In partnership with Koinly, you can now generate quick and easy crypto tax reports to use for tax filing. A crypto tax report details all of your cryptocurrency transactions – deposits, trades, or withdrawals you’ve made – during the tax year you want to file for, from every platform you’ve used. You can’t file without one, but compiling it is a long, time-consuming task for accountants without specialised software. Some trading platforms, like Koinly, can generate the report for you.

A crypto tax report includes your gains, losses and absolutely everything you need to accurately report your crypto profit, all in one.

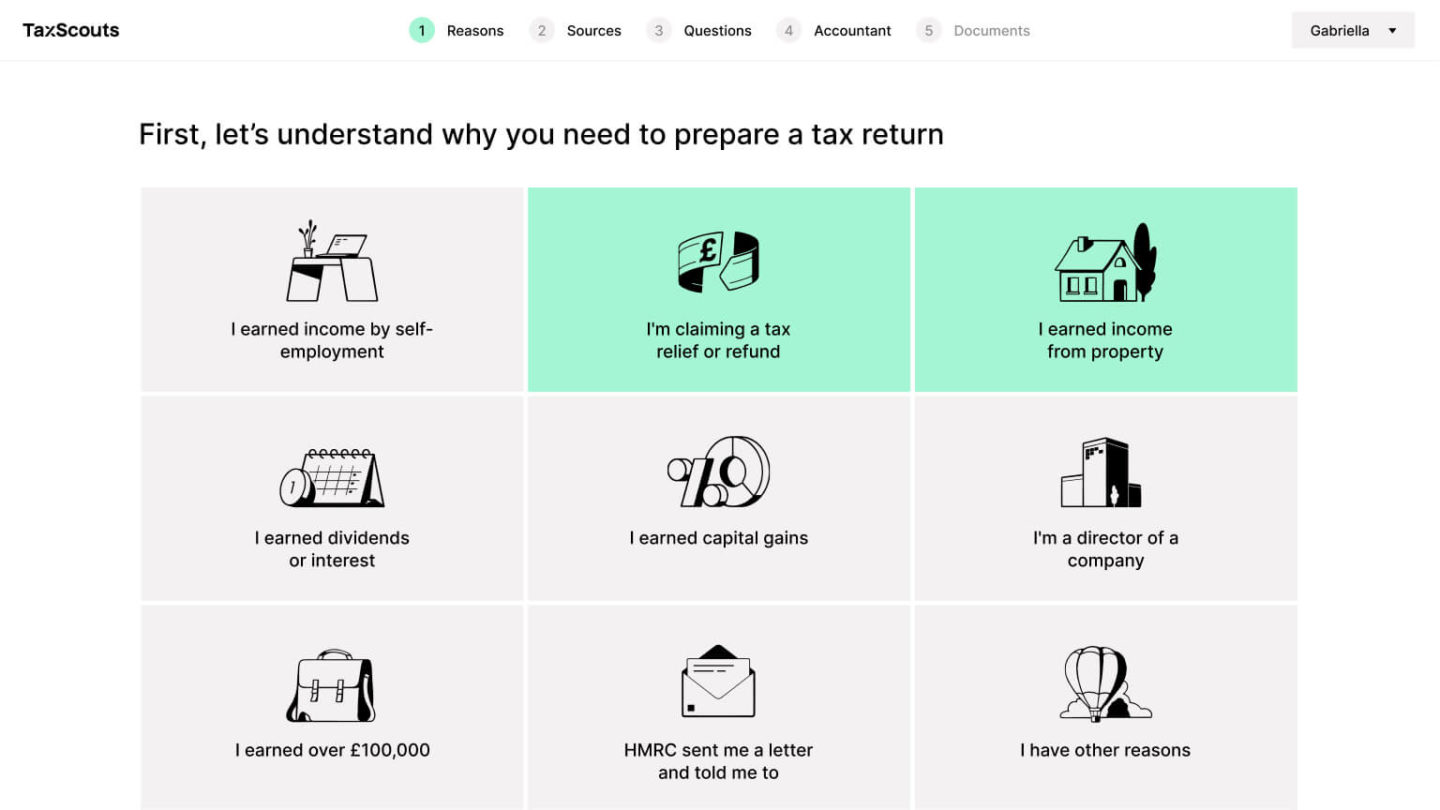

Get up to 1000 transactions done for free and a big discount on anything more through Koinly. Once you’ve got your report, you can add it to your TaxScouts account in one click.

Learn more here.