We’ve teamed up with Koinly to bring you the easiest way to file your crypto tax return.

As crypto investors, in all your glorious forms, you spend lots of time going over transaction histories, inputting numbers to spreadsheets and other general admin.

Well, say goodbye to the never-ending admin. Get back your time, never make a mistake and sort your crypto taxes faster than ever before with the solution we’ve created.

Let’s get started

In this guide, you’ll learn how to get your crypto tax report through your TaxScouts account and straight to your TaxScouts accredited accountant, so they can get your tax return sorted and filed.

We’ll discuss the steps you need to follow to get started on your smooth-sailing crypto tax return journey.👇

Step 1:

Sign up for or log in to your TaxScouts account and get started on your tax return.

Step 2:

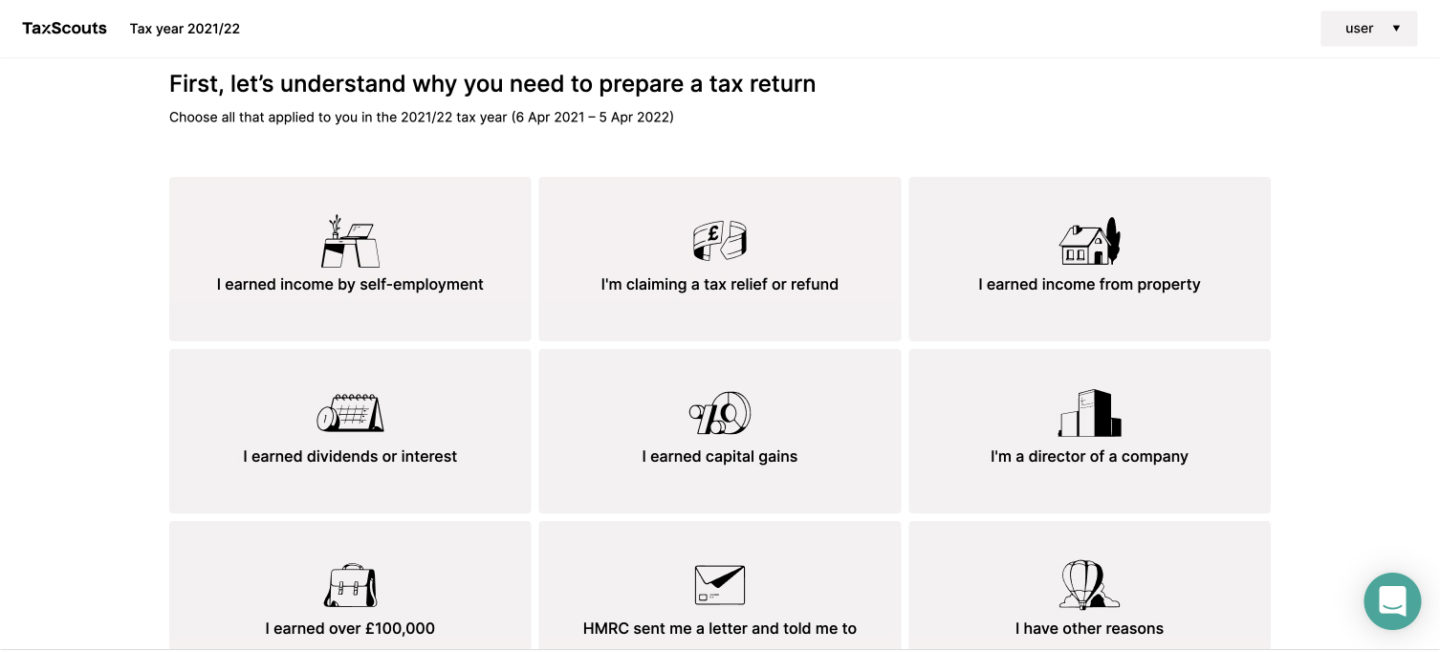

Select your reason(s) for doing a tax return.

There could be several, including that you’re a crypto investor, so you’d pick ‘I earned capital gains’. 🚀

Step 3:

