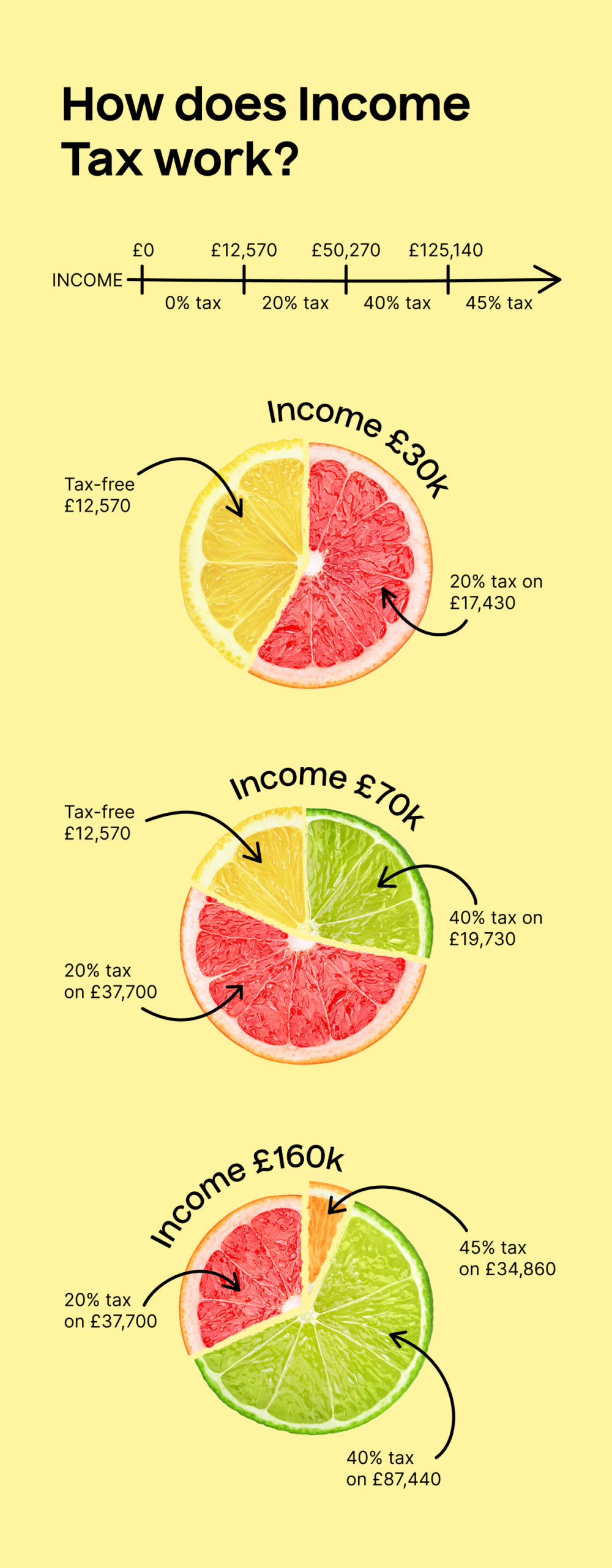

How your income tax is calculated

When you’re self-employed, you have to pay your income tax and national insurance contributions yourself in your annual Self Assessment. Our calculator helps you quickly assess how much you owe.

However you may be eligible for a tax refund when:

- You already made tax payments for the year but your annual income ended up less than planned

- You have done things that qualify for a tax relief (made private pension contributions, given to charity, etc.)

In your case when you earn £50,000:

Income tax breakdown

You pay no income tax on first £12,570 that you make

You pay £7,286 at basic income tax rate (20%) on the next £36,430

National insurance contributions breakdown

No contributions on the first £12,570 that you make

You pay £2,186 in contributions (at 6%) on the next £36,430 that you make

You pay £0 in NI Class 2 contributions