Today, we’re talking about scams – because at TaxScouts, the only thing that we care about more than dishing out hassle-free tax support is your security when it comes to paying your tax bill.

How to identify a scam

Some scams are easier to identify than others. But some are pretty iron-tight which is why so many people get stung. To give yourself the best chance of security against them, we’ve put together a top 7 hacks that scammers often use when they send you comms.

This can make it easier to work out what’s legitimate and what’s not.

1. Typos

Look out for typos when you get a suspicious-looking email or text. Often, scammers will include them deliberately to determine whether or not you’re concentrating. Anyone that misses them suggests to the scammer that they might be gullible to the scheme.

2. How did HMRC contact you?

Be mindful of the ways that HMRC communicates. They will never Whatsapp you, Tweet you or contact you via any other social media unless you have messaged them via the platform first.

When it comes to SMS messages, they have confirmed that they will never use this method to notify you of a rebate, refund or fine. Basically, if it’s not a letter, stay woke. If it is online or by phone, question what’s being asked of you.

3. Urgency

A classic technique that scammers will use is to make you think that whatever action they’re asking for is urgent. This is to make you panic and act without thinking – and in this state of mind, you’ll be more likely to fall for a scam. A recent example of this was a voicemail from “HMRC” that warned of a warrant for your arrest because of tax fraud. If you do receive this, ignore it. It’s a scam.

The numbers associated with it are those from a Malaysian dial-code and the following:

- 01622690690

- 02052006933

- 02042001957

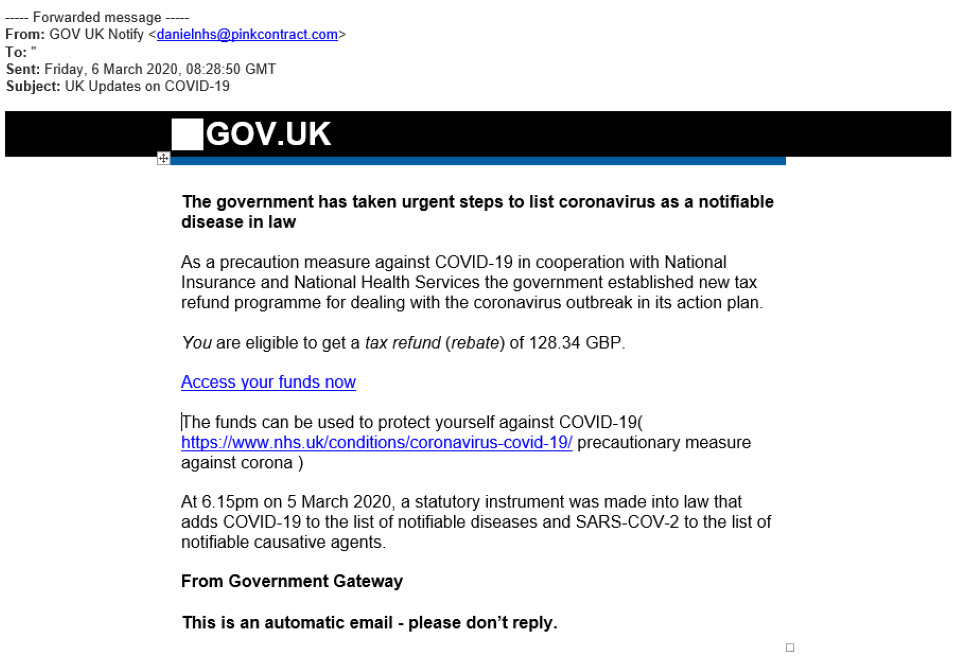

4. Inconsistencies

Like in the above examples, you should look out for the sender address and the sender name being different. The easiest ones to spot are where the sender is listed as someone official (e.g. HMRC or gov.uk) but the email address is clearly a personal address (e.g. mark65@hotmail…).

This is the same with businesses contacting you by SMS. Their contact name will appear as HMRC but the number will be a personal mobile number.

5. The dreaded link

When you receive an email asking you to login to your account via a link, especially if it’s to the end of claiming a refund, paying a fine or claiming a rebate, do not click it. If it’s legitimate, you should be able to go onto the HMRC website, login directly and find something related to the issue on your account.

This is the same, even more so for texts. It’s very rare for a company to text you with a direct link to something – so avoid clicking it at all costs! Like the email, if you can’t find what’s referred to in the text by going to the website directly, it doesn’t exist.

6. What are you being asked for?

Phishing is very prevalent in the online financial world.

Something to be mindful of is what information you’re being asked to provide in replying to an email. It may not be a blatant question but just think before you reply, what information am I giving away when I respond? If it’s your login details, card details, address, account details and more, then think again.

7. Random aggression

A tactic that often gets people to act out of character is by being erratically aggressive. The more uncomfortable you’re made to feel, the more likely you are to do as you’re being instructed to make the aggression stop. It’s very common when you’re approached over the phone.

This tactic is used in the HMRC voicemail scam we mentioned earlier.

8. Out of the blue contact

If you weren’t expecting the correspondence, it may not be legitimate. It’s unlikely that HMRC will contact you out of the blue with random information. Think about it. Outside of your tax code changing or being told that you’ve paid too much or too little tax (which is by letter), why do they ever contact you asking for you to take an action? HMRC characteristically does not run a speedy service, so it’s unlikely that they’ll ever ask you to do something “right now”.

If you are contacted, you can refer the scam to HMRC who will look into it for you.