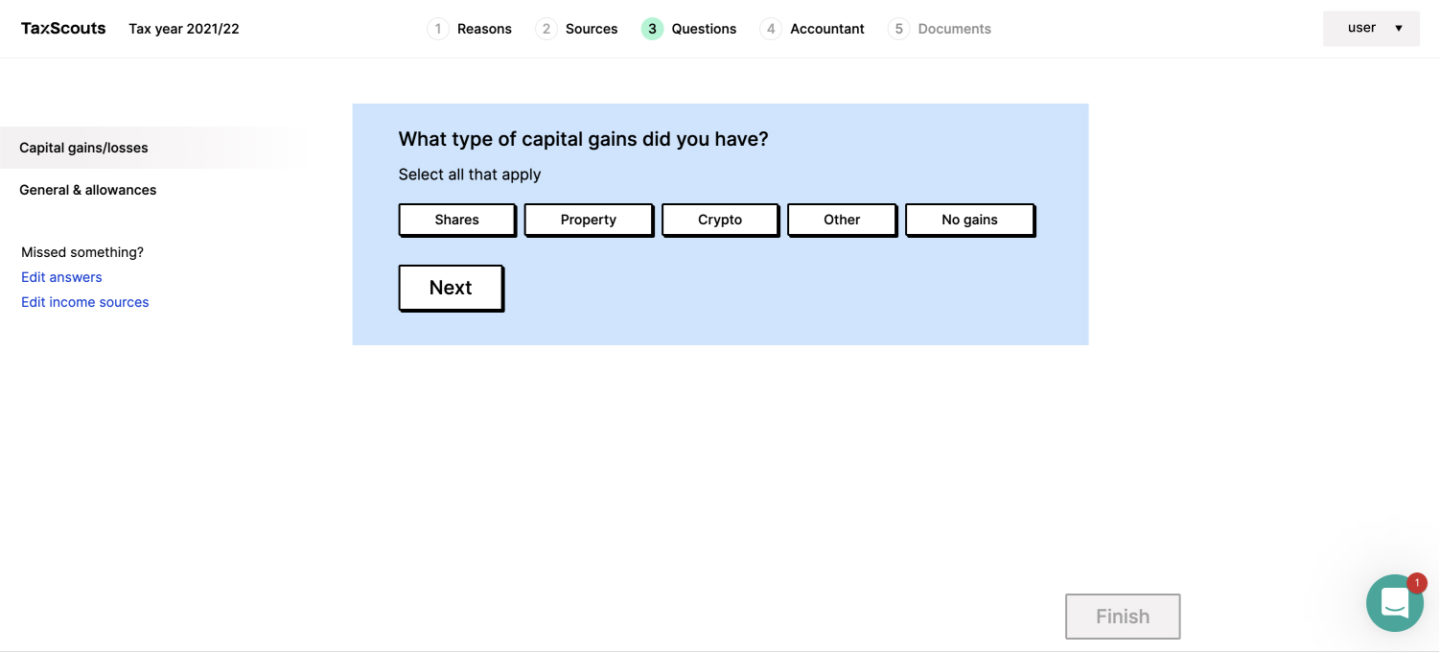

Select ’Crypto’ as a source of capital gains.

Although we’re focusing on crypto here, don’t forget to add any other capital gains like shares or property that apply to you.

Step 4:

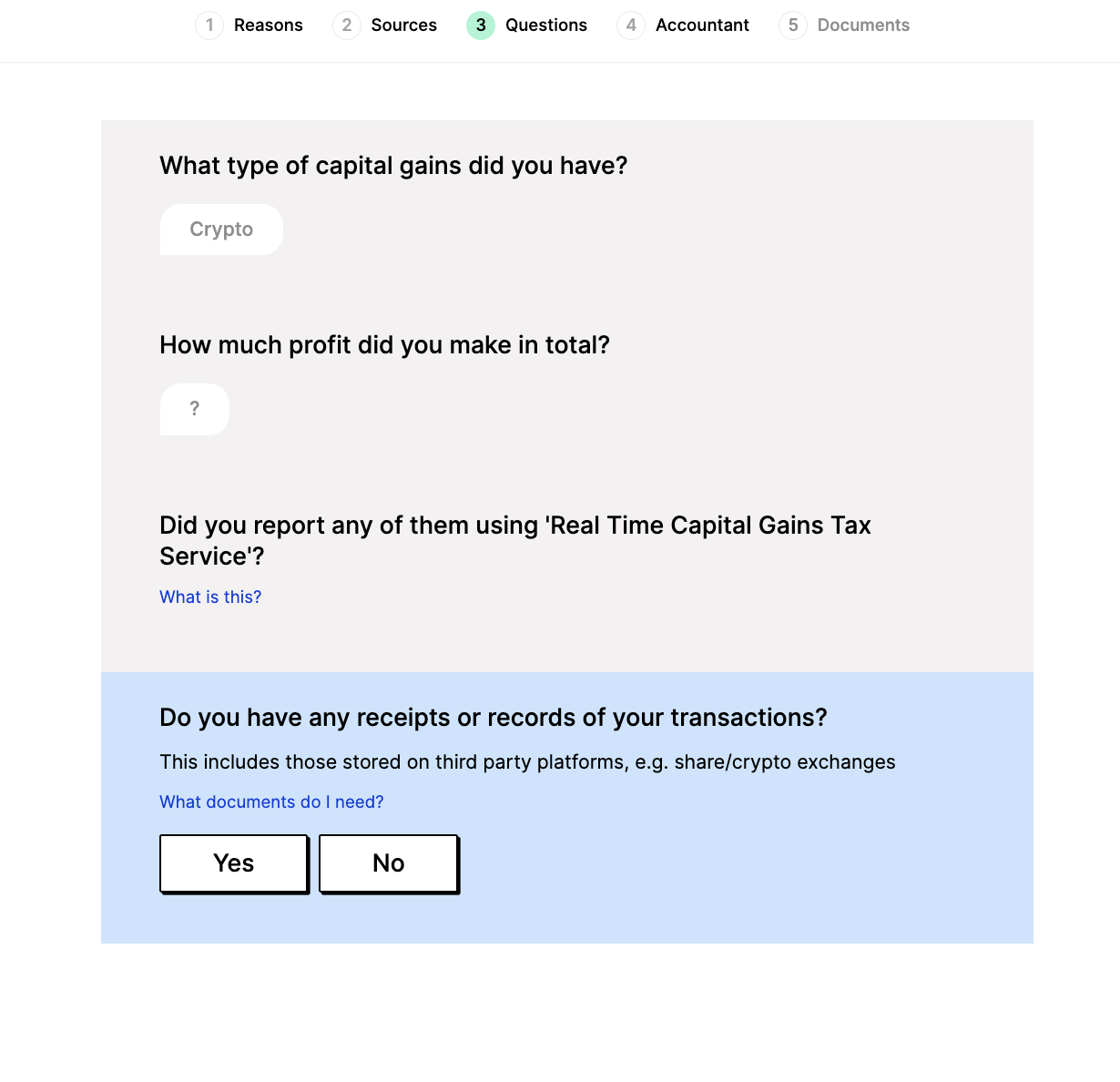

You’ll be prompted for a total profit amount. You can either estimate or leave it empty if you’re not sure.

Confirm whether or not you reported gains using the Capital Gains Real Time Service. If you don’t know, leave it blank.

Finally, let us know if you have receipts or records of your transactions. 🧾

A transaction is any deposit, trade, or withdrawal you’ve made.

