A P60 form is a statement that summarises how much you’ve paid over the tax year through your employer.

Your employer should give you your P60 at the end of each tax year. Sometimes, companies wait until payroll to send them out, so you should receive your P60 form by the end of April.

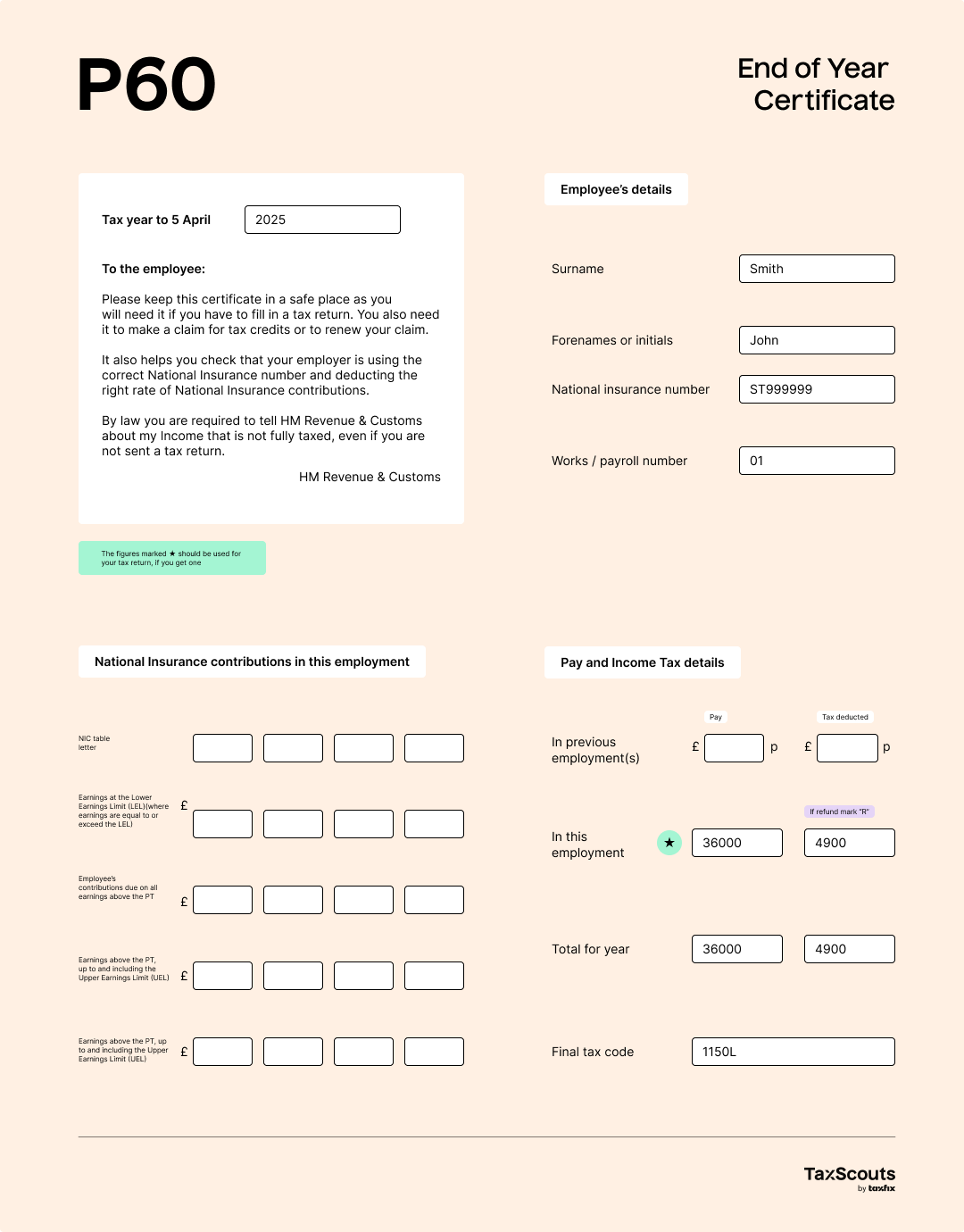

What’s in a P60 form

You can expect all your tax and salary information to be on your P60. This includes:

- Your National Insurance number

- How much you earned in a given tax year (gross income)

- How much tax and National Insurance your employer has paid

- Your personal details

- Your employer’s company details

- Your tax code

What does a P60 form look like

There is no standard format for a P60. Although they may look a little bit different, the information the P60 form contains is always the same.

Your employer provides the information listed above to HMRC, which they use to make tax calculations and how much tax, like Income Tax or National Insurance contributions, you may owe.

What do you need it for?

You should keep your P60 for your tax records. You’ll need it for a variety of different reasons like:

- Applying for a mortgage

- Filing a Self Assessment tax return

- Taking out a loan or credit card

- Receiving tax credits

- To use in cases of tax disputes

- As a form of proof of income

If you don’t have access to your P60 and need to file a tax return, don’t panic. TaxScouts can get your Self Assessment done without one, as long as you have access to your HMRC Government Gateway.

How do I get my P60?

After every tax year, your employer should provide you with your P60. However, if they haven’t, you can always request it from them. Your employer is required to keep your P60 on record for three years for tax purposes. So if you lose it, just ask them for another copy.

If, for whatever reason, they aren’t able to produce another one, don’t panic!

HMRC aren’t able to provide a replacement P60 form but you can:

Need a hand?

If you’re trying to get your taxes sorted and need a hand interpreting your P60, don’t hesitate to get in touch! Our friendly support team is happy to help. You can reach them on [email protected] or via the live chat on the homepage.