After our accountants have filed your tax return with HMRC, it can take a few days to show up in the portal.

Meanwhile, the portal will automatically generate a submission receipt.

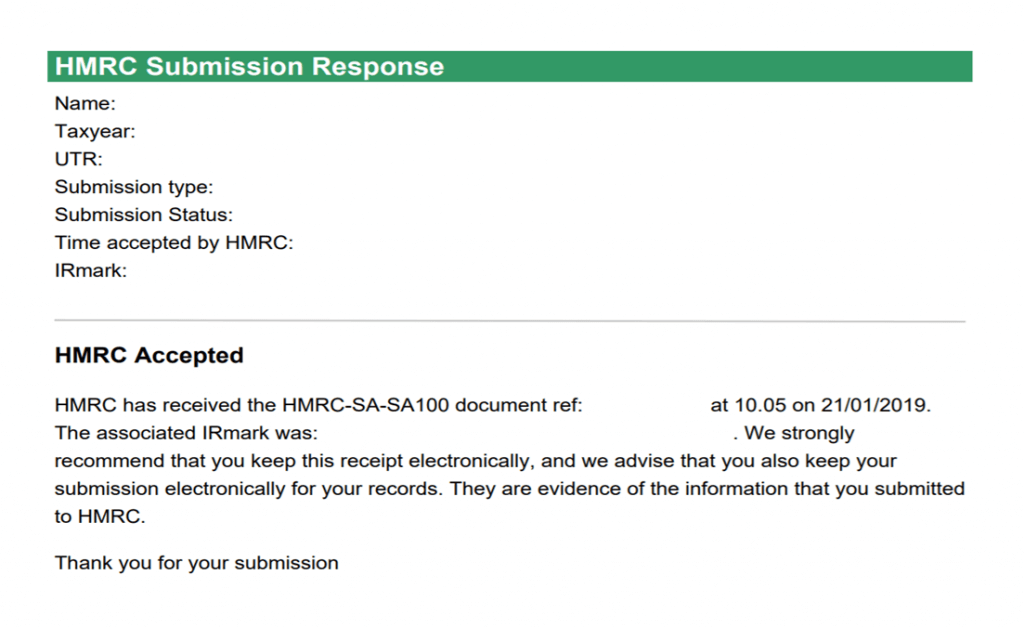

A submission receipt is proof that HMRC has received your Self Assessment tax return. So once you submit a tax return, whether that’s through us or using HMRC’s digital service, you’ll be able to confirm it’s been received using the submission receipt.

You can also confirm this over the phone by giving HMRC a ring. Have the reference number of the submission receipt on hand when you call up, which they’ll ask you for.

When do you get the submission receipt?

You’ll get the submission receipt as soon as the tax return is submitted to HMRC. However, once you click submit, it can take some time for the screen to load and confirm that it’s been received. You can always log out and log back in at a later time to check the status of your tax return.

Once you do get confirmation it’s been submitted, you can then access your submission receipt. We recommend keeping the reference number somewhere secure for future reference.

How to check this inside the TaxScouts dashboard

Step 1

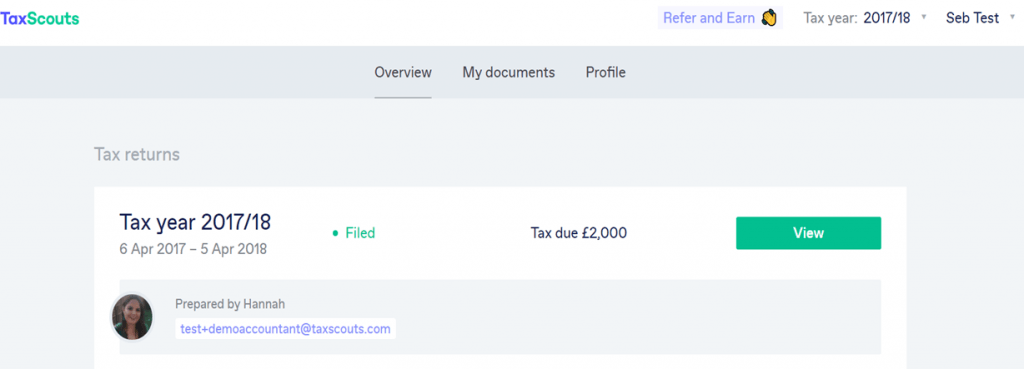

Log into your TaxScouts account and select the tax year you are looking to file a tax return for.

Click the “view”button.

