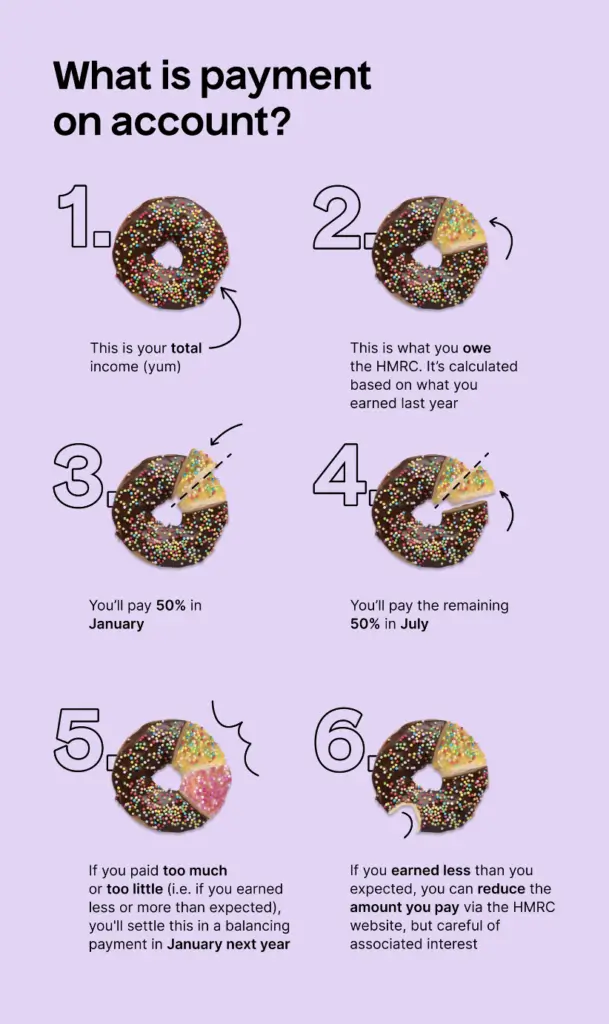

Payment on Account means that you pay tax in two instalments:

It’s usually the self-employed (and very rarely landlords) who have to use Payment on Account.

If you’ve already paid more than 80% of your tax bill by January, don’t worry about Payments on Account. You won’t be charged again in July.

Why is my first Payment on Account so high?

Basically, in your first year of self-employment, you pay 150% of your tax bill in one go.

Here’s how this would work out in practise.

- Your tax bill for is £5,000

- You’ll need to pay this in full by the self assessment deadline plus an advance payment of £2,500 (50% of £5,000)

- You pay the remaining 50% (£2,500) by July 31st

What if my income is less next year?

You can ask HMRC to reduce your payment.

However, we recommend you pay the Payment on Account as it is. If your profits are indeed down, then HMRC will refund you the difference.

What if my income is higher next year?

You will be required to make a balancing payment by January 31st next year so your account is up to date.

How to check what to pay

Log in to your online account and click “View statements”.

You can find information on payments you’ve made already or your next payments.

Is it optional?

No.

Once you submit your Self Assessment tax return, you are automatically enrolled.

The only exceptions:

- You’ve already paid 80% or more of the total tax amount you owe (for example, through PAYE)

- Your tax bill from Self Assessment was under £1,000.

If you don’t pay tax through PAYE, you’re self-employed and your tax bill is more than £1,000, you’ll have to pay tax again in July.

Here’s a visual guide to help you understand a little better.