If you’ve lost your HMRC log in user ID, don’t panic. It happens to the best of us, but there’s always a solution!

If you remember creating an account then the process will be familiar to you. But either way, read on for a detailed how-to guide.

All you need to do is request a new user ID. To do this, first you need to go to the HMRC services page.

Step one – complete. ✔️

But we won’t stop there. We’ll take you through the whole process so you know exactly what to do once you’re on the page.

Scroll down to “lost user ID or password”. Click on “recover your user ID”. The same principle applies if you’ve lost your password and even if you’ve lost both your ID and password.

Now, HMRC like to make sure you’ve double checked (even though we know you’ve probably triple checked) your emails to look for your Government Gateway user ID. So when they ask, you can click on “No, recover my user ID” straight away.

You’re then given the option to either enter the email address associated with the account or to click on the button to confirm you’ve forgotten or can’t access the email address.

If you do have your email address – woohoo! HMRC will email you a code which you then enter on the website. Once they know it’s you (and not an imposter) they’ll email you a new user ID.

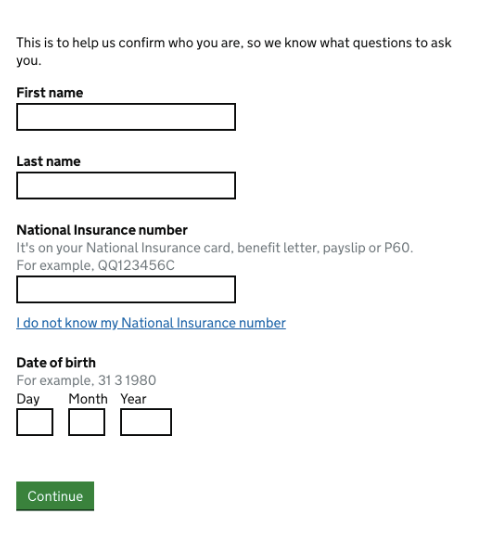

If you click “I have forgotten or cannot access this email address” then you’ll be taken to another page which asks for a little bit more information from you. Nothing complicated, don’t worry.

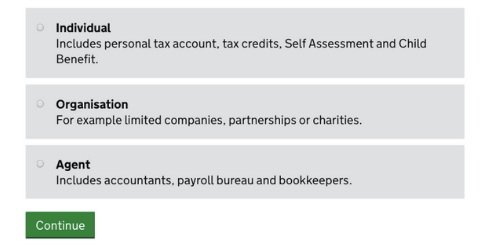

First, they’ll ask what kind of account you have. In most cases, you’ll need to select “Individual” if you’re looking to file your personal tax return.

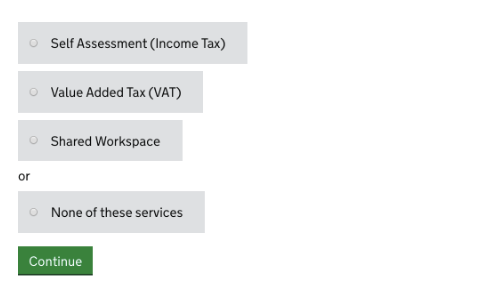

Next you’ll have to tell HMRC if you’ve used any online tax service before:

- If this is your first time, select “None”.

- If you’ve done your tax return before, select “Self Assessment”.

If you’ve never used HMRC online before

In this case, HMRC will need more information about you. There are sometimes cases where you may have made an account a long time ago and then forgotten about it. Although it’s not the most common scenario, it happens.

If you do exist, they’ll be able to match the information you provide them with existing records from their database.

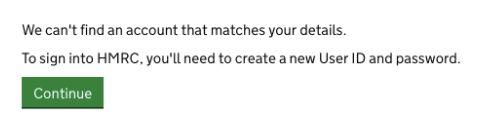

If HMRC can’t find you then you’ll be directed to creating a new user ID.

Click “Continue” – it’s very straightforward.

If you’ve submitted a Self Assessment in a previous year

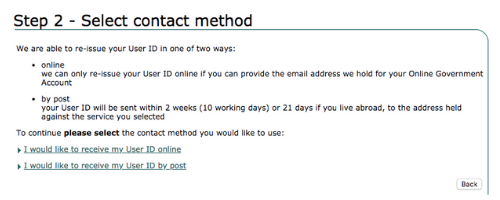

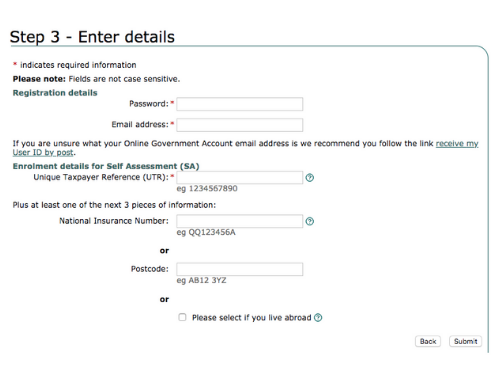

If you have filed a tax return with HMRC before, the process is pretty simple because your information will already be on their database. You’ll need to provide the same information again and then select how you prefer to receive your user ID.

You can receive it online, usually via email, or by post.

Only select online if you have access to the email address you used the last time you filed. They will use the email that’s already on the system.

Otherwise, you can choose to receive your ID by post. It does take longer to arrive, especially compared to doing it online. Usually, it takes around 14 days.

And then you’re finally at the last step! Click “submit” and you’re done. Phew 😅

If you’re looking for your password instead

Check out our guide on how to recover your HMRC Government Gateway password.