The additional rate tax is the top rate of Income Tax in the UK. You pay this when you earn more than £125,140 per year.

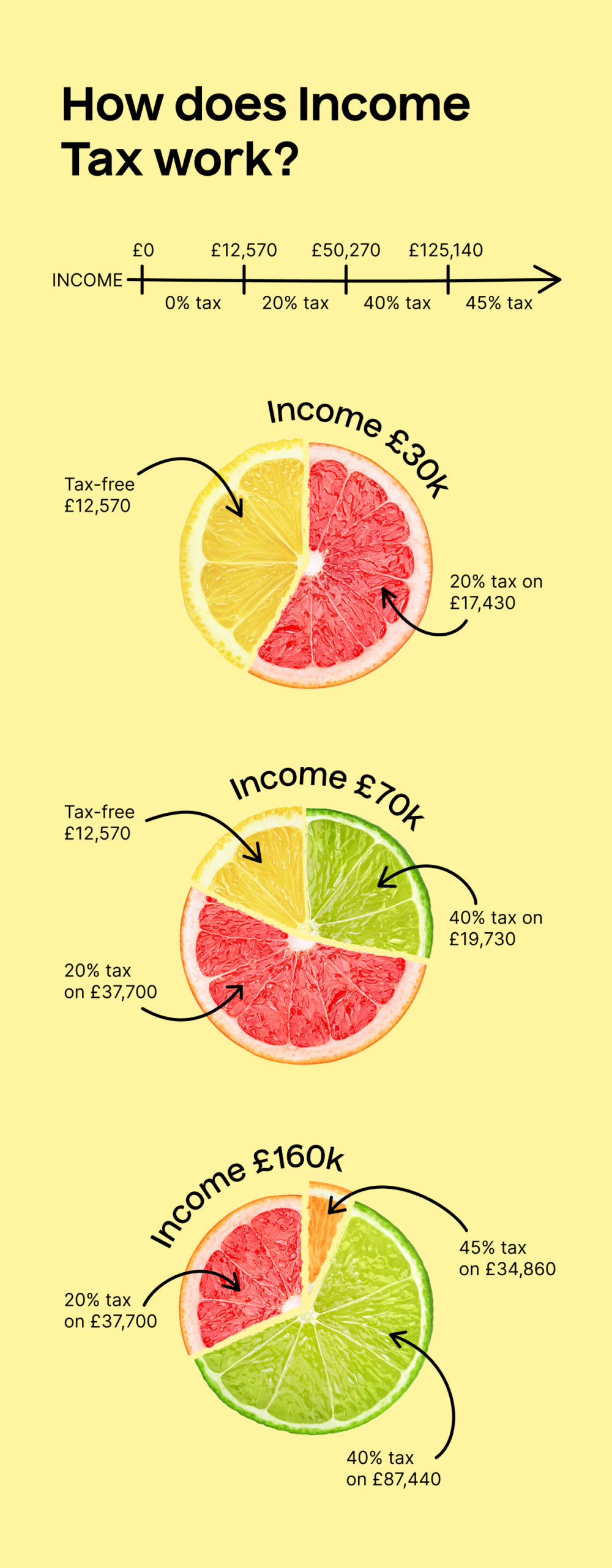

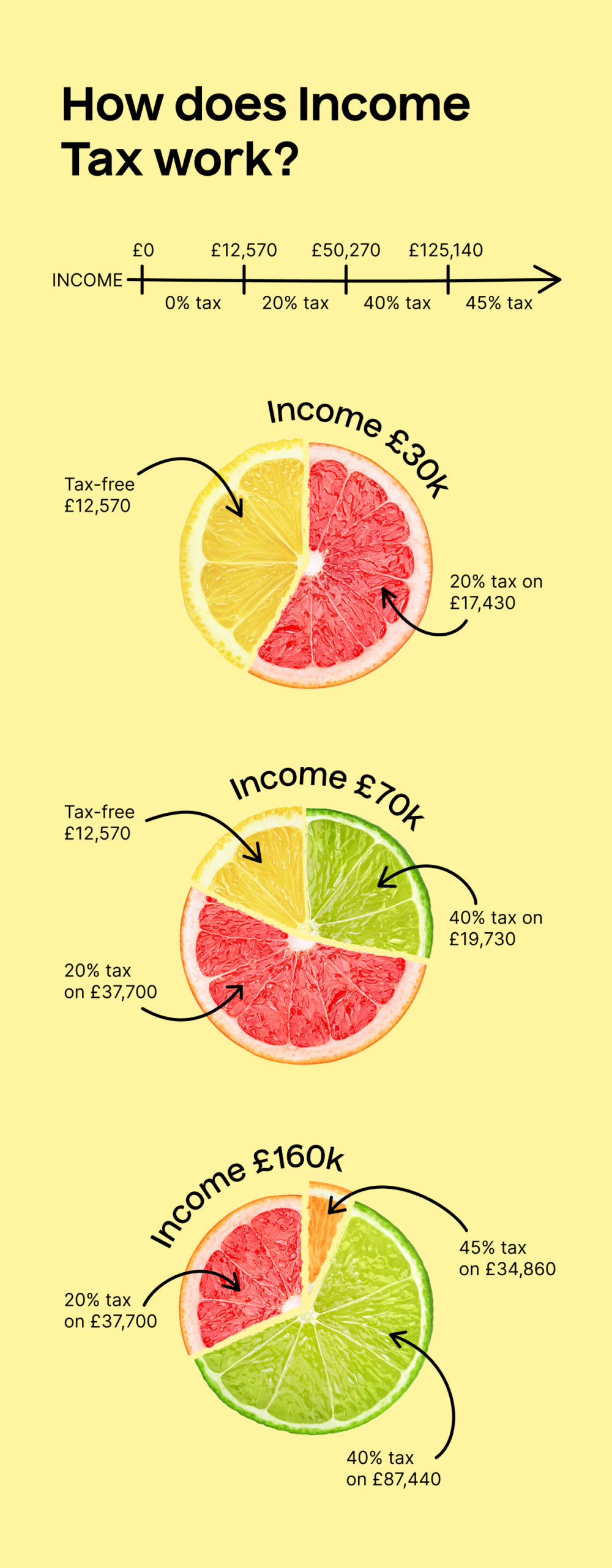

How does Income Tax work?

Income Tax is paid by everyone in the UK who earns more than £12,570 per year. The first £12,570 is Income Tax-free and known as the Personal Allowance. However, when you earn more than £100,000 per year, you gradually lose your eligibility for this allowance, £1 at a time.

Take a look at the Income Tax rates for the 2024/25 tax year:

| Income |

Tax rate |

|

| Up to £12,570 |

0% |

Personal allowance |

| £12,571 to £50,270 |

20% |

Basic rate |

| £50,271 to £125,140 |

40% |

Higher rate |

| Over £125,0140 |

45% |

Additional rate |

Additional tax rate in action

In the 2024/2025 tax year, the additional rate is 45% on earnings above £125,140. So if your annual income is £170,000, for example, you’re an additional rate taxpayer. This means that you pay 45% tax on your income above £125,140.

In this case, that’s broken down like this:

- 45% on £44,860

- 40% on £99,730

- 20% on 50,270

If you’re in Scotland, the additional rate tax is actually 47% on earnings above the same £125,140 limit.

When do I pay 60% tax?

When you earn more than £100,000, you start to lose your entitlement to the Personal Allowance. You lose it by £1 for every £2 that you earn over £100k. However, you’re not taxed at 45% until you earn over £125,140 which means that between £100,000 and £125,140, you’re taxed an extra 20% on the Personal Allowance that you’re losing. This can be confusing to get your head around, so take a look at our guide on the tax implications of earning over 100k.