Lost your HMRC password and need to recover it? Honestly, we’ve all been there!

Luckily all is not lost! There are a few ways to recover your user ID. Just read below. 👇

HMRC Online

To sign in to HMRC Online, simply go to the HMRC services registration page.

When you arrive, go straight to the ‘problems signing in’ section and click ‘password’. You’ll be redirected to a new page.

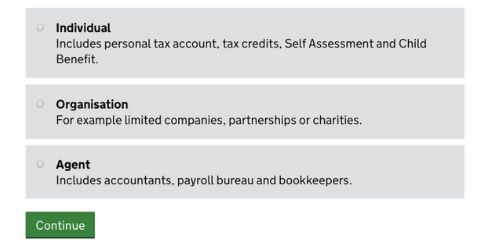

The first question is about the type of account you have.

If you’re looking to do your individual self assessment, select ‘individual’.

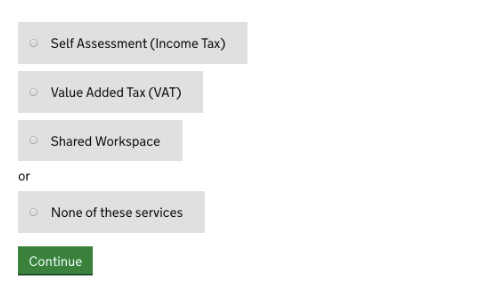

Next, HMRC will try to find you in their database:

- If this is your first time using HMRC online, select ‘none’.

- If you’ve submitted a tax return in a previous year by yourself, select ‘Self Assessment’.

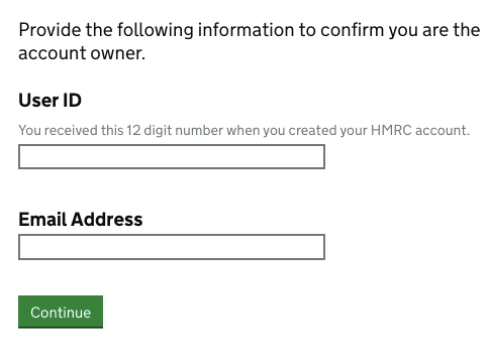

If it’s your first time using HMRC Online

In this case, HMRC will simply need your User ID and email. If you have this information, they’ll just send you a new password.

It’s just like resetting your password for Google or any other service. You’ll be able to log in almost straight away. Quick and simple.

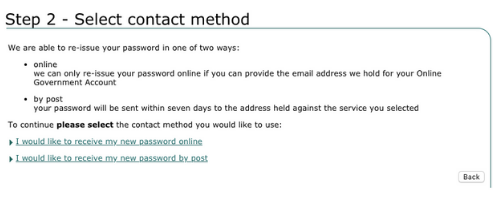

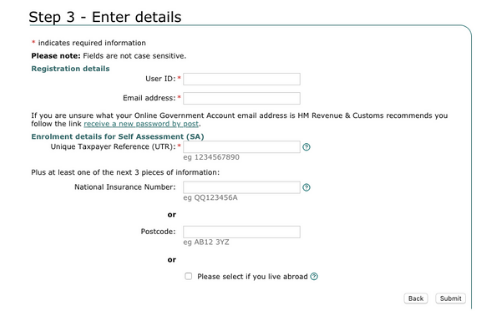

If you’ve submitted a Self Assessment in a previous year

If you’ve previously submitted a Self Assessment, then you’ll need to provide HMRC with some basic information about how you prefer to receive your new password – this could be either online or by post.

If you have access to the email address that you signed up with, select online.

If you don’t have access to the email with which you signed up with, then choose ‘receive my password by post’.

The downside of receiving your password by post is that it could take up to 14 days for your password to arrive. You’ll want to consider this if you’re due to file your tax return.

⚠️ Submitting your tax return late could result in being fined by HMRC. Read more about this here. ⚠️

Click ‘Submit’ and you’re done – your password is on its way!

If you still have issues recovering your password, you can contact HMRC on 0300 200 3600.