First and foremost, don’t panic. If you’ve not done a tax return for a long time, whether that’s three years, five years, ten or even twenty years, all is not lost. The most important thing to do is to sort it out quickly, and let HMRC know that it’s under way.

Generally, HMRC will only accept three years of late tax returns, although sometimes they may let you submit returns older than that.

The reason why you didn’t file a tax return even if you were supposed to matters.

Were you self-employed the whole time?

If you switched between being employed and self-employed, good news! You will not have owed self-employed tax for each one of these years.

Whilst you were employed, your taxes would have been paid by your employer so you’ll only have a backlog of payments for self-employed years.

You should discuss this with your accountant who can help you calculate how much you owe. Otherwise, you can chat to HMRC on 0300 200 3310 to let them know your employment situation history.

Watch out for being dealt something called a “Failure to Notify” – as it sounds, failing to notify HMRC of the discrepancy. It will be looked at more harshly if HMRC chase you rather than the other way around.

From the horse’s mouth:

“We can reduce the amount of any penalty we charge you depending on our view of how much assistance you gave us. We refer to this assistance as the ‘quality of disclosure’ or as ‘telling, helping and giving’.”

HMRC via gov.uk

Were you unable to pay?

If you didn’t pay your tax returns because you weren’t able to, you should speak to HMRC about a ‘Time to Pay agreement’.

With this, HMRC will let you either:

- Take more time to pay

- Schedule your payments in instalments

Be aware though that these agreements are much easier to set up before your payments are overdue.

That’s not to say that HMRC can’t help after the deadline, it’s just not a done deal.

You may also be charged interest from the date that your payment was late.

To set this up, you can use HMRC’s Income Tax helpline: 0300-200-3300

How much did you earn?

You don’t always have tax to pay – it really depends if your income was above a certain amount.

Here are the three taxes to look out for:

Why didn’t you pay?

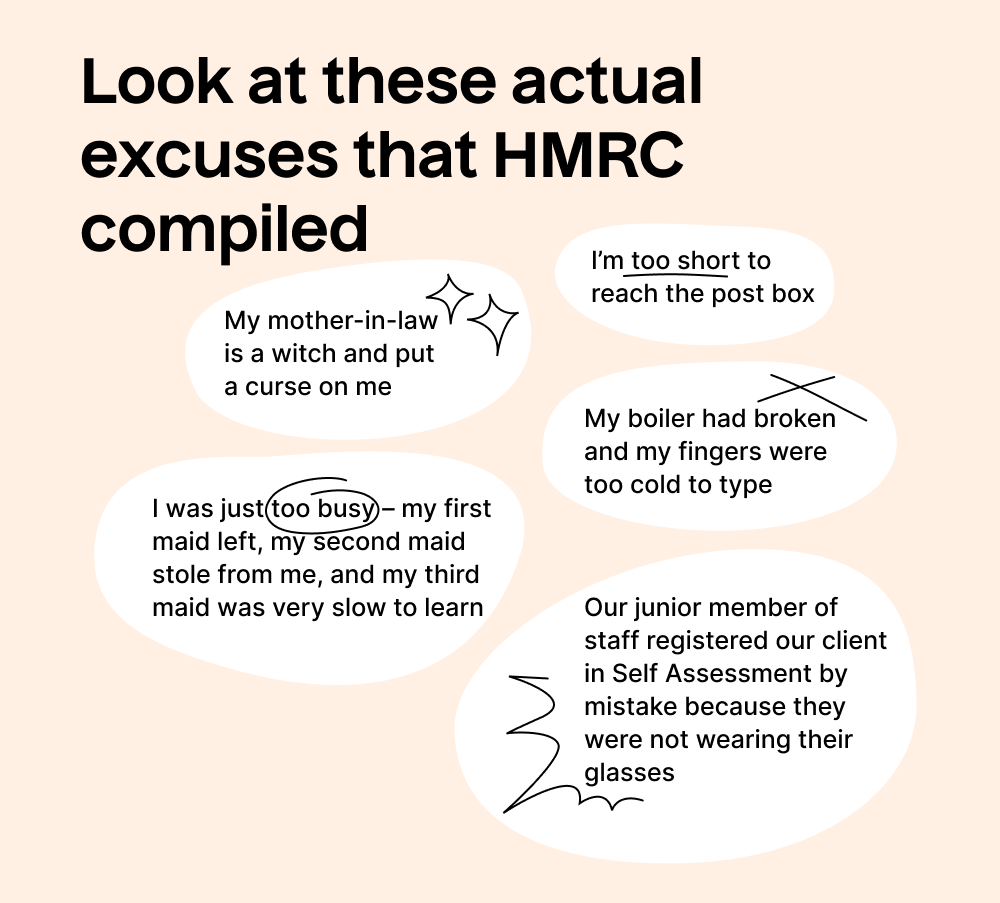

If you’ve not seen our HMRC expensing excuses blog, we’d recommend that you take a look. If you think your excuse for not paying is thin, you ain’t seen nothing. Take a look at the full article here.

What we’re trying to say is that if you have a valid reason for not being able to pay, this may be taken into account.

Make sure, though, that if you do have an excuse, you record everything from correspondence, hospital notes and more. In the case that your excuse is exceptional, HMRC may deem it excessive to chase you for the money you owe and you’ll be able to claim for something called Special Relief.

Have HMRC chased you?

This one is particularly important.

If you’ve not been chased yet by HMRC, you’ll still benefit from being the first to disclose.

Their general process is to send what’s known as a determination when they notice that you owe them money. The determination will be an estimate of what you owe and you’ll be liable to pay by a date set out by HMRC.

If you’re still unable to pay, you may be able to request a Time to Pay agreement or, if your circumstances are exceptional, you might be able to claim Special Relief.