Step 5:

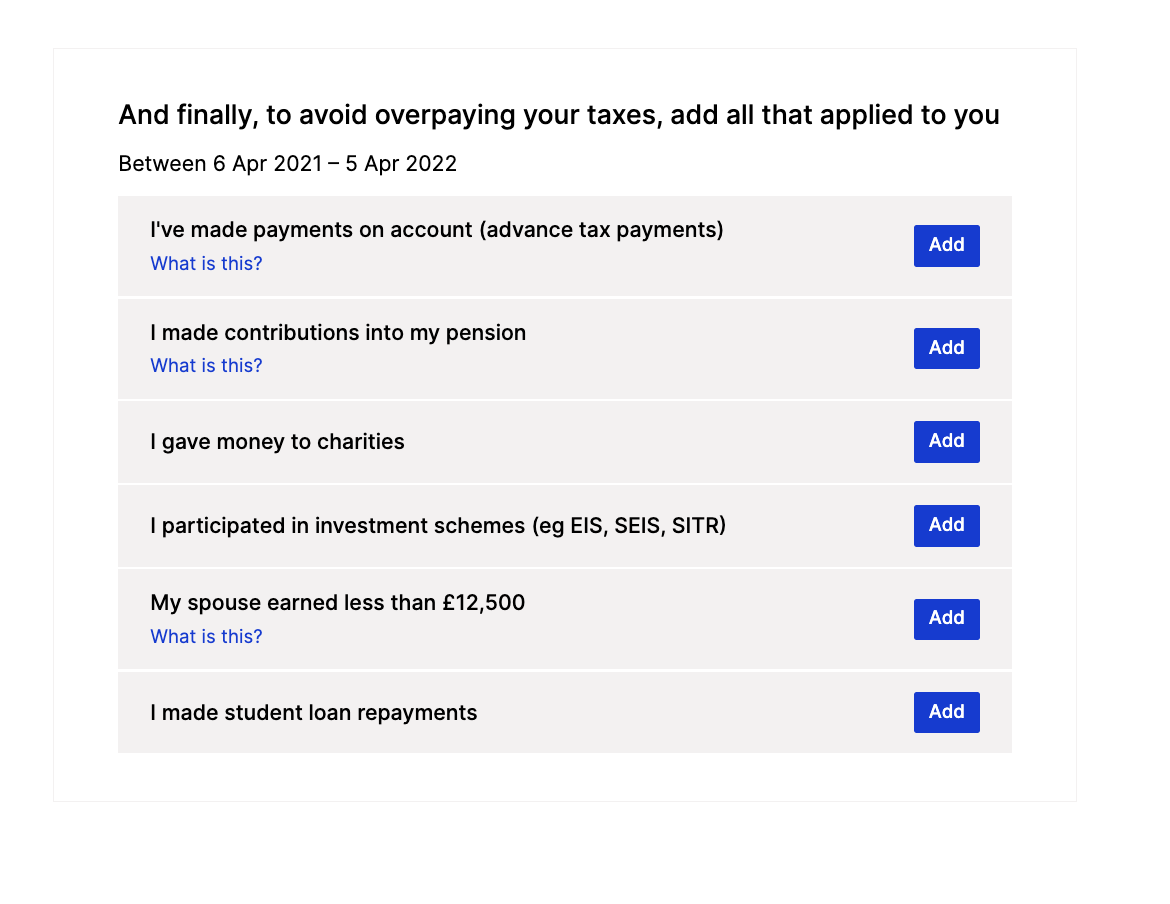

Next, select all the checkboxes of the scenarios that apply to you. Click ‘Finish’.

Step 6:

You’ll be assigned an accountant who will take care of your tax return once you click ‘Assign accountant and pay £169’.

