So, you’ve set up your limited company, and now it’s time to get familiar with the CT41G form. This letter from HMRC gives you everything you need to know about your tax obligations, from how to register for Corporation Tax to the all-important deadlines.

Inside, you’ll find your Unique Tax Reference (UTR), instructions on setting up your HMRC online account, and details about your first company tax return. But don’t worry, we’ll walk you through it. Let’s get into it! 👇

What is a CT41G form?

If you’ve just set up a limited company, HMRC will send you a CT41G form. Think of it as their way of checking in to see if you’ve started any business activity because once you have, you’ll need to register for corporation tax. 💼

The CT41G form includes all the important info you need, like:

Ignoring this form? Not a great idea! Miss a deadline, and you could face penalties before your business has even got off the ground.

When will you receive the CT41G form?

The CT41G form usually arrives within a few weeks of your company being registered with Companies House. If it’s been over a month and nothing’s turned up, it’s worth contacting HMRC to check on its status.

What to do when you receive the CT41G form

So, you’ve got the form, now it’s time to get it sorted. Don’t worry, it’s pretty straightforward. Your main job is to give it a good look over and follow the steps. It’s also wise to keep a copy with your company records, as you never know when you might need to refer back to it. 🚨

Start by checking your details. The CT41G form includes your company’s Unique Tax Reference (UTR), a 10-digit number that identifies you as a taxpayer. Sounds important? That’s because it is. Make sure it matches what’s on your Companies House records, as you don’t want any mix-ups!

Once you’ve double-checked everything, you’re all set to move forward with the next steps.

What instructions does the CT41G form give?

Once your CT41G form arrives, don’t just toss it in a drawer, there are a few key things you need to do:

- Register for Corporation Tax: if your company has started trading, you must register within three months of business activity.

- Set up your HMRC online account: you’ll need this for filing your company tax return and managing any tax payments.

- Note your deadlines: add your first Corporation Tax return deadline to your calendar now. Future you will thank you! 📅

In short, the CT41G form tells you exactly what to do next, whether you’re up and running or still waiting to launch. Just follow the instructions, and you’ll stay on HMRC’s good side.

Misplaced your CT41G form? Here’s what to do

If you’ve lost your CT41G form, there’s no need to worry. The key thing you’ll need is your Unique Tax Reference (UTR), and there are a few easy ways to get it:

- Check previous correspondence from HMRC: your UTR is often included in tax-related letters.

- Log into your HMRC online account: you can find your UTR there if you’ve already registered.

- Call HMRC on 0300 200 3410: you’ll need to confirm some details, but they can reissue the letter if necessary. 📩

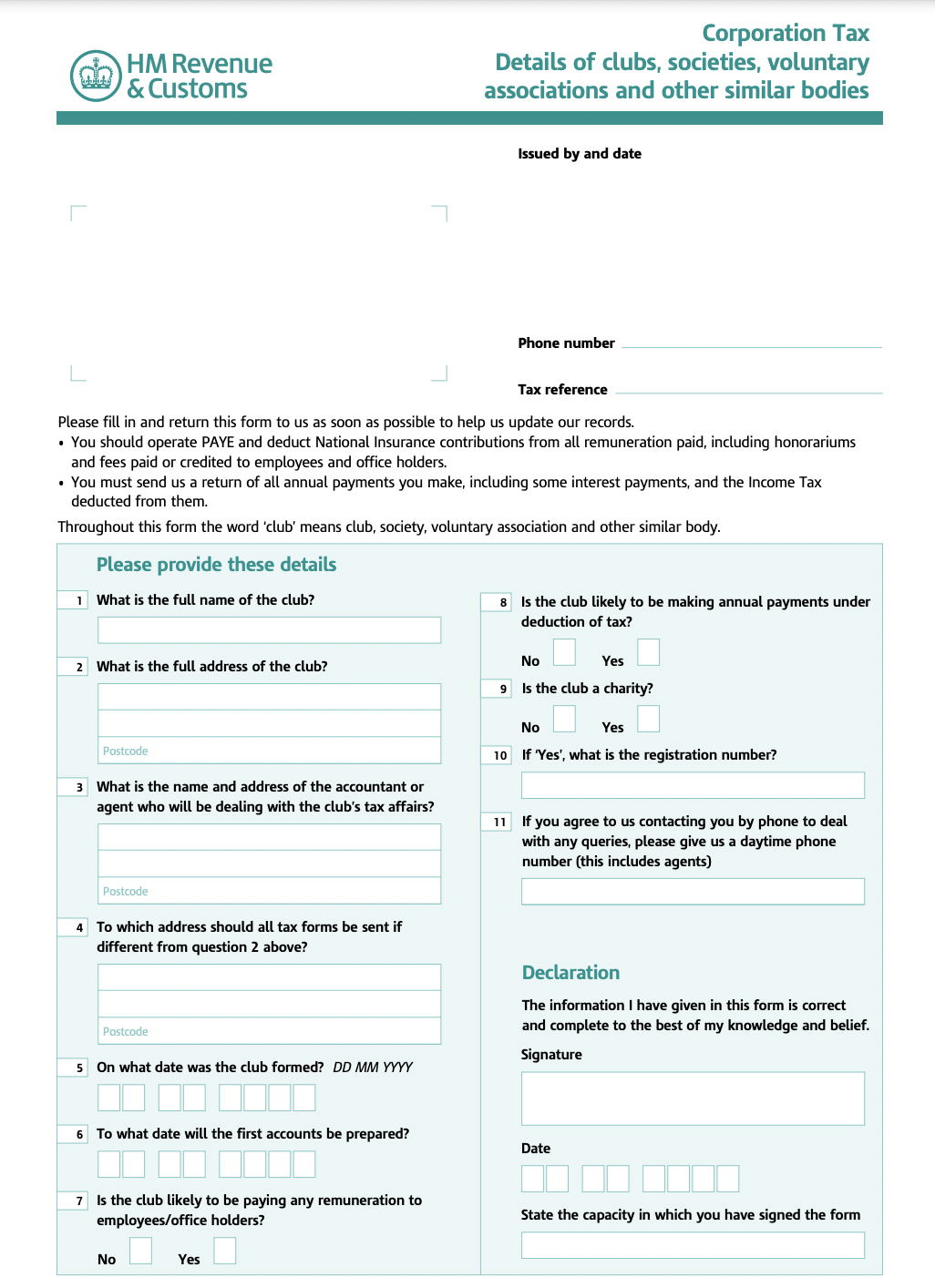

What does the CT41G form look like?

Here’s a look at the CT41G form so you’ll know exactly what to expect. 👀 Check out the example below to spot the key details, like your Unique Tax Reference (UTR).

You’ve got this!

The CT41G form is your guide to managing corporation tax. It outlines key deadlines, explains how your tax is calculated, and provides the necessary steps to stay compliant. Keep the form handy, follow the steps, and you won’t have to worry about HMRC knocking on your door. 😮💨