The basic tax rate (BR) is the rate of Income Tax that you pay when you earn between £12,571 and £50,270. This rate is accurate as of the 2024/25 tax year.

How much is the basic tax rate?

If your income is between £12,571 and £50,270, you’ll pay 20% Income Tax, known as the basic tax rate, in England and Wales.

Check out our Income Tax calculator for this years breakdown.

How does it work?

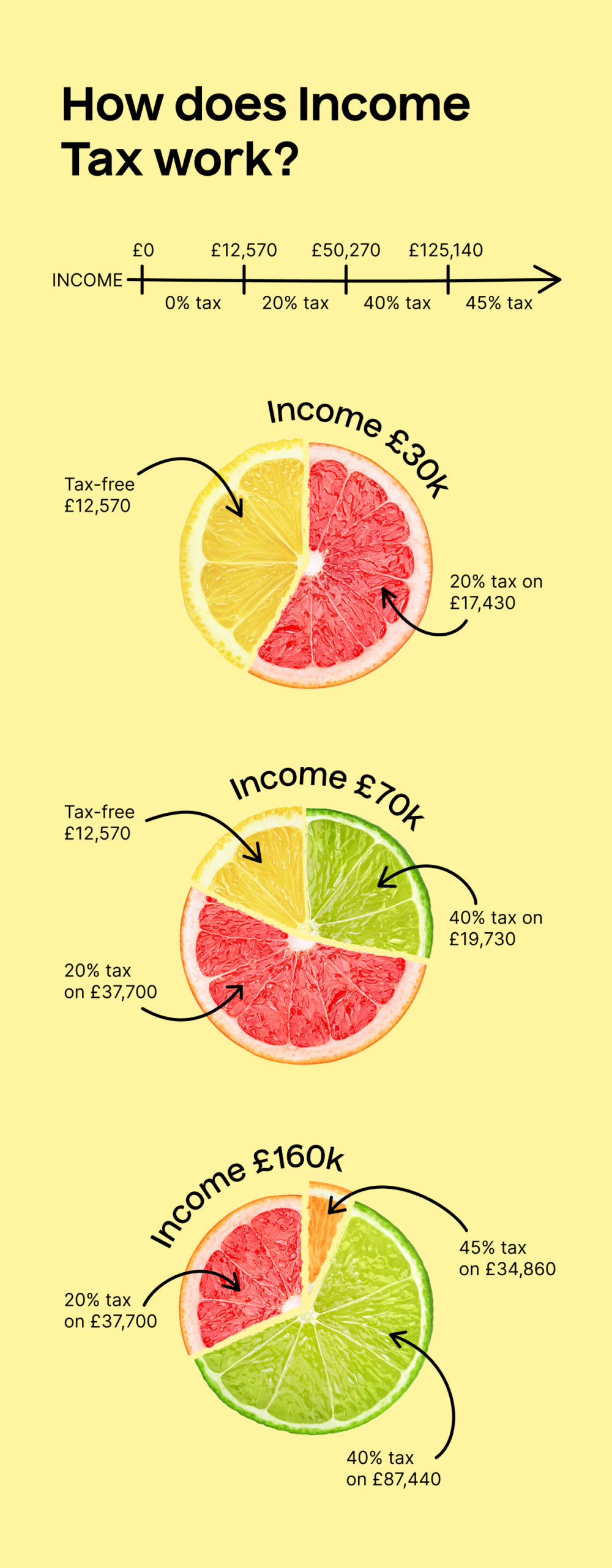

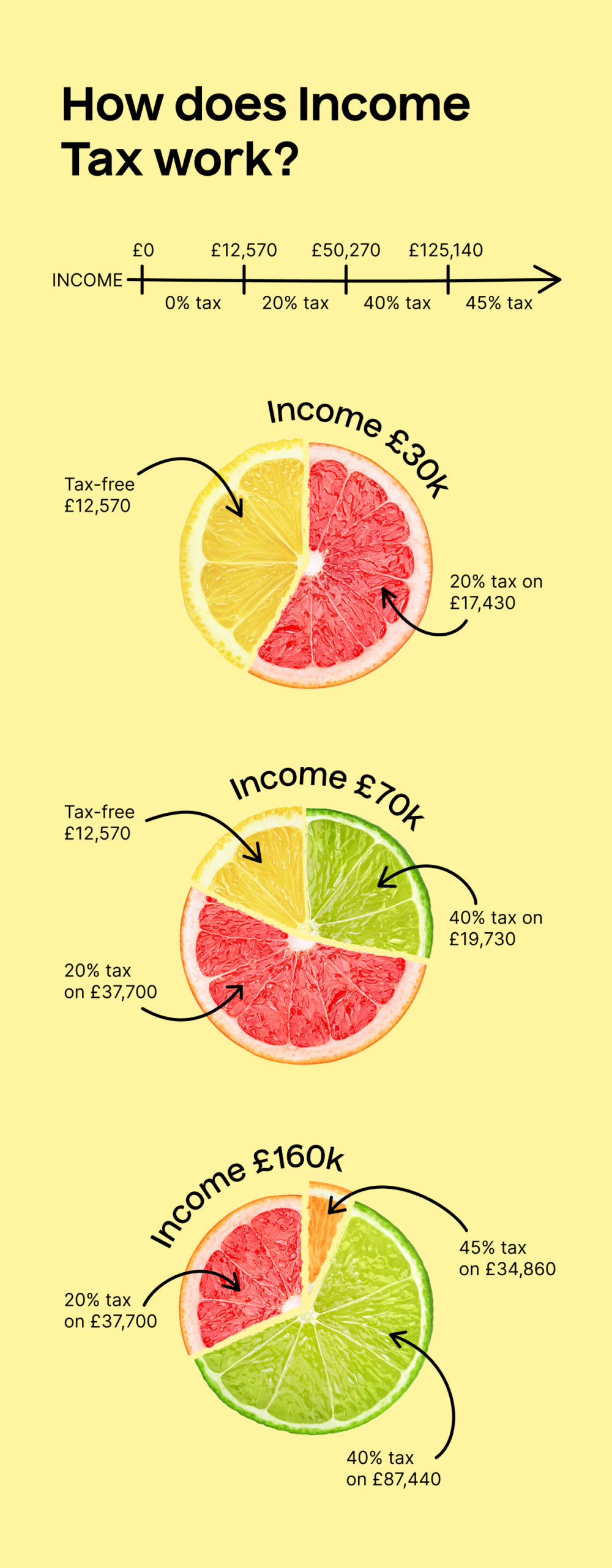

The key thing to remember about basic tax is that you only pay it on your taxable income. Yes, it sounds obvious, but it can be a little confusing at first. Take a look at the current rates of Income Tax:

| Income |

Tax rate |

|

| Up to £12,570 |

0% |

Personal allowance |

| £12,571 to £50,270 |

20% |

Basic rate |

| £50,271 to £125,140 |

40% |

Higher rate |

| over £125,141 |

45% |

Additional rate |

Let’s look at an example:

- If you earn £30,000, you owe 20% on £17,729 of your income

- If you earn £55,000, you owe 20% on £37,699; 40% on £4,730

The basic tax rate only applies to the portion of your income within the basic tax band. If you earn more, you’ll pay additional tax on the higher income brackets. So if you earn, say, £155,000, you’ll be taxed at three different rates: the basic rate, the higher rate and the additional rate.

| I earn £155,000 – how am I taxed? |

| £50,270 |

20% |

| £99,730 |

40% |

| £30,860 |

45% |

What’s the Personal Allowance?

The Personal Allowance is the income that you can earn tax-free in the UK. That means that when you earn less than £12,570, you aren’t liable to pay Income Tax. You may also be wondering why the Personal Allowance is missing from the above table. That’s because when you earn £100,000 and more, you gradually start to lose your tax-free Personal Allowance, pound by pound.

When you earn more than £125,140, you lose your entitlement to the Personal Allowance entirely.