The P45 form is a statement that shows how much tax you’ve paid on your salary so far in the tax year.

How do I get a P45 form?

When you leave your job or change to a new one, your old employer will generate a P45 from their payroll system. They should automatically send you this.

You should receive two copies:

- One for yourself

- One for your future employer (your new employer will ask for your P45 as part of the onboarding process)

What’s in a P45?

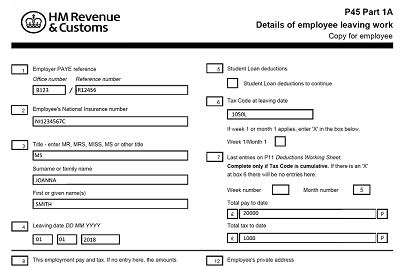

Your P45 will contain details all of which your new employer will need. This includes:

- Your National Insurance number

- When you left work

- How much you earned in the given tax year

- How much National Insurance and Income Tax you paid

- Your details and your employer’s

- Your most recent tax code

- Whether you need to continue paying student loans

This information will help your new employer put you on the correct tax code. This is important as it will make sure you pay the correct amount of tax at your new job.

Without it, you’ll be given an emergency tax code.

What does a P45 look like?

There is no standard format for it (each may look a bit different), but the minimum information on it is always the same.

What do you need a P45 for?

The P45 which you don’t give to your employer should also be kept safe. You may need this to:

What if I lose my P45?

In this case, you won’t be able to get a replacement. However, your new employer will ask you to fill in a starter checklist instead.

⚠️ Not having a P45 could mean you pay too little or too much tax. ⚠️

If you notice you’ve paid too much, you can either:

- Contact HM Revenue and Customs straight away

- Wait for a tax rebate

If you choose to wait for an automatic tax rebate, this is usually done by the end of the tax year (5 April). HM Revenue and Customs (HMRC) will send you either:

- a tax calculation letter (also known as a P800)

- a Simple Assessment letter

This will tell you how to get a refund or pay tax you owe.