Why do I need to add joint ownership of property details to my tax return?

If you and your partner have joint ownership of property that you rent out together, each of you will have to complete a tax return.

Same goes if you are selling a property that you own together.

As a result, TaxScouts allows you to specify that your property is jointly owned and enables you to include the co-owner’s details.

This ensures that both you and your partner get the same accountant, who is already familiar with your shared property, expenses, and has already completed the relevant tax calculations.

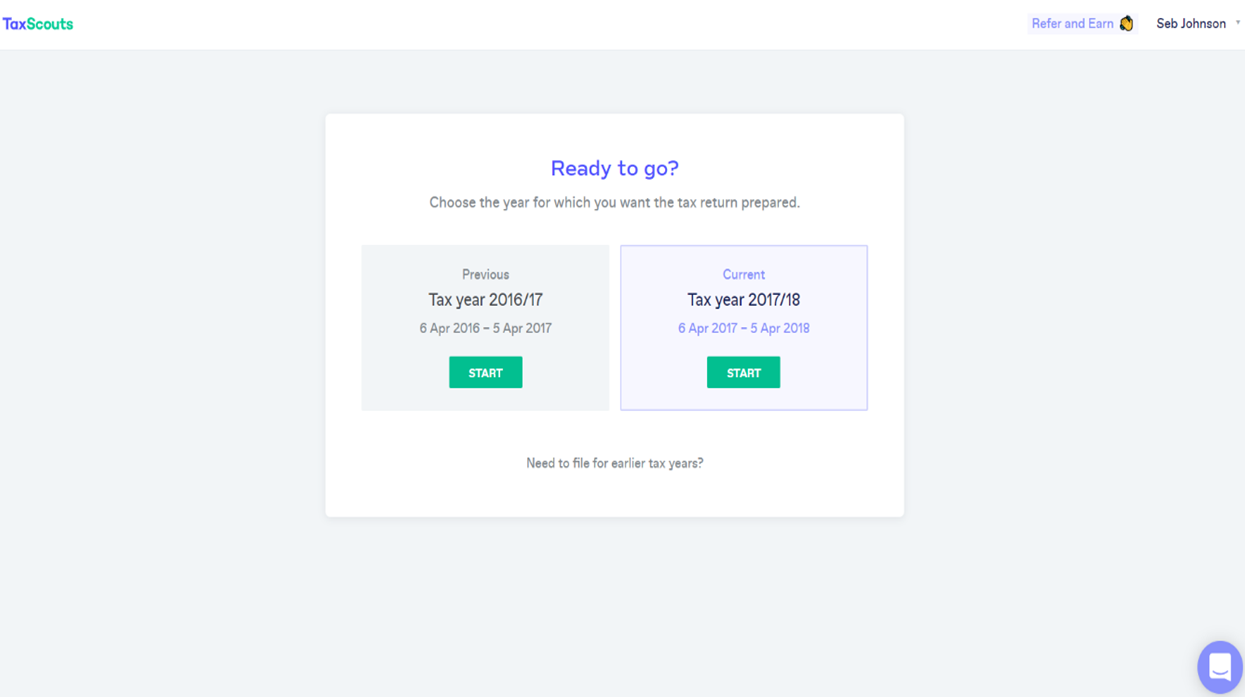

Step 1

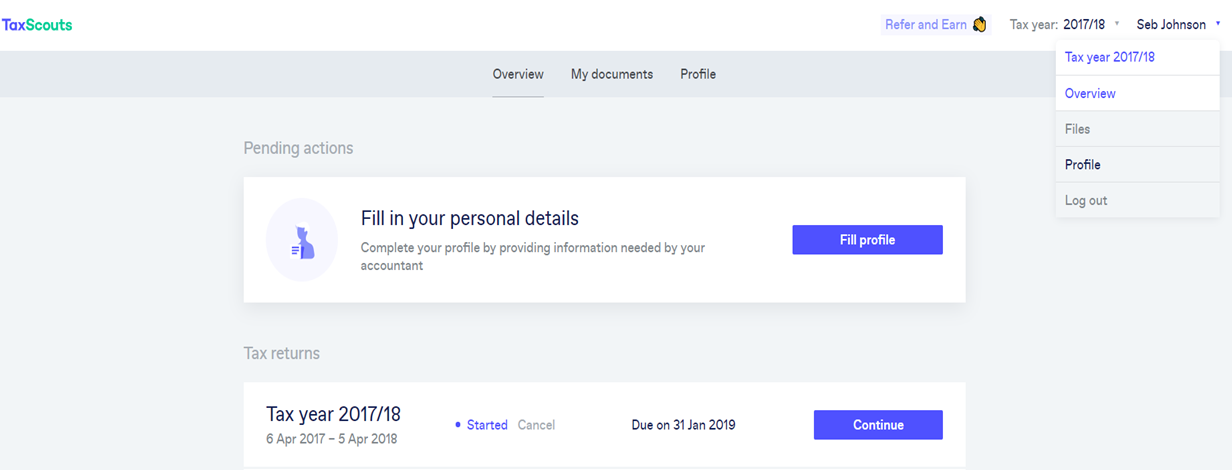

Log into your TaxScouts account and select the tax year you are looking to file a tax return for.

