Registering for a personal tax account with the UK Government is free and can be done in just 10 minutes.

You’ll need:

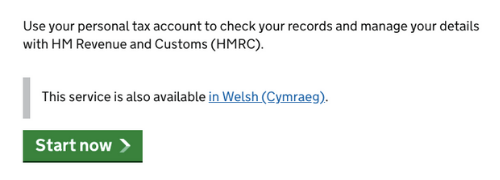

Step 1. Go the HMRC website

Visit gov.uk/personal-tax-account. Once there, click “Start now”.

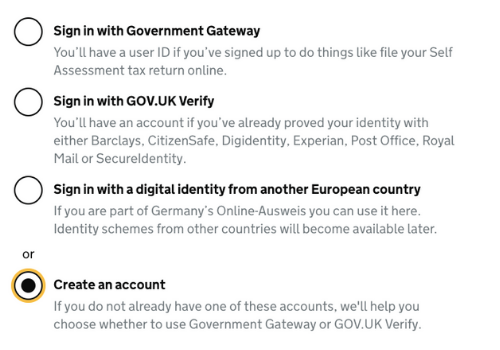

Step 2. Create a Personal Tax Account

Select how you want to sign in to your Personal Tax Account.

Since we’re now setting it up for the first time, let’s select “Create an account”.

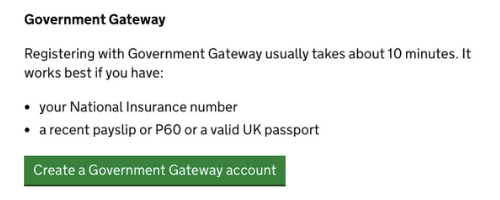

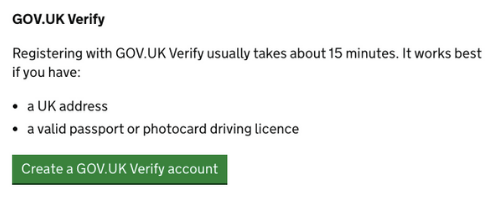

Step 3. Register using Government Gateway

Next, you’ll have to choose how to register.

Most people will find “Government Gateway” more accessible, so let’s select that.

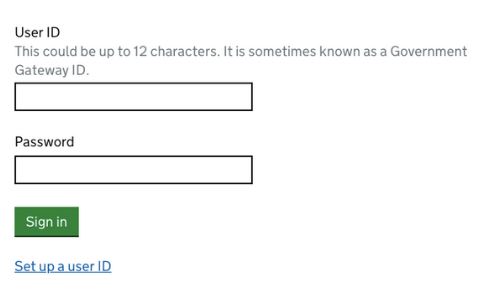

Step 4. Set up a Government Gateway User ID

Next, you’ll need to sign in with your Government Gateway account – if you have one.

Since this is the first time, let’s select “Set up a User ID”, right under the “Sign in” form.

Step 5. Answer other questions

You might see one of these questions:

- if you’re an agent registering on behalf of a client.

- if you’re trying to file a Self Assessment tax return.

Since this is the first time, select “No” if you see one of these questions.

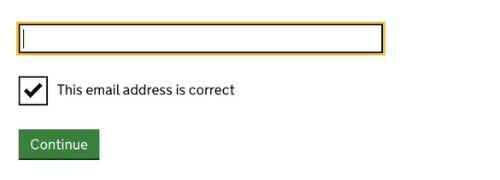

Step 6. Provide your email

This is important: write your email address next and be ready to access it: you’ll receive a code that you’ll need soon.

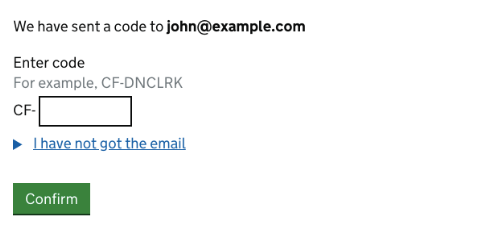

Step 7. Confirm your email

Open your email and get the code HMRC just sent you.