Step 2

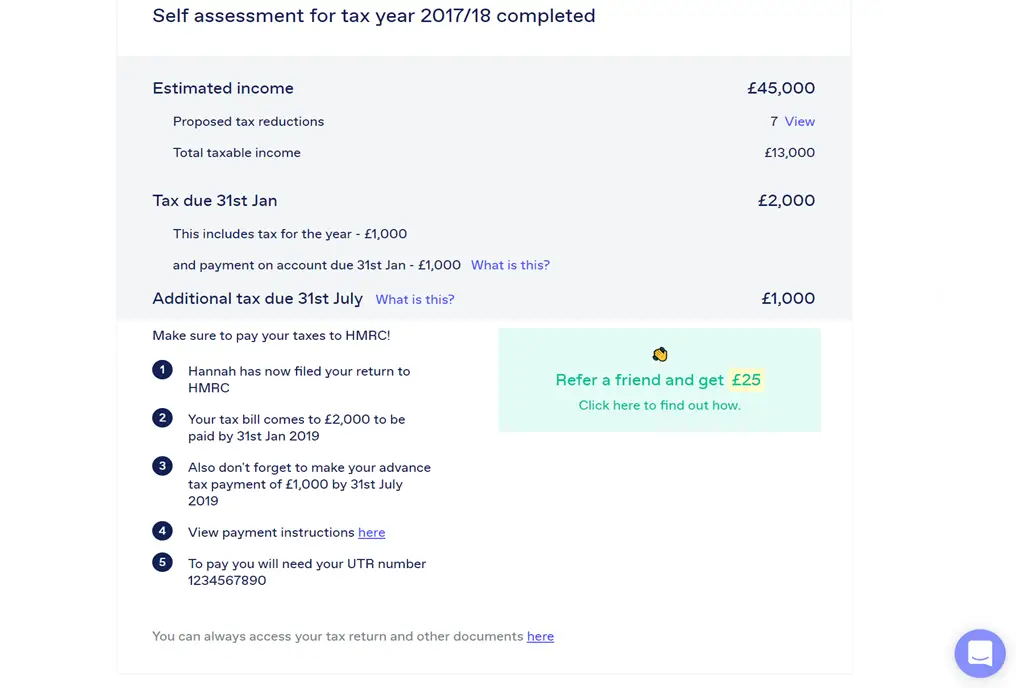

Scroll to the bottom of the page where it says “you can always access your tax return and other documents here”and click the button.

Step 3

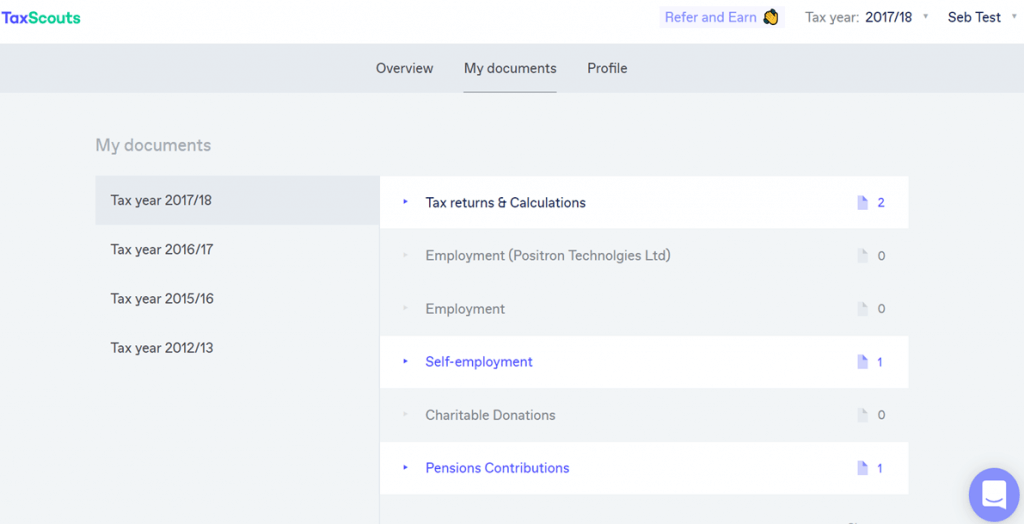

Click on “Tax returns & Calculations”.

From the drop-down menu that appears, you’ll be able to select and download your tax return, tax calculation, and HMRC submission.

You can also click on and download your submission receipt.

Step 4

You now have proof that your return has been received by HMRC.

You can ring them and quote the reference number on the submission receipt if you’d prefer to receive confirmation over the phone. Remember, they won’t call you to confirm so you’ll have to make the first move.

Still need help?

If you have trouble finding your submission receipt or logging into your TaxScouts account, click on the blue “Help/Chat” icon located on the bottom right side of your screen.

Our support team is happy to help.