The P45 form is a statement issued by your employer when you leave your job. It’s got all the important info about your income and taxes while you were there, making it essential for your records.

So, whether you’re switching jobs or gearing up for your Self Assessment, we’re breaking down everything you need to know. 🔍

How do I get a P45 form?

When you leave your job or change to a new one, your old employer will generate a P45 from their payroll system. They should automatically send you this.

You should receive two copies:

- One for your personal records

- One for your future employer (your new employer will ask for your P45 as part of the onboarding process)

If you haven’t received your P45, don’t panic. 🙃 Just ask your previous employer to sort one out for you – it’s their job, after all. If you can’t get hold of a P45, our system will simply ask for your final payslip from the previous tax year instead.

What’s in a P45?

A P45 contains essential information required by your new employer and for your Self Assessment tax return:

- Your National Insurance number

- When you left your job

- How much you earned in the tax year

- How much National Insurance and Income Tax you paid

- Your details and your employer’s

- Your most recent tax code

- Whether you’re still paying off student loans

This information helps your new employer set you up with the right tax code, so you don’t end up overpaying or underpaying tax. Without it, you’ll be given an emergency tax code, which could mean paying more tax than you should! 🚨

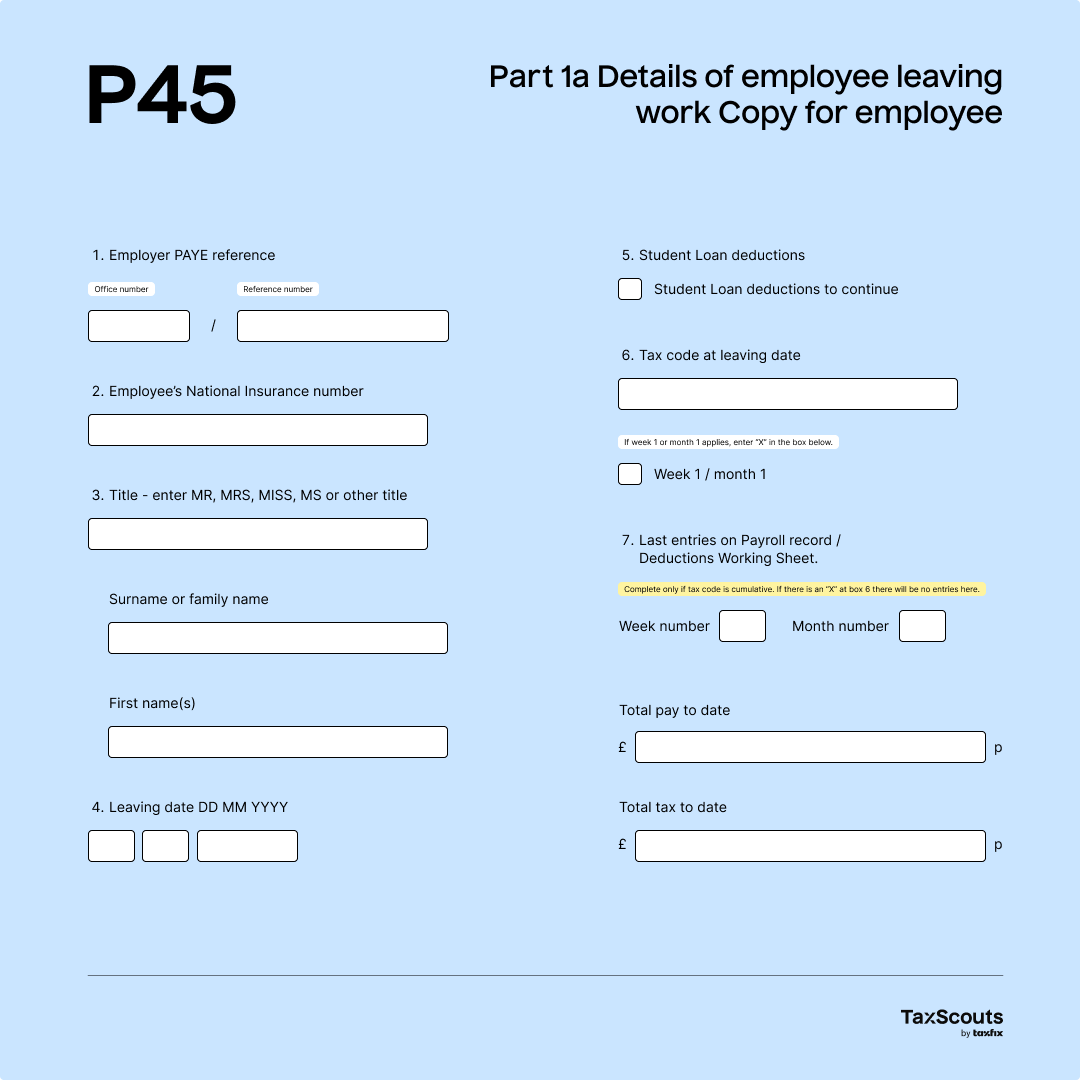

What does a P45 look like?

There is no standard P45 example (each may look a bit different), but the minimum information on it is always the same.

What do you need a P45 for?

The P45 which you don’t give to your employer should also be kept safe. You may need this to:

- File your Self Assessment tax return

- Keep accurate tax records (in case of disputes) 😠

- Ensure you’re on the correct tax code at your new job, avoiding underpayment or overpayment of tax.

Why do accountants need my P45/P60?

Accountants use the information on your P45 or P60 to:

- Verify your income and taxes for the year ✅

- Ensure accurate tax filing and prevent errors that could lead to penalties

- Help you claim a tax rebate, if applicable 💸

What if I lose my P45?

In this case, you won’t be able to get a replacement. However, your new employer will ask you to fill in a starter checklist instead.

⚠️ Not having a P45 could mean you pay too little or too much tax. ⚠️

If you notice you’ve paid too much, you can either:

- Contact HMRC straight away

- Wait for a tax rebate

If you choose to wait for an automatic tax rebate, this is usually done by the end of the tax year (5 April). HM Revenue and Customs (HMRC) will send you either:

- A tax calculation letter (also known as a P800)

- A Simple Assessment letter

All your FAQs answered

Is it safe to share my P45/P60?

Yes, it’s safe to share your P45 or P60 with a trusted accountant. These forms only include tax details, so there’s no need to worry about your bank accounts or personal finances. Just make sure you’re working with a reputable tax professional to keep things secure. 🔒

Can I get a copy of my P45 from HMRC?

No, HMRC doesn’t issue replacement P45 forms. You’ll need to contact your former employer to request a new one.

How long does it take to get a P45?

Your employer should provide your P45 immediately after your final paycheck is processed. If it’s delayed, reach out to them for an update. 👋

What if I haven’t received my P60?

If you haven’t received your P60 by 31 May, contact your employer to resolve the issue.

We’re here to help!

We hope this guide has made your P45 a little less mysterious. It’s an important document, whether you’re starting a new job or preparing for your Self Assessment, so understanding the ins and outs is essential. And remember, we’re always here if you have any questions along the way!