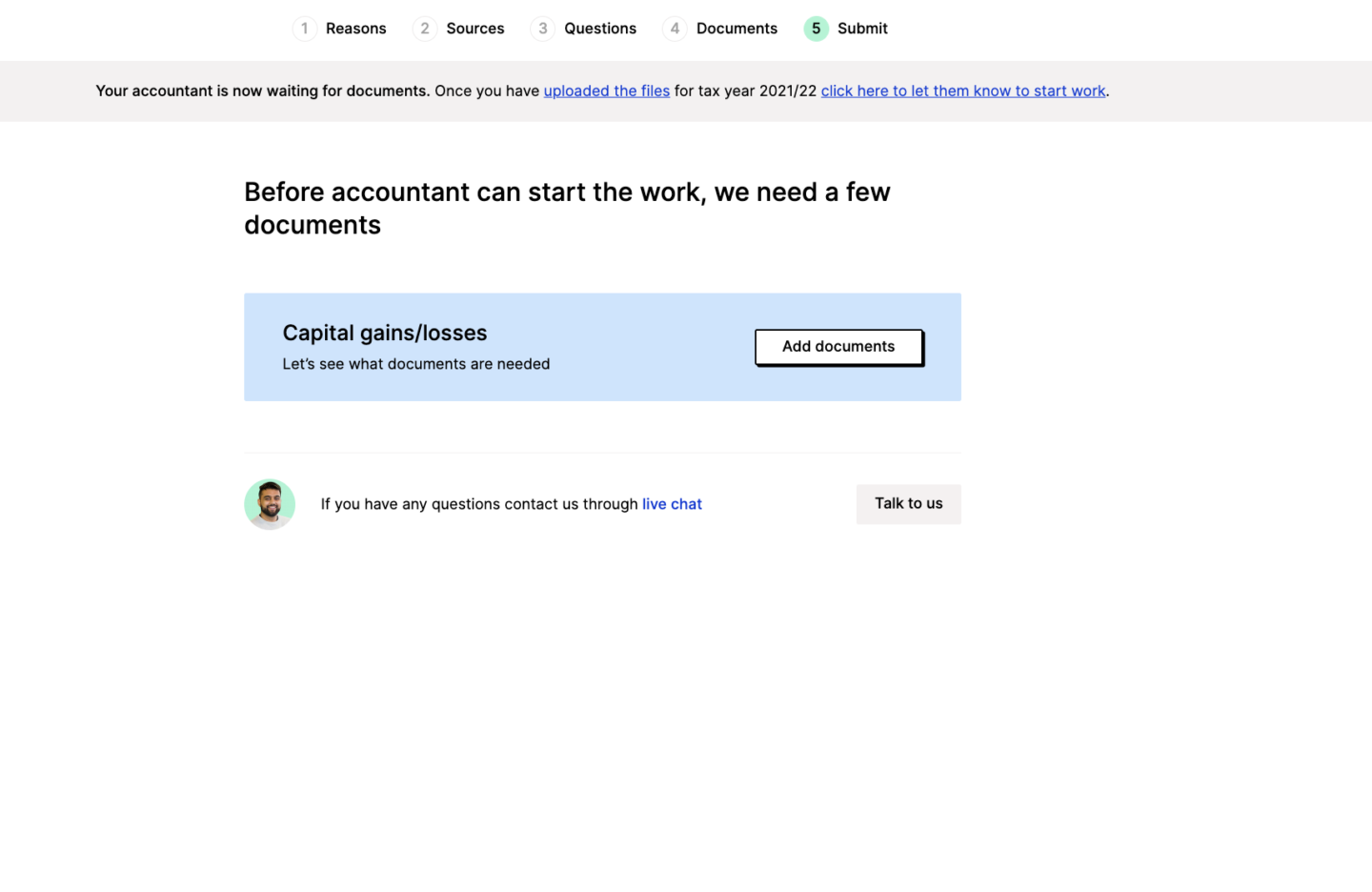

Step 7:

After paying, you’ll be prompted to add supporting documents. Click ‘Add documents’.

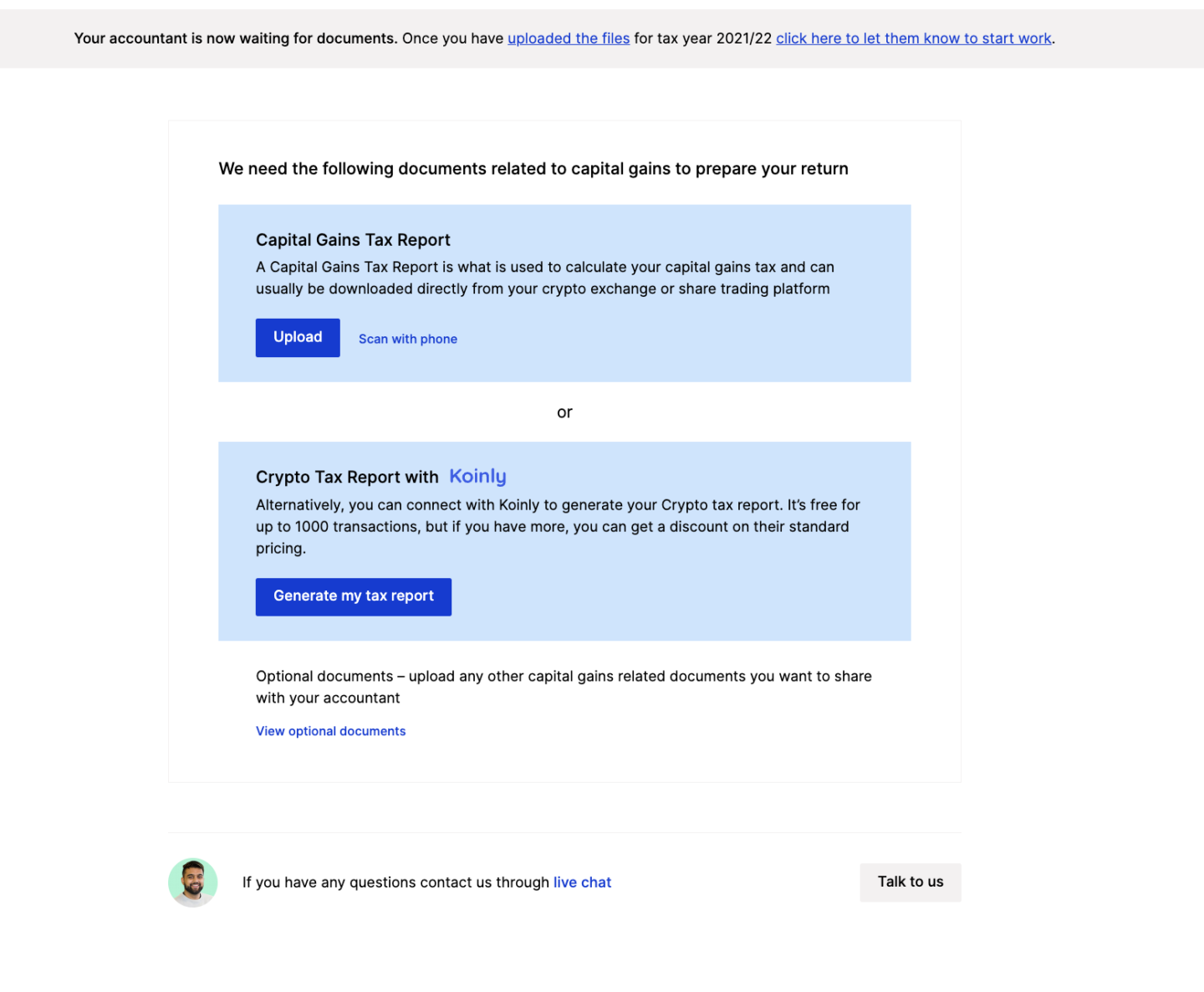

Step 8:

You’ll now see an option to click on the Koinly + TaxScouts solution. Click on ‘Generate my tax report’.

