While the Seed Enterprise Investment Scheme (SEIS) gives incredible tax reliefs, you need to claim them in order to benefit.

Here is how to do it.

Information you need to have before you can claim SEIS

Company names that you invested into Date on which the shares were issued to your name Amounts you invested in each company HMRC office that authorised the issue of the SEIS3 certificate Where you can get this information

1. Your SEIS3 certificate

This document contains the key information needed for claiming your tax relief with your self assessment.

You will get this from the company you invested in.

They’ll be able to apply for one:

After they’ve been trading for 4 months When they’ve spent 70% of the invested money If you used an agency or a platform for your SEIS investments, then you should receive SEIS3 certificate from them.

2. Your Share Certificate

This is the document that proves you’re a shareholder in the business.

You also get it from the company you invested in.

How to actually claim SEIS

Keep in mind that you’re only eligible for the CGT exemption if you keep the shares for 3 years.

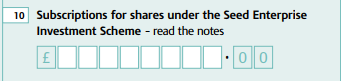

When you’re filing your personal tax return you must claim the SEIS tax relief by filling in the “other tax reliefs” section on your Additional Information (SA101) page .

You’ll need the enter the total amount invested into companies under SEIS:

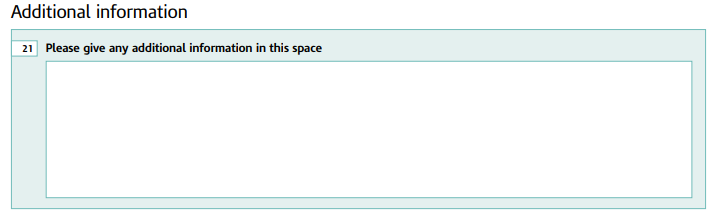

At the bottom of the page you’ll need to provide the information listed at the top of this article at the additional information section:

Of course, you can also use TaxScouts and we can sort all of this for for you.