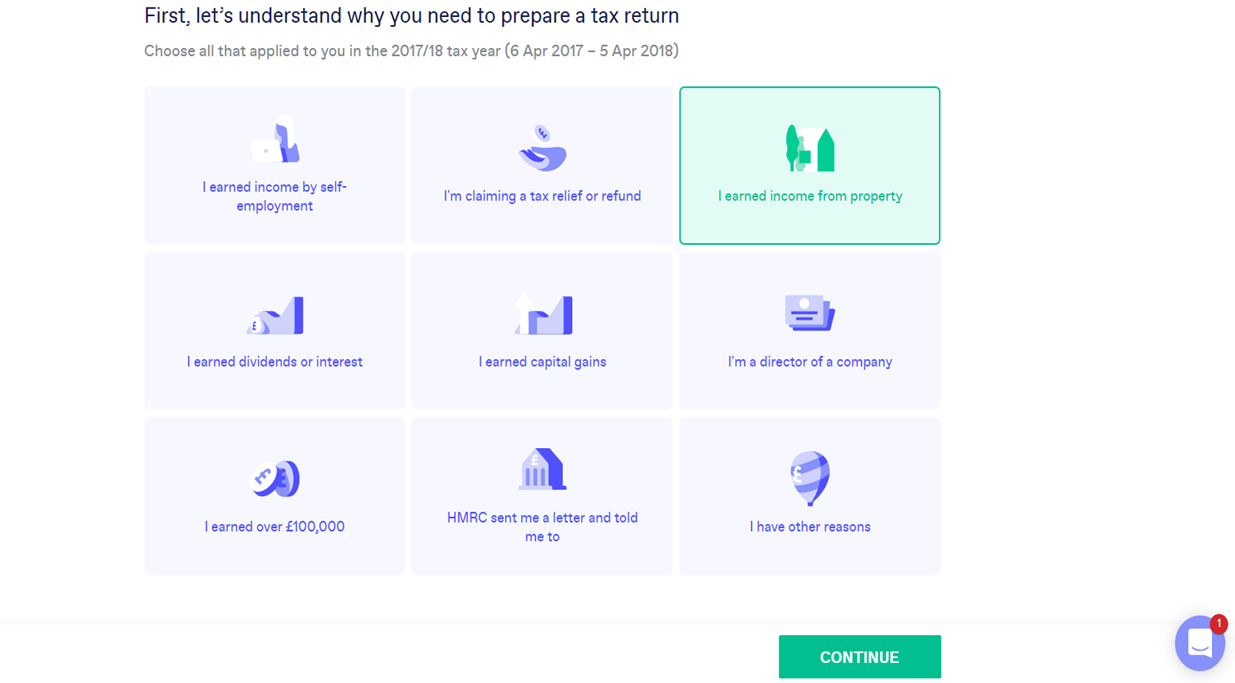

Step 2

If your main reason to file a Self Assessment is property income, select “I earned income from property”.

Make sure you select all the reasons why you need to prepare your tax return:

