You may have read our piece in the FT back in October (no big deal) about the one million freelancers who could face being overcharged on their tax bills next year.

As a result of the pandemic, many of the self-employed lost out on work, with many more ineligible to claim government support.

