Gift Aid is a tax incentive that allows charities to claim back Income Tax (at the basic rate) on donations made through the scheme.

For every £1 that you donate through Gift Aid, the charity actually receives £1.25. This happens as long as the donation comes from your own funds. Essentially, you’re increasing the donation amount by 25% (if you’re a basic rate UK taxpayer).

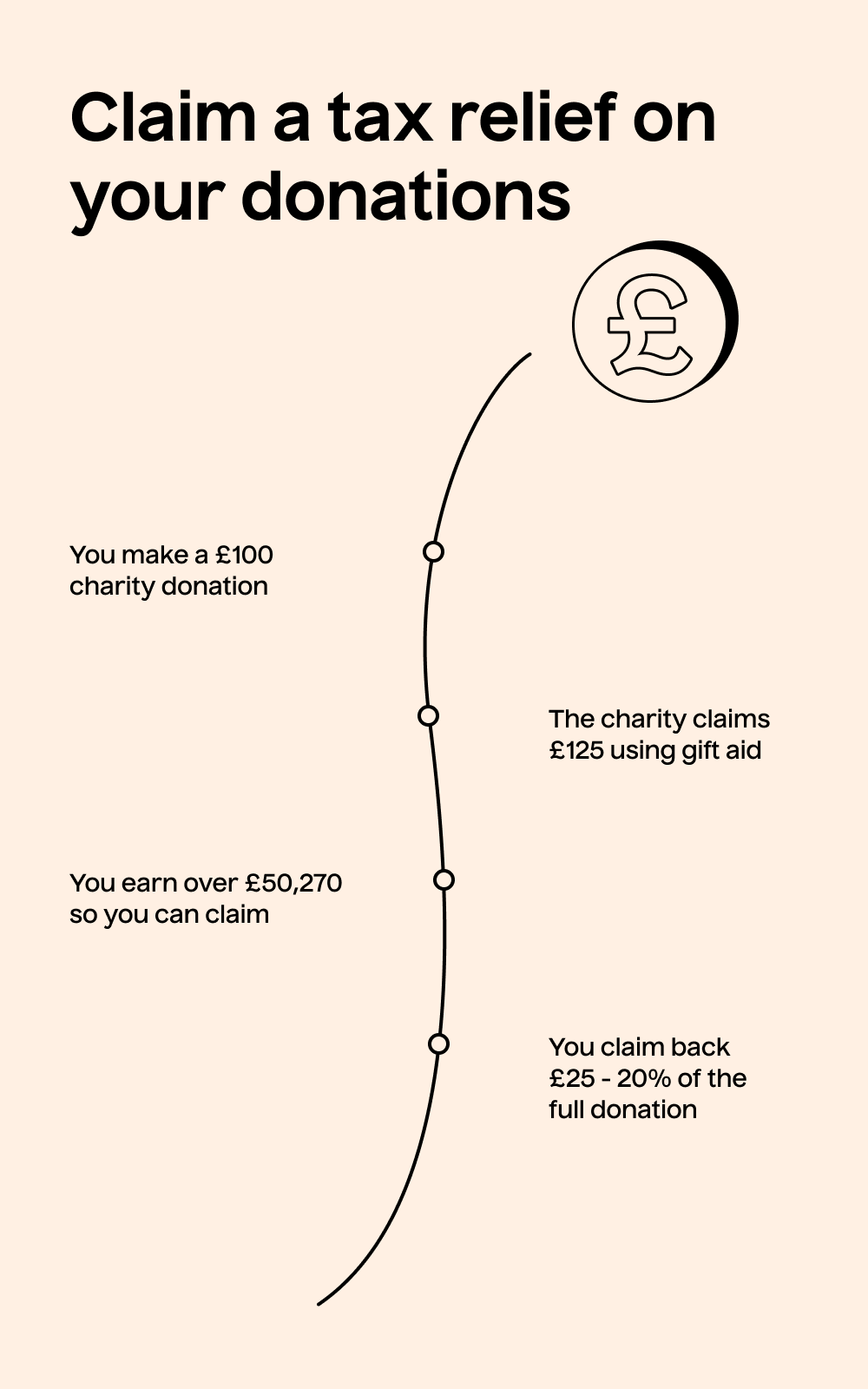

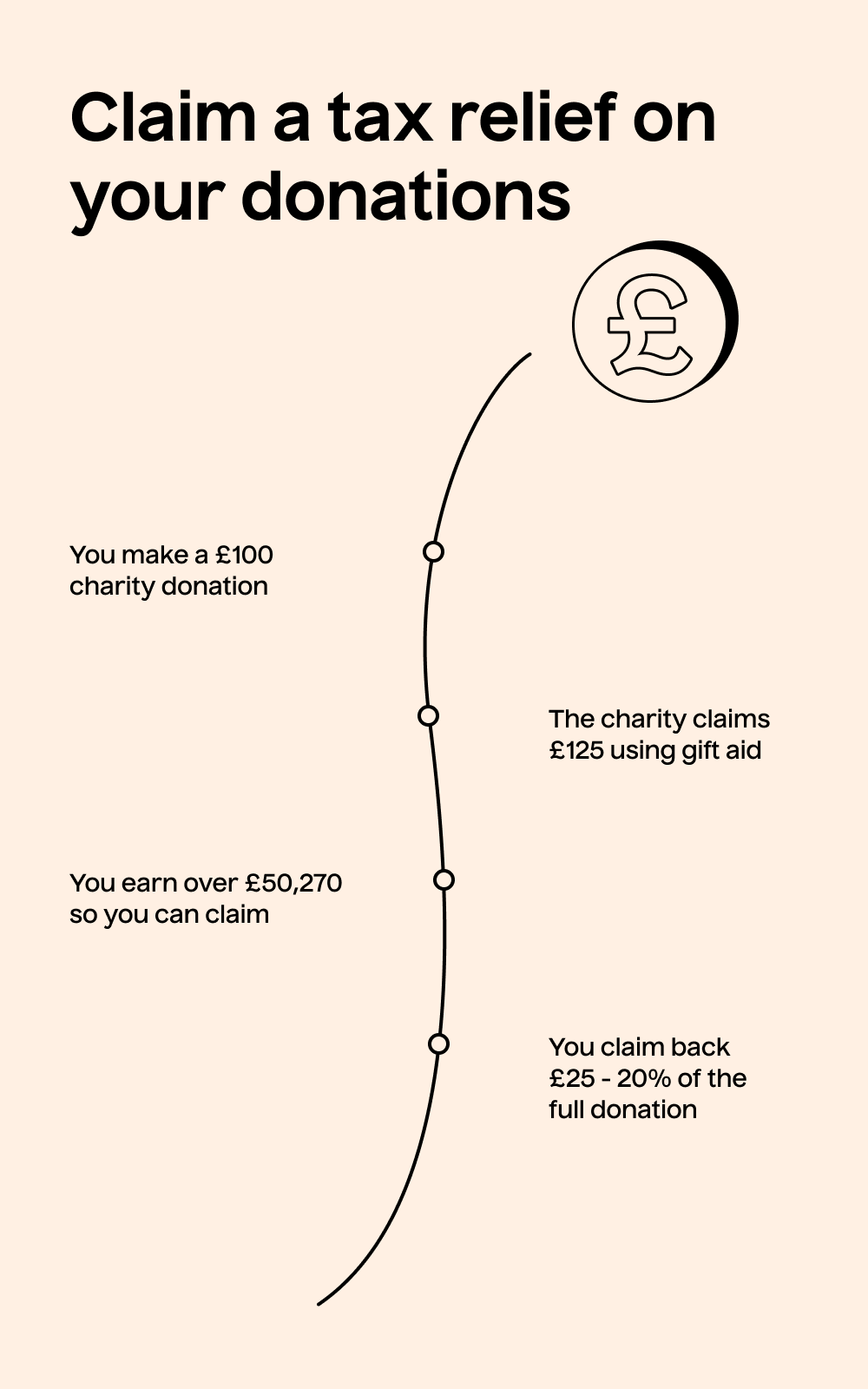

If you’re a higher rate taxpayer (meaning you earn over £50,270) or additional rate taxpayer (earning over £125,140), then you can file a Self Assessment and claim Income Tax relief for the difference between your rate of tax (40% or 45%) and the basic rate (20%).

How do I know if I can claim Gift Aid?

Most employed people are eligible to claim Gift Aid, but there are a few exceptions to this rule. A charity can only claim Gift Aid when:

- You make a donation from your own funds

- You’ve paid UK Income Tax and/or Capital Gains Tax during that tax year

- The amount of tax you pay is at least equal to the value of Gift Aid

Your donations will only qualify if they’re not more than four times what you paid in tax in that tax year (from 6th April to 5th April). If you’re self-employed, you’re still eligible to claim Gift Aid on your donation. It’s treated in the same way as gifts from employed individuals: paid from taxed income, and the charity will claim the relief on qualifying donations.

An example of how it works

Let’s say you’re a basic-rate UK taxpayer and you want to donate £100 to the charity Macmillan Cancer Support. You fill out the donation form and tick the Gift Aid box.

Your £100 will be treated as a gift that has been made after-tax (deducted at the basic tax rate) by HMRC. So, the total value of your gift would be £125. The charity can then claim this 20% back on your donation. £125 x 20% = £25