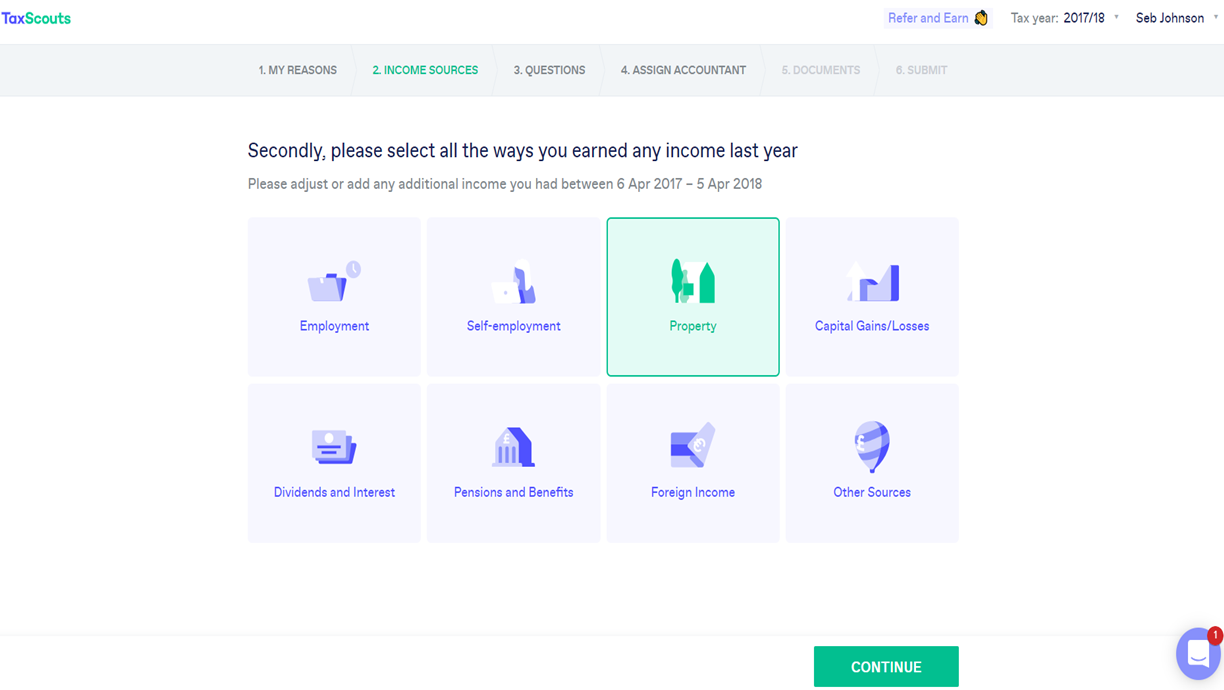

Step 3

Next, select all your sources of income, and for property select “I earned income from property”.

Next click “Continue”.

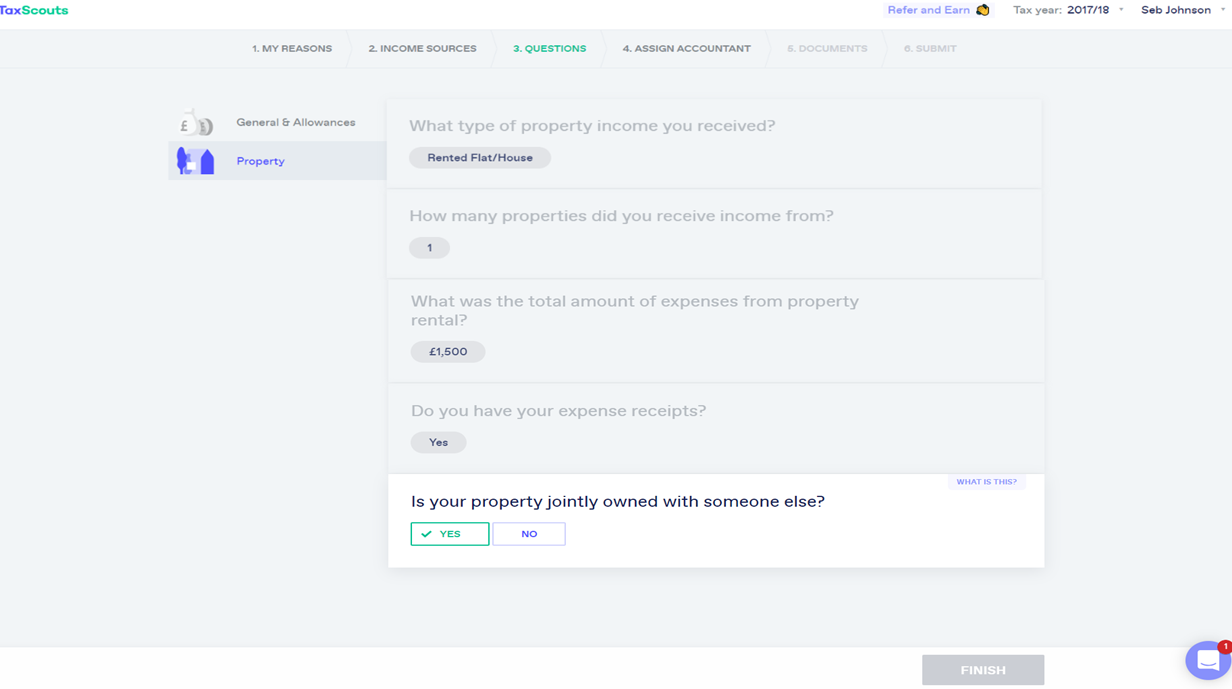

Step 4

Under the property section, answer the “Is your property jointly owned with someone else?” with “Yes” and then continue answering the property-related questions.

Step 5

After you’ve completed the remaining questions and submitted your tax return to your assigned accountant, click on your name on the top right-hand side and select “profile” from the drop-down menu.

Step 6

Select “Co-owner details” from the tab on the left and then continue to enter their details:

- their first and last names

- their email address.

Still need help on joint ownership of property?

If you need help with any aspect of adding co-owner details , please log in to your TaxScouts account and click on the blue “Help/Chat” icon found on the bottom right side of your account.

Our support team will be happy to help.

Otherwise, take a look on HMRC for more detail.