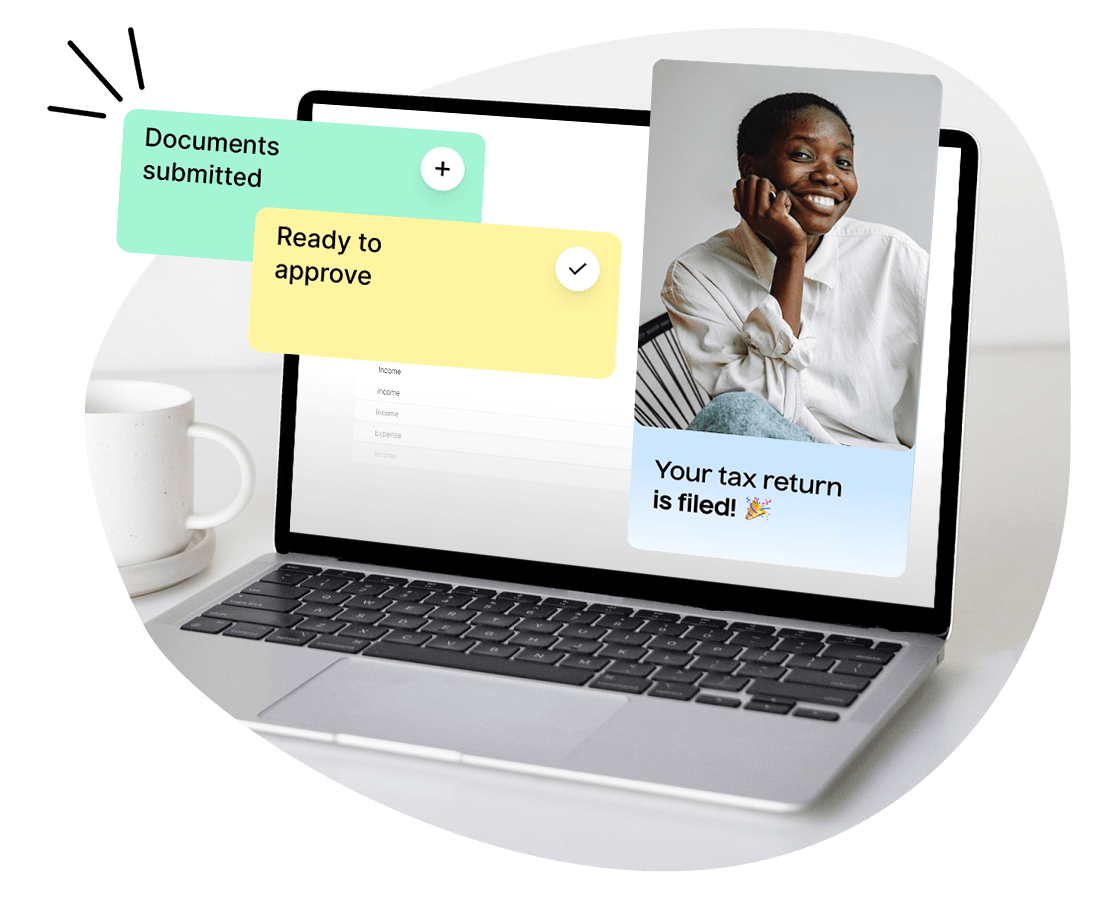

There are two main things that set us apart. Firstly, for you, the users. We automate all the admin that accountants usually charge for. This saves them time and means we can pass on any cost savings to you. It also means that we can get your tax return filed in as little as 48hrs, from signup to filing, or your tax advice consultation booked in minutes.

If you’re ready to go, we’re ready to help.

For our accountant partners, our platform is built in a way that means you don’t compete with each other. You don’t bid on clients and never lose out on business to other accountants. The clients are yours, and when they return from previous years, they’re assigned automatically to you.