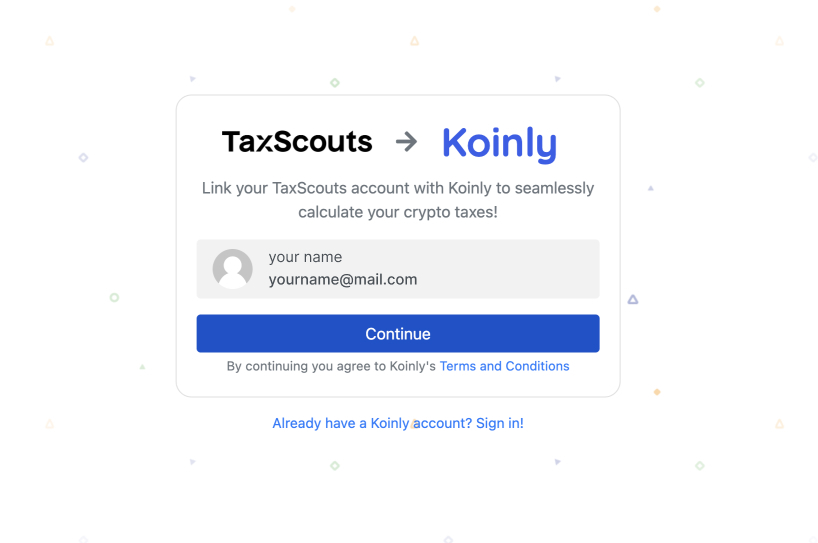

Step 9:

If you don’t have a Koinly account, sign up to generate your report. If you already have a Koinly account, click ‘Sign in’ at the bottom to link it to your TaxScouts account.

If you have:

- Less than 1,000 transactions then the Koinly solution is free to use for TaxScouts customers 🥳

- More than 1,000 transactions, you’ll need to sign up for one of Koinly’s paid tiers, whether or not you already have an account with them (plus, TaxScouts users get a discount 😏)

