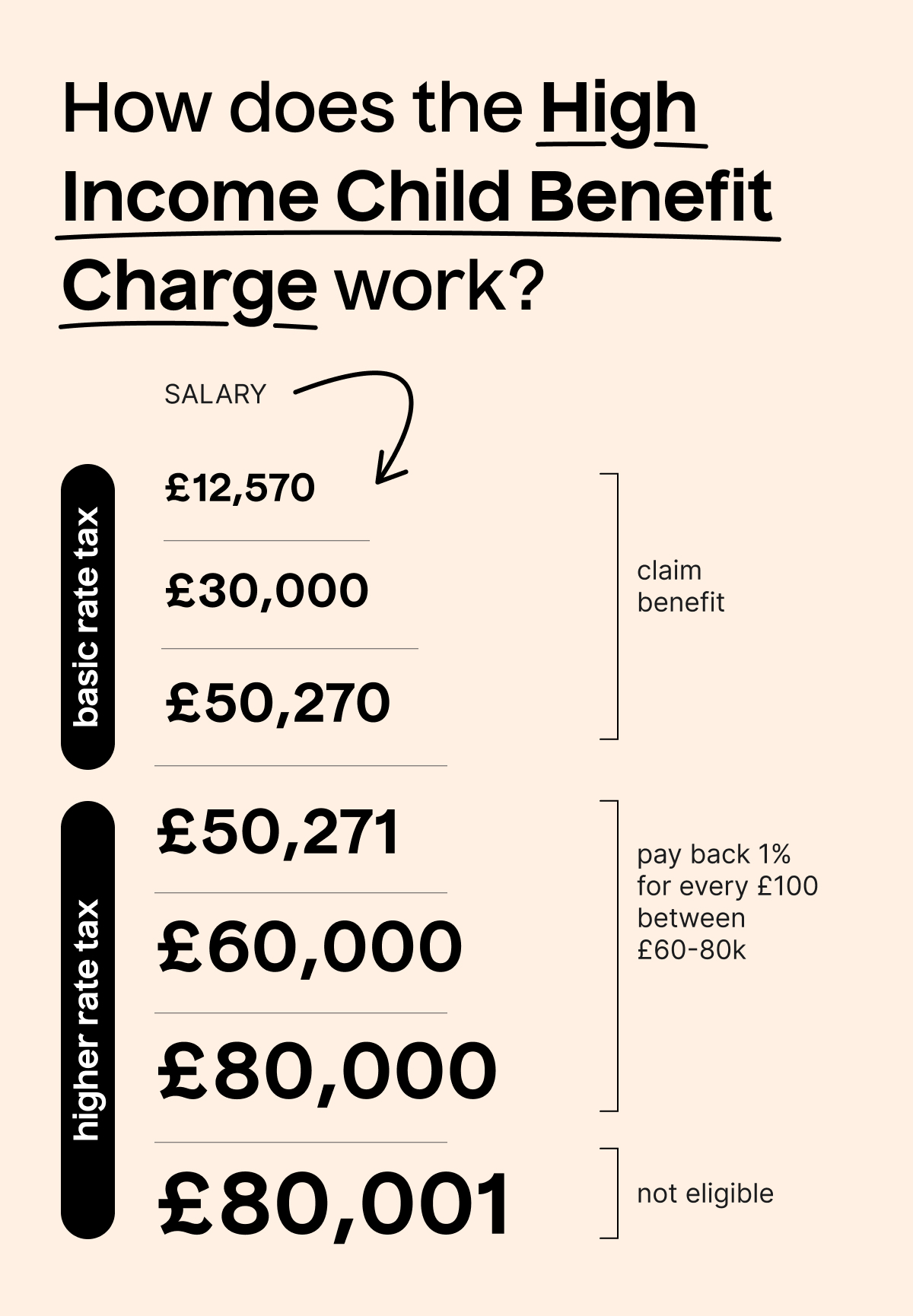

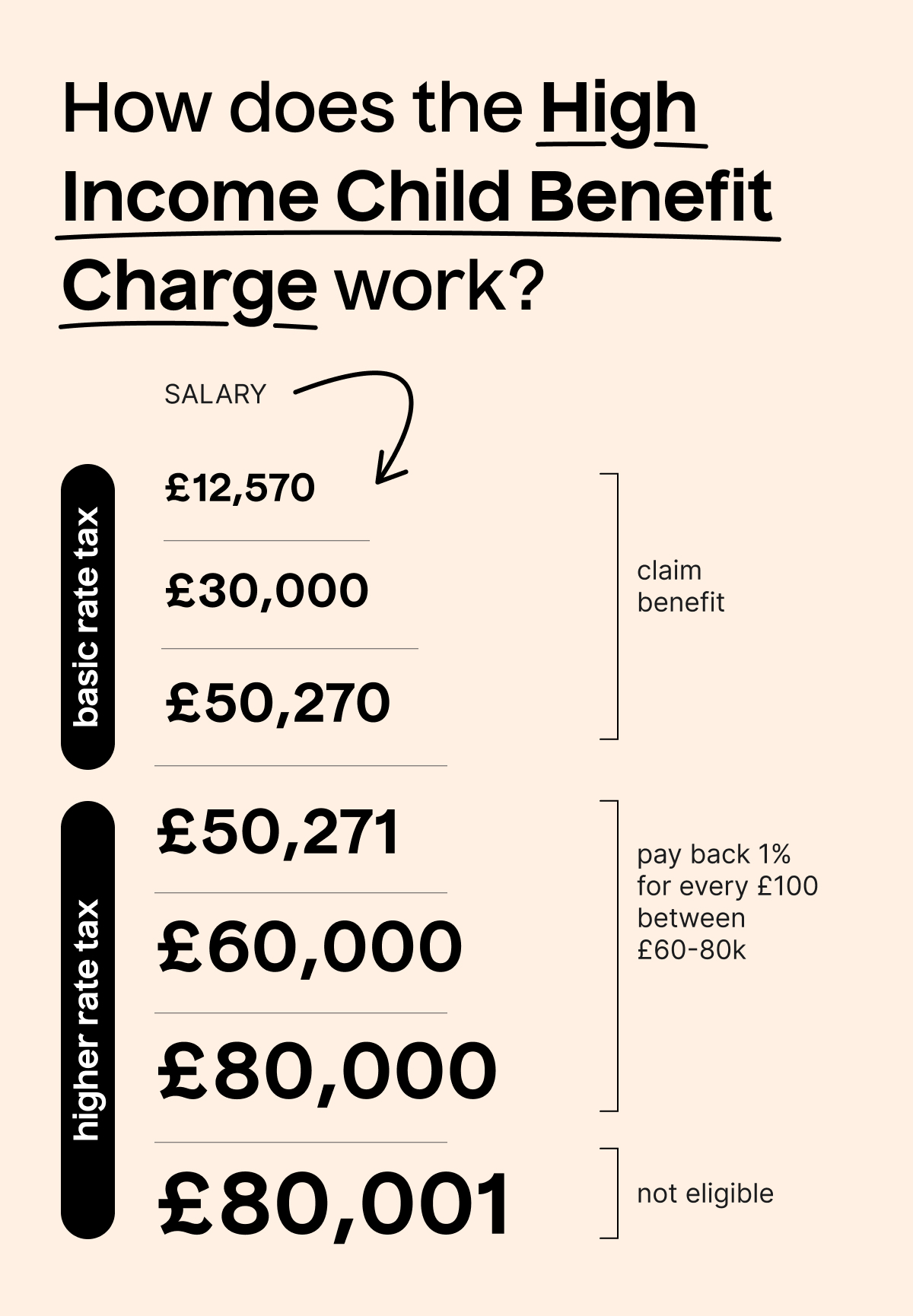

We’re glad you asked. Basically, when you earn more than £60,000 and you’re claiming the benefit, you may have to return some or all of it 😱

This is because in 2013, the government deemed those earning £50,000 or more a year to be high earners and so less in need of the benefit. Back in 2013, the threshold to be a higher rate taxpayer was £42,475. Today in 2024, you have to earn £50,270 to be taxed on the higher rate. In the Spring Statement 2024, Jeremy Hunt announced that the threshold to return your child benefit would go up to £60,000 – £80,000, which is more in line with inflation and today’s salaries.

Be aware though that if you owe money, payments can be backdated to 2013.

What makes you liable?

Here are the scenarios where you might owe the HICBC:

- One partner in a household earns more than £60,000

- As the highest earner in a household, it’s your responsibility to declare your liability – HMRC won’t notify you themselves

- The children don’t need to be yours to be liable

- If you move in with a new partner, you become liable

- You can be chased even if you temporarily move in with a new partner then split up

What can be done?

You can first of all opt out of receiving the benefits. It won’t get rid of your bill completely but it will stop charges from being added. Also there was a recent case won against HMRC that ruled that they were not allowed to backdate payments for one individual. So there may be space to fight back.

Get professional help

Book a 1-1 tax consultation with an accredited accountant to make sure you’re declaring your liability properly and to see if there are other, more tax-efficient ways you can claim the benefit if you’re eligible.

Book now

How much is the benefit?

The benefit is £25.60 per week for your oldest child and then £16.95 a week for each of your other children. Use our calculator to work out what you can claim and what tax charge you may potentially owe back.

How do you claim?

To claim, you’ll need to do this through HMRC’s website using their claim form. It can be done as soon as your child is born or comes to live with you. It can take up to 16 weeks, and sometimes longer, for HMRC to process your claim.

Who can make the claim?

Remember, only one person can claim this benefit. If you aren’t working or earning less than £190 a week and you’re the person claiming, you’ll get National Insurance credits towards your state pension.

Making a claim for the first time?

You can make a claim by filling out the CH2 claim form. It can be filled both by hand or online, whichever you prefer.