The Higher Rate tax band is a tax rate through which you pay Income Tax. You pay the higher rate on the portion of your income between £50,270 to £125,140. The tax rate itself is 40% for this portion of your taxable income.

What is a tax band?

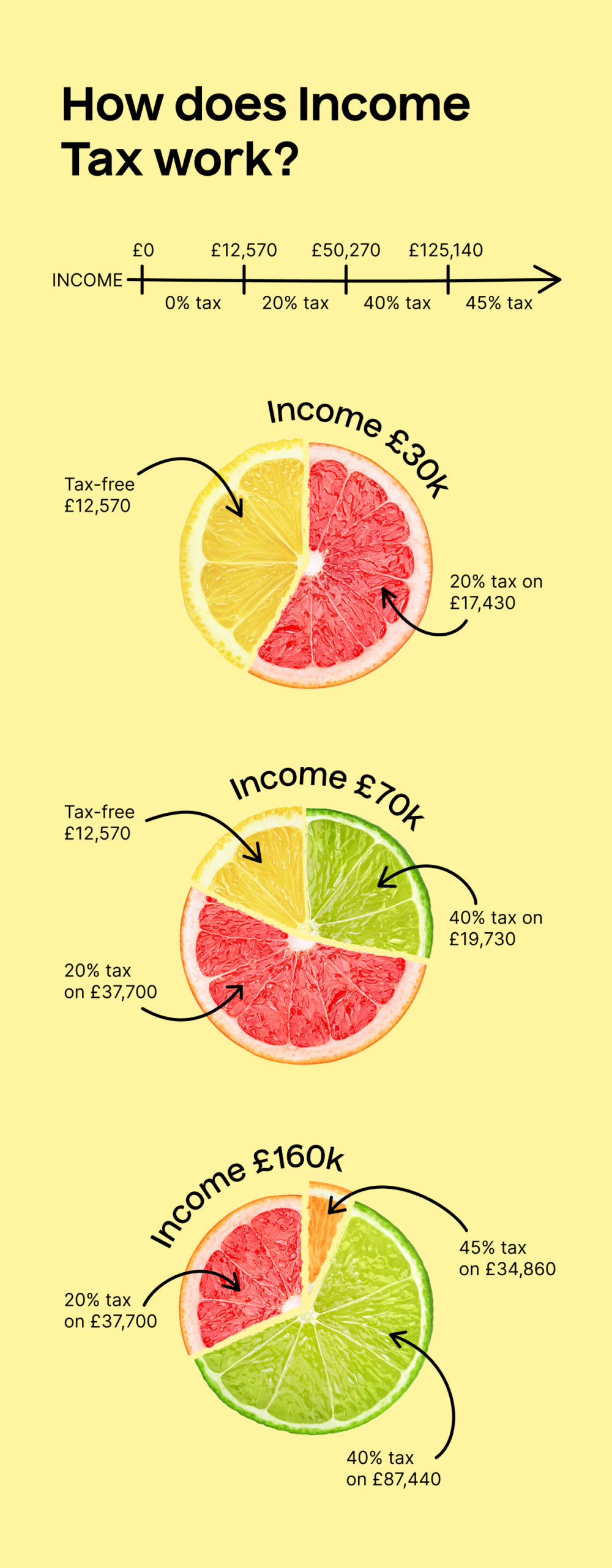

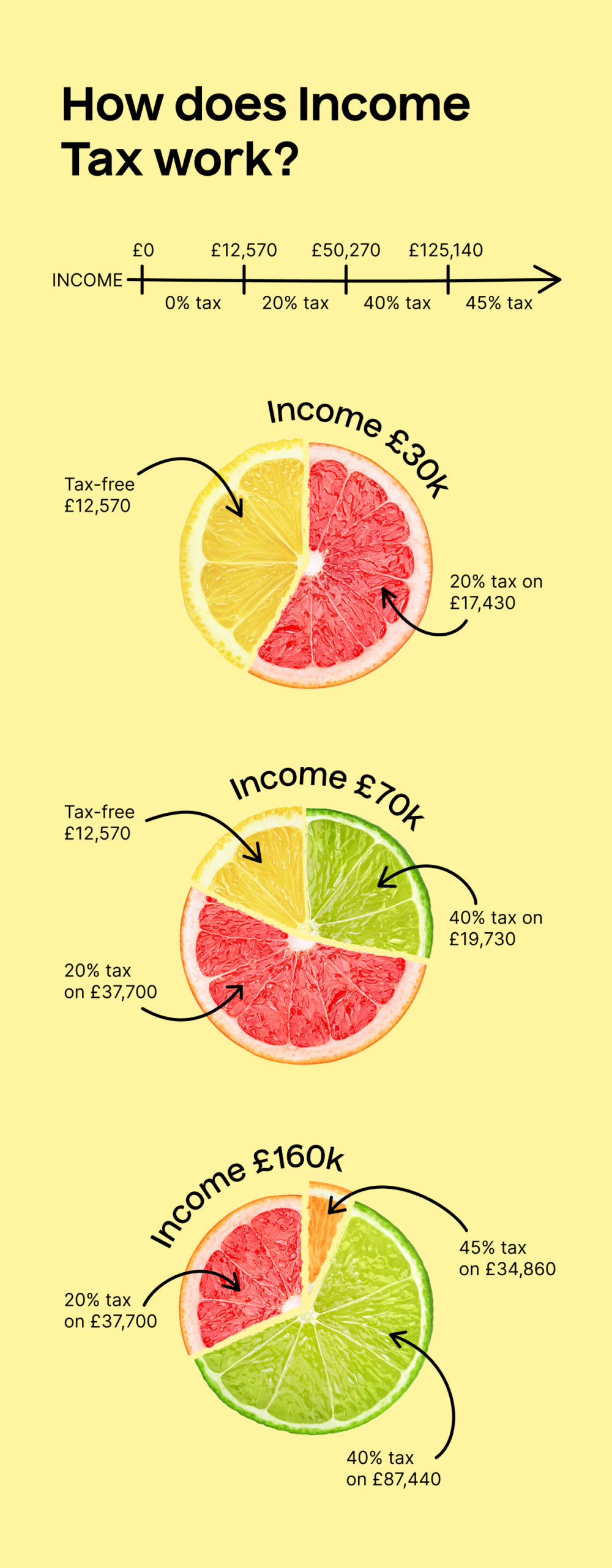

To understand tax bands, you should first understand how HMRC looks at your income. Use the below table to take a look at how it’s split in the 2024/25 tax year:

| Income |

Tax rate |

|

| Up to £12,570 |

0% |

Personal Allowance |

| £12,571 to £50,270 |

20% |

Basic Rate |

| £50,271 to £125,140 |

40% |

Higher Rate |

| over £125,141 |

45% |

Additional Rate |

When you earn less than £12,570 every year, this income is tax-free. It’s known as the Personal Allowance. Any income that you earn above this is taxed at the above rates. But it’s important to remember that the rate that you’re taxed is segmented.

What does this mean? Here’s an example based on earning £64,000 per year:

- £12,570 – tax-free

- £37,700 – 20%

- £13,730 – 40%

Use our Income Tax calculator to try it in action.

Here’s our visual take on Income Tax 👇

Who pays Higher Rate tax?

You pay the above tax rates whether you’re employed and earning a salary or self-employed and earning money from multiple gigs.

When you’re self-employed, you pay via a tax return.

More important info about tax bands

- If you earn over £150,000, you had to file a Self Assessment tax return until 2024/25

- Once you earn over £100,000, your tax-free Personal Allowance decreases by £1 for every £2 that you earn above £100,000

- Your income between £100,000 and £125,140 is taxed (unofficially) at 60%