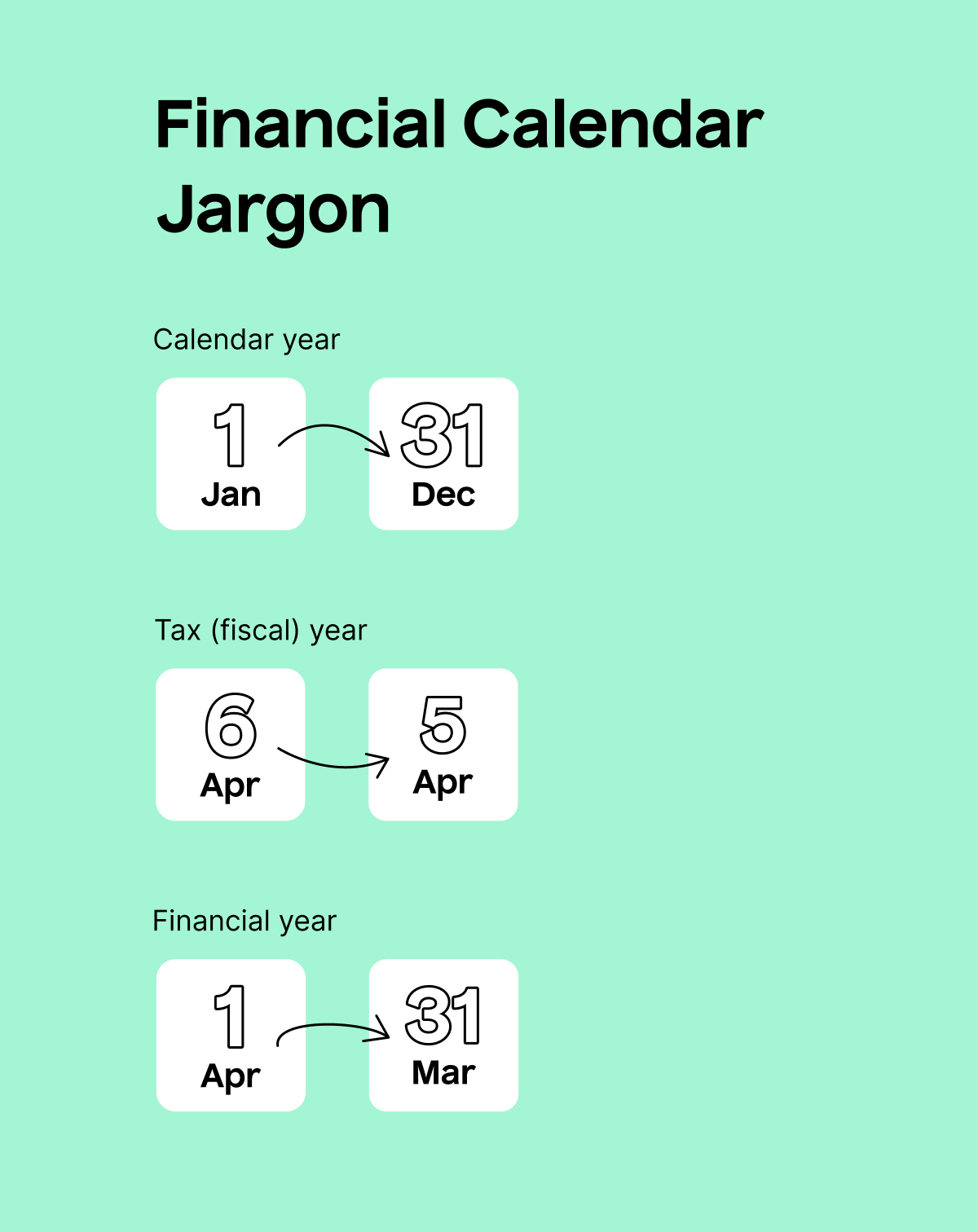

If you’re one of the many self-employed workers, landlords, investors or anyone else due to file your first Self Assessment tax return, you might be wondering: when does the tax year end in the UK?

It’s a good question, especially since the UK tax year doesn’t follow a logical pattern and differs from most European countries – we just had to be different, didn’t we? 😅

If you want to know the answer, keep reading!

When does the tax year end?

It ends in early spring.

Yep, you read correctly – spring 🌸

If you’re self-employed or have to file a tax return, you should calculate your income and expenses based on this period.

So why does the tax year end in April?

You might have noticed that the tax year doesn’t follow the usual calendar year pattern (i.e. January to December). Wanna know why?

Here’s a quick history lesson…👇

Back in medieval times the calendar year was split into quarters that were each based around 4 key dates:

- 25th March – Lady Day (aka New Year)

- 24th June – Midsummer

- 29th September – Michaelmas

- 25th December – Christmas

Back then, people used to settle their debts and rents the day before each of these key dates. The 25th March marked the start of the new calendar year and, after time, it became known as the start of the financial year as well.

Then in the 1500s, most of Europe (the Roman Catholic side) switched from the Julian calendar to the Gregorian calendar. But the UK didn’t follow suit and was more than 11 days out of alignment with the rest of Europe.

It wasn’t until 1752 – when the government simply removed 11 days from the calendar 🤯 – that permanently moved the tax year-end forward. One final change was made in the 1800s to tidy up the discrepancies between the Julian and Gregorian calendars – a day was added to the tax year.

This resulted in the odd dates for our end-of-year tax return!

What you need to do at the end of the tax year

At the end of the tax year, HMRC will send you a notification to file your Self Assessment tax return for that year.

However, while the tax year ends on the 5th of April, you still have nine months before the deadline to file. That said, it’s important to prepare.

Making sure you’re organised with all your invoices, bills, statements and receipts from the tax year will help you in the long run when it comes to filing your tax return.

Get Self Assessment tax advice from TaxScouts

Still confused? Don’t be! If you have a tax-based problem, get in touch with us for some simple, one-off tax advice from our accredited accountants. Learn more here.