A Double Taxation Agreement (DTA) is an agreement between two countries. It prevents you from paying tax twice on the same income. If both countries have a Double Taxation Agreement, you don’t pay additional tax on the same income, but you may still have to file a tax return in both countries. Here’s a list of current double taxation agreements between the UK and other countries.

I’m a UK resident but earn foreign income

- HMRC will tax your worldwide income. You need to include both your UK and foreign income on your UK Self Assessment

- Without a DTA, iIf you’ve already paid tax on your foreign income outside the UK, you have to pay tax in both countries

- With a DTA, you can claim back the foreign income tax as tax relief for your UK Self Assessment tax return

I’m not a UK resident but I earn income from the UK

- You must complete a UK Self Assessment

- Only include and pay tax on income earned in the UK

- With a DTA, you can usually claim back the UK tax paid on your income in the other country

- You can also choose to stay a non-resident by claiming the “Remittance basis” of taxation. You’ll still need to pay tax on UK earnings in the UK but your foreign earnings will be taxed elsewhere

I’m a tax resident in both countries

- You’ll have to check the DTA between that country and the UK

- Check the rules to make sure that you don’t pay tax twice

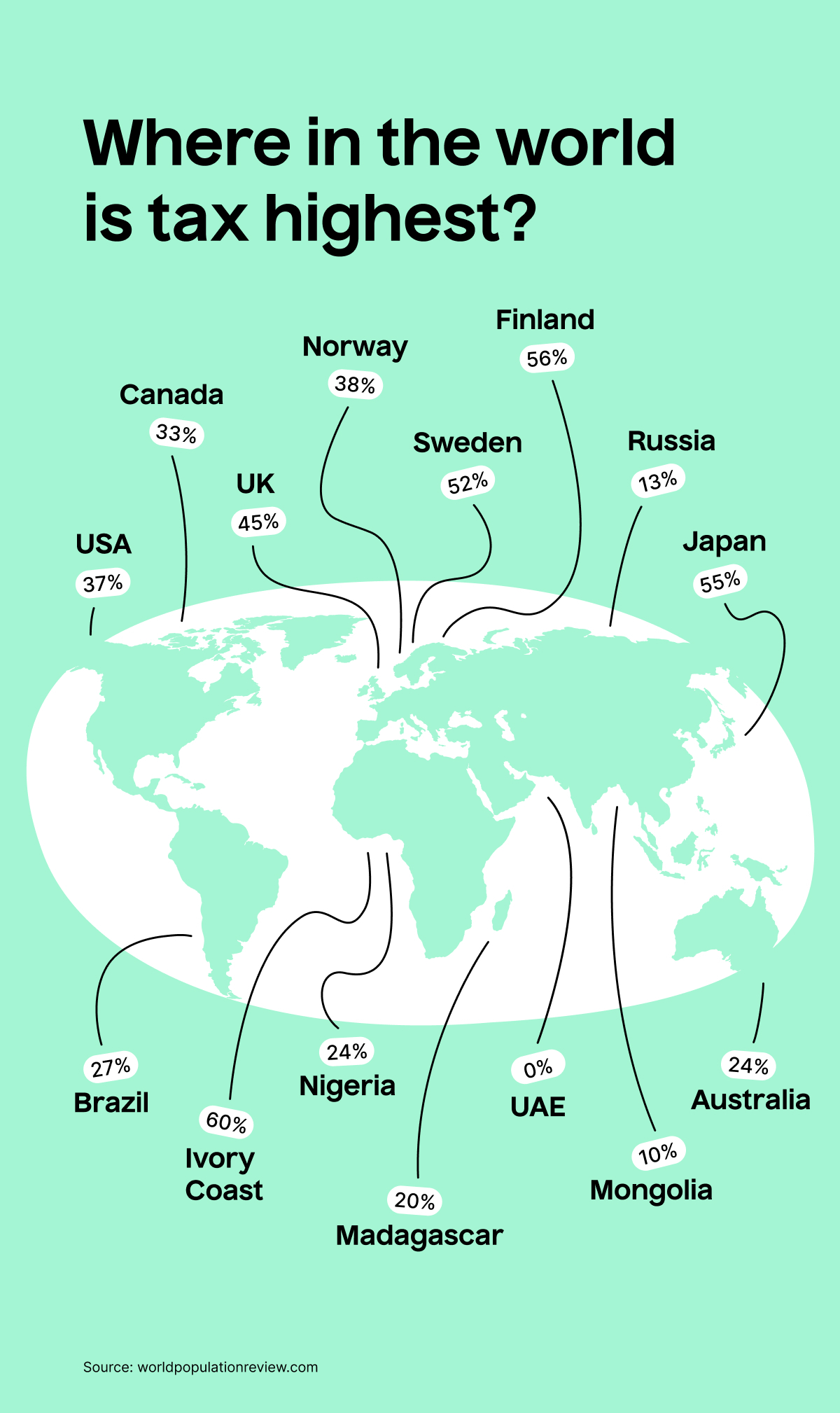

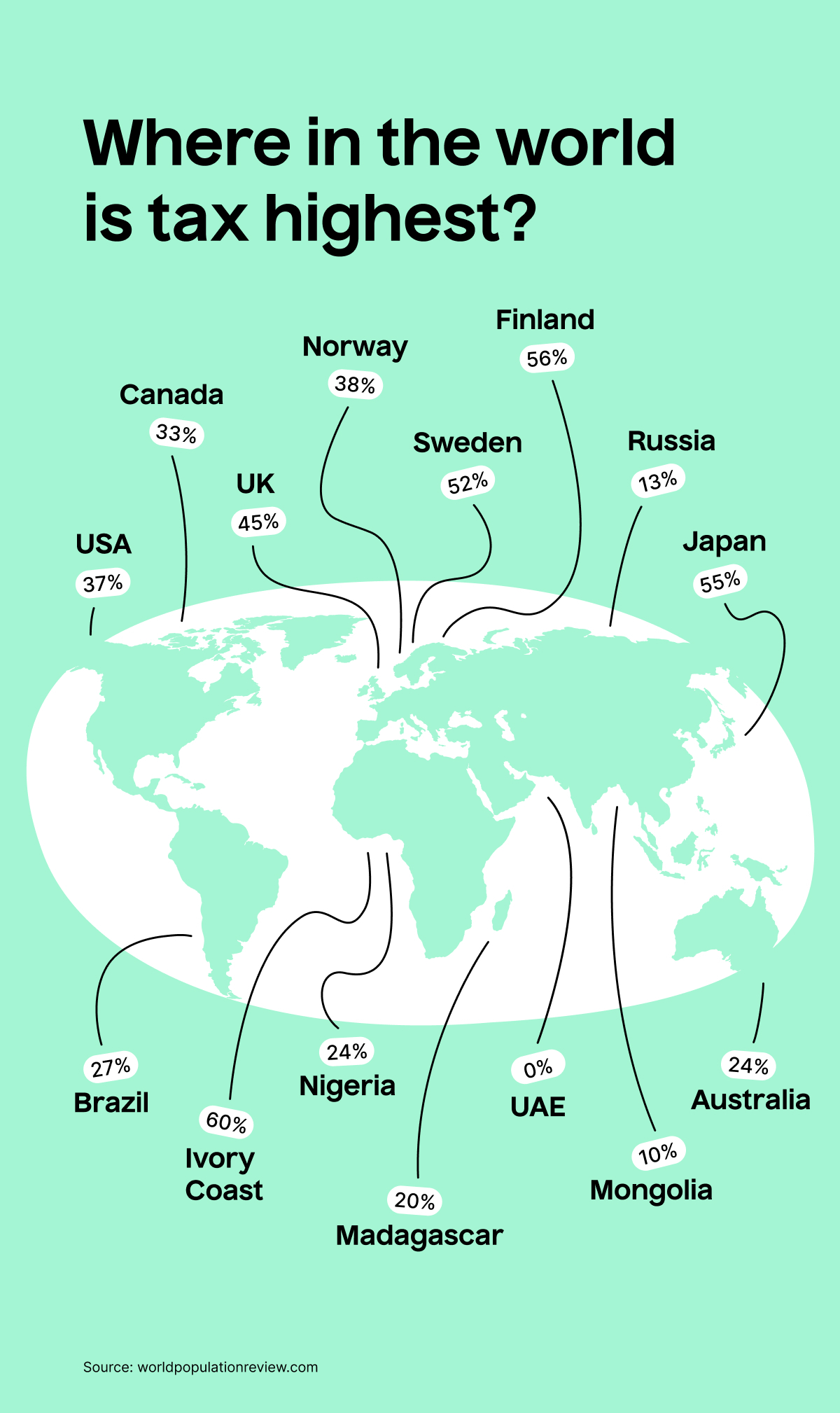

Have a look at our map to see the tax rates in different countries:

Luckily, you only have to pay once!