Step 8. Provide your name

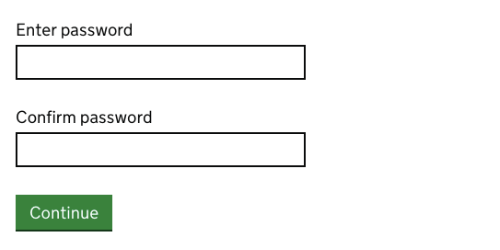

After you’ve confirmed your email, you’ll be asked to submit your name…

…and a password.

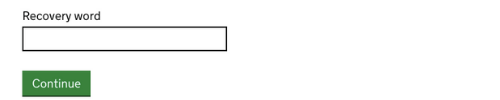

Step 9. Provide a recovery phrase

Now you’ll need to provide a recovery word – just in case you ever forget your password.

It can be anything – we recommend something easy to remember, like a favourite movie or book.

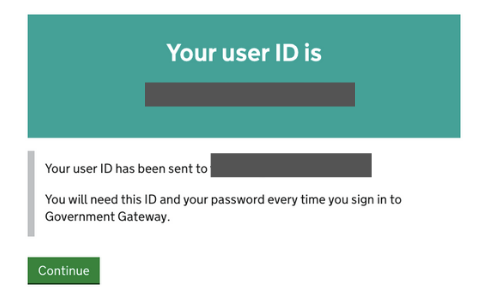

You’re almost done – you’ve now received your User ID!

This is important: write down your Personal Tax Account User ID and password!

There are just a few more steps related to account security.

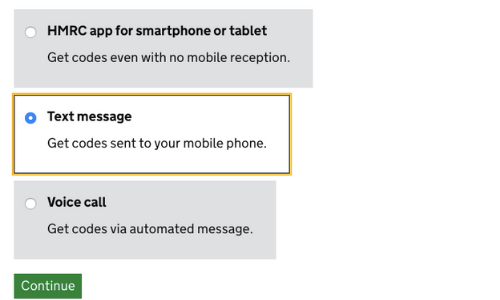

Step 10. Get your access code

First, the website will ask you how you want to receive your access code.

The easiest one is via text message – let’s select it.

You’ll receive a text message on your phone – enter this code on the next screen.

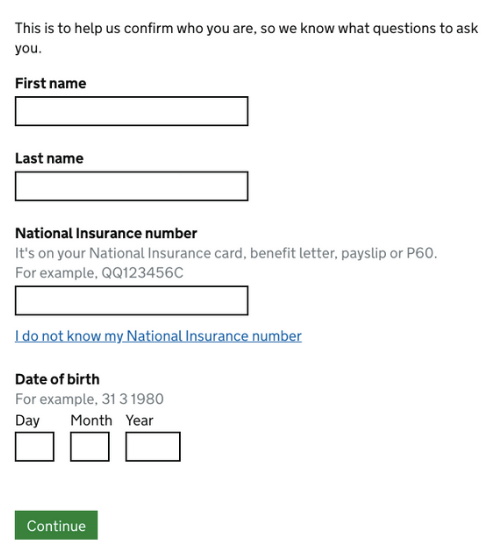

Step 11. Verify your identity

Almost there!

Now HMRC will ask you a few details so they can match you with existing records.

First, your name and National Insurance Number (NiNo):

Second, select how you want to verify your identity:

- passport

- employment slip

- P60

If you do not have a UK Passport, you’ll need to provide more details – it’s very similar to a credit check.

Give HMRC any info you have on loans, bank accounts, mobile contracts, addresses you’ve lived at, etc.

Step 12. Decide if you want to go paperless

The final step!

HMRC will ask you if you want to go paperless or not and then you’re done!

You’re now signed up with HMRC and have your own Personal Tax Account.