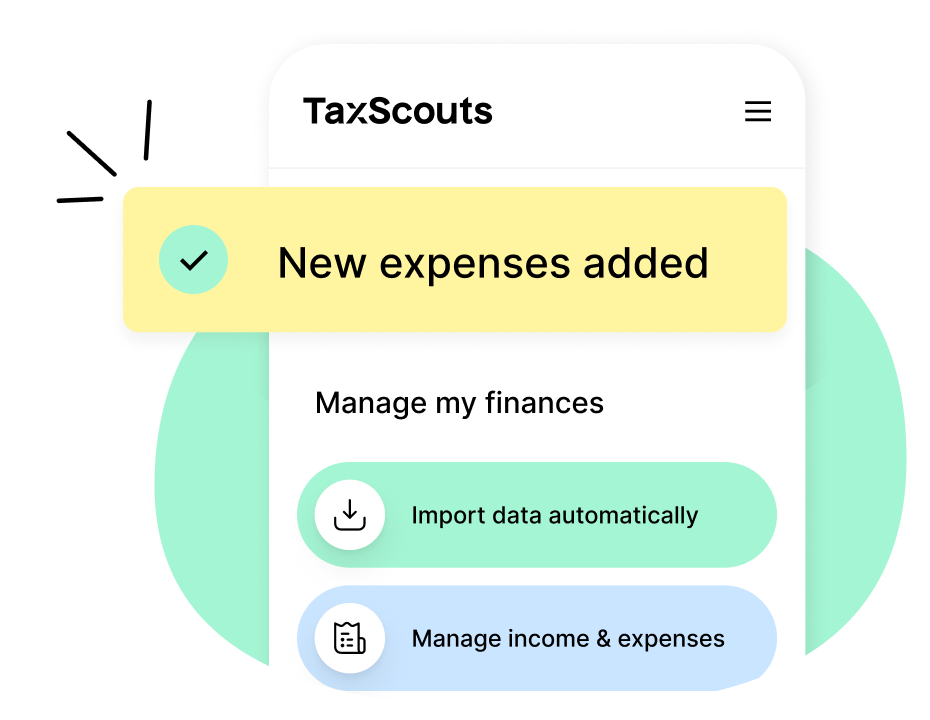

Our bread and butter is our accounting support: professional expertise provided by our network of accredited accountants. Back in 2017 when we launched TaxScouts in the UK, we did that selling our slick and snappy online tax returns, filed by an accredited accountant. Now we offer two one-off accountant-based services in the UK (tax returns and tax advice consultations), and we’ve got more in the pipeline coming in 2023.

We charge for our accountants’ time and expertise. But when it comes to the bookkeeping tools to help you get organised, it’s on us. Part of our ethos is keeping things simple and straightforward, and not needlessly charging for things. So we’re sticking to that belief.