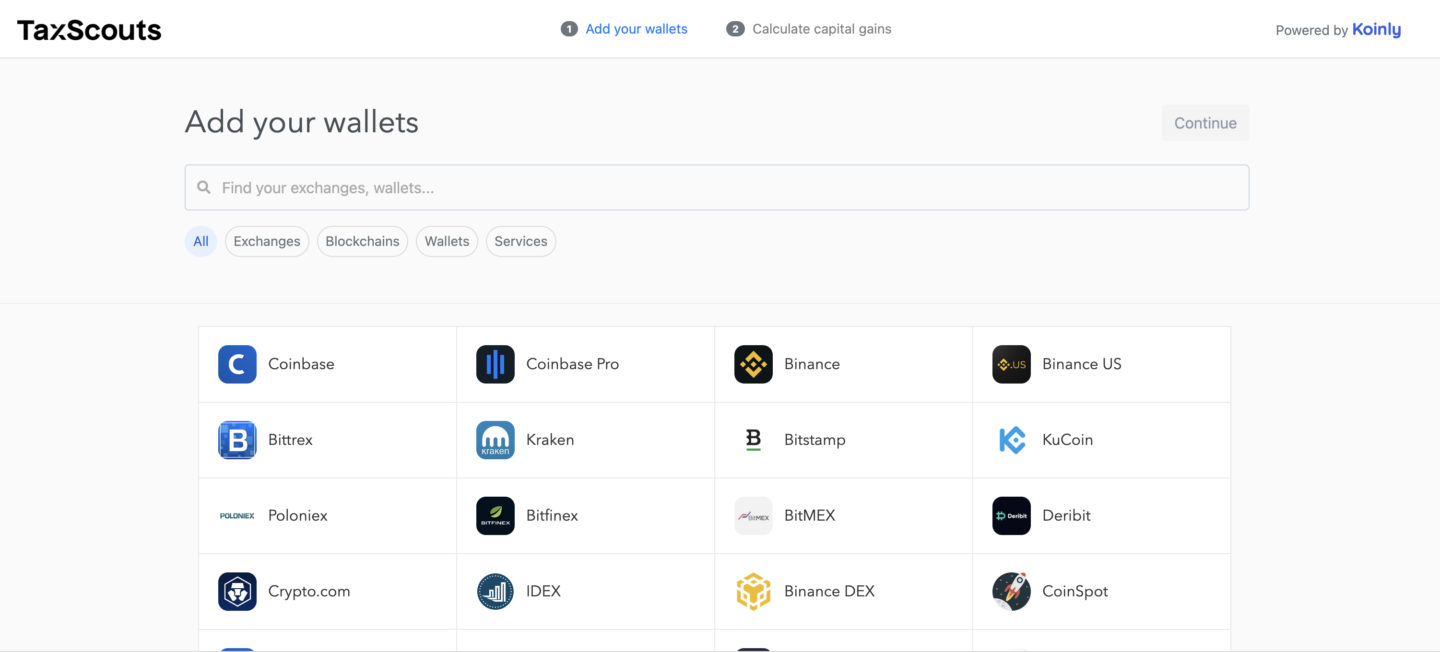

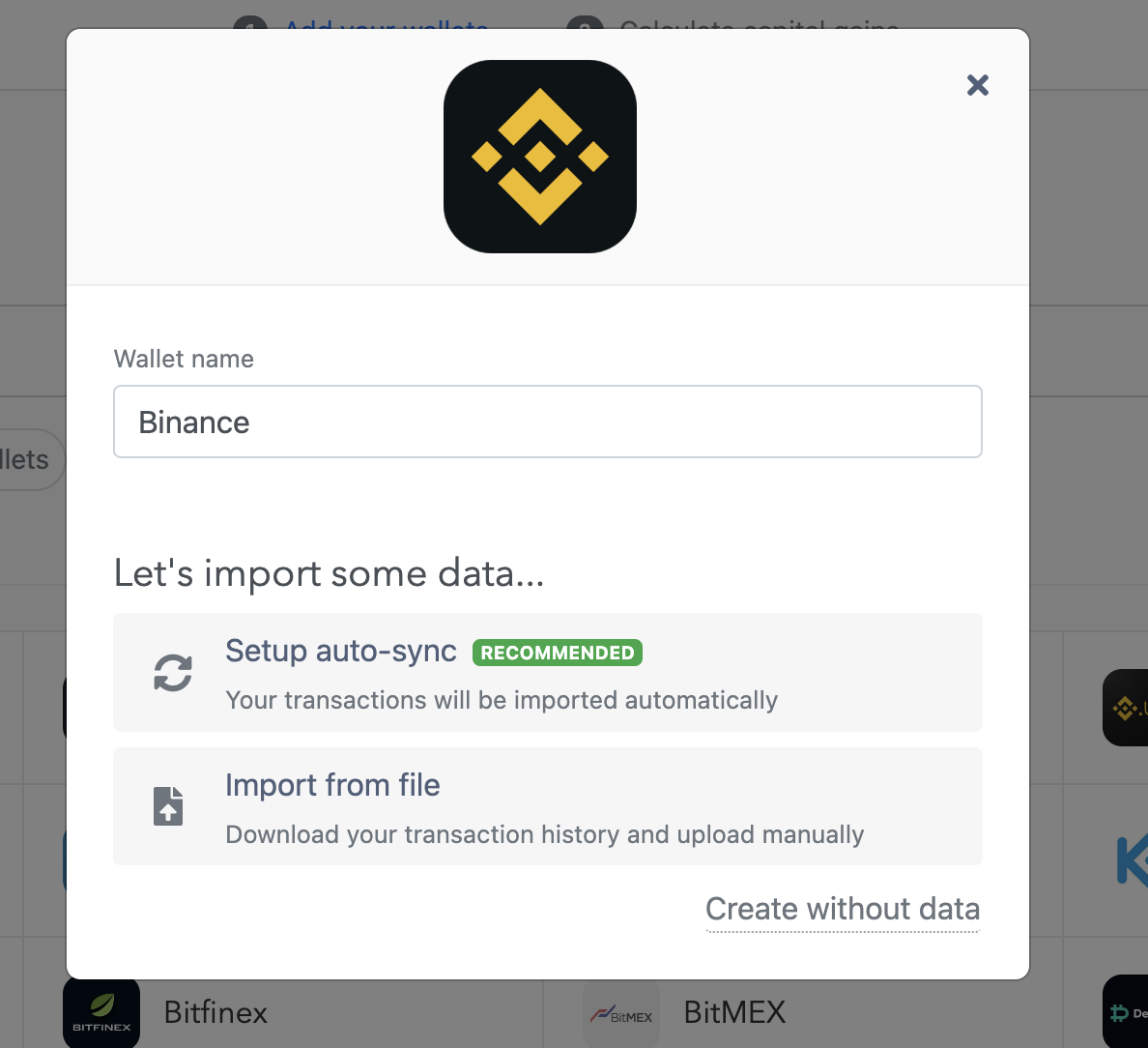

Step 10:

Next, add all the wallet(s), exchanges, or blockchain that you use.

Step 11:

It’s time to import all your transactions 📝

You have 2 options. You can either:

- Upload your transaction history manually by attaching it as a file

Click continue once you select your wallet(s).

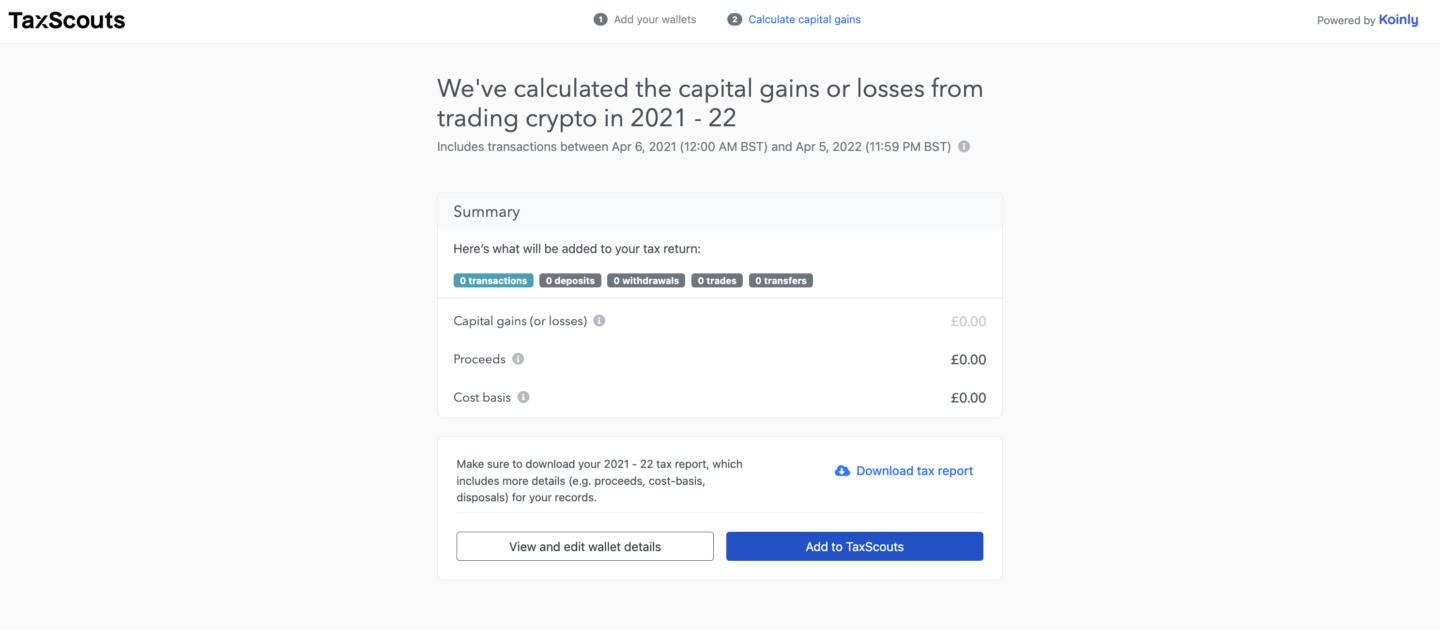

Step 12:

Next, click on ‘Calculate capital gains’ on the top menu to generate your crypto tax report.

Step 13:

You can download your tax report now (for your own records). Then click ‘Add to TaxScouts’. You’ll be redirected back to the TaxScouts website and be shown a summary of your crypto gains.

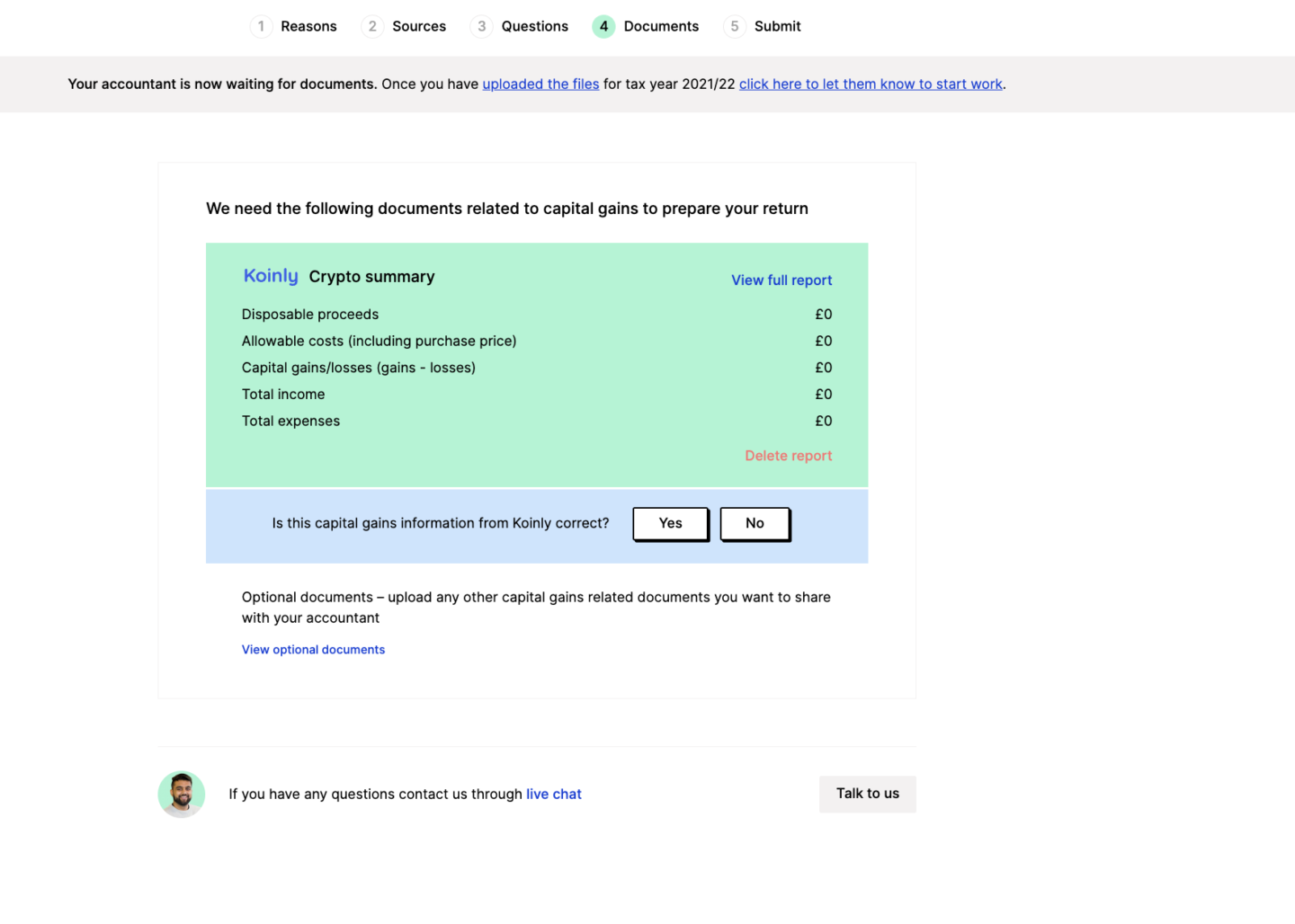

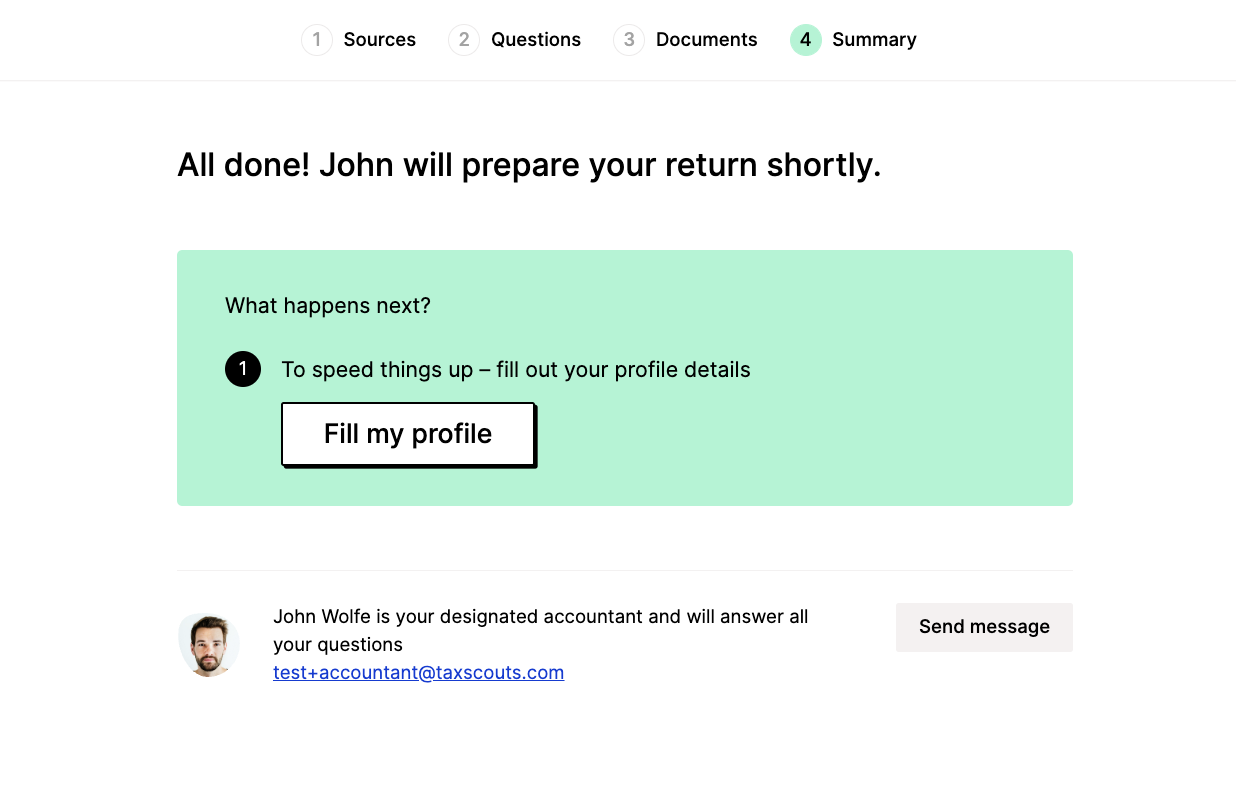

Step 14:

If you’re happy that the numbers on your crypto tax report are correct, click ‘Yes’. If you’re not, you can go back to Koinly to change your data and generate a new report.

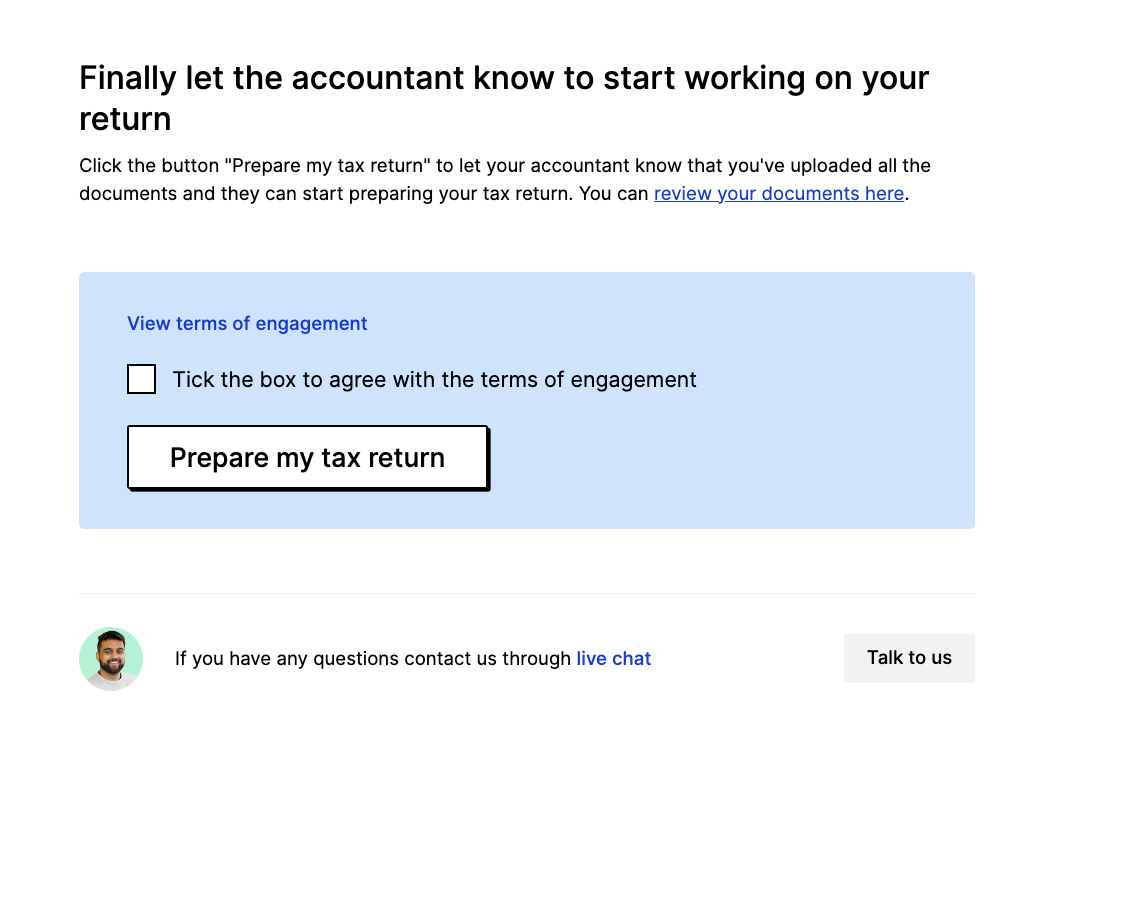

Step 15:

Finally, you need to agree to our terms of engagement, and click on ‘Prepare my tax return’.

And you’re done! Fill in your profile details while your assigned accountant begins preparing your tax return, woohoo. 😊

Got more questions?

If you have questions about the crypto tax report you generated, speak to Koinly directly. If you have any questions about your tax return, contact your accountant or get in touch with our support team. Email them at [email protected] or go through the live chat on our website.

Have questions about crypto tax in general or want to be more tax-efficient? We can help! Learn more about sorting your tax return, getting one-off, personal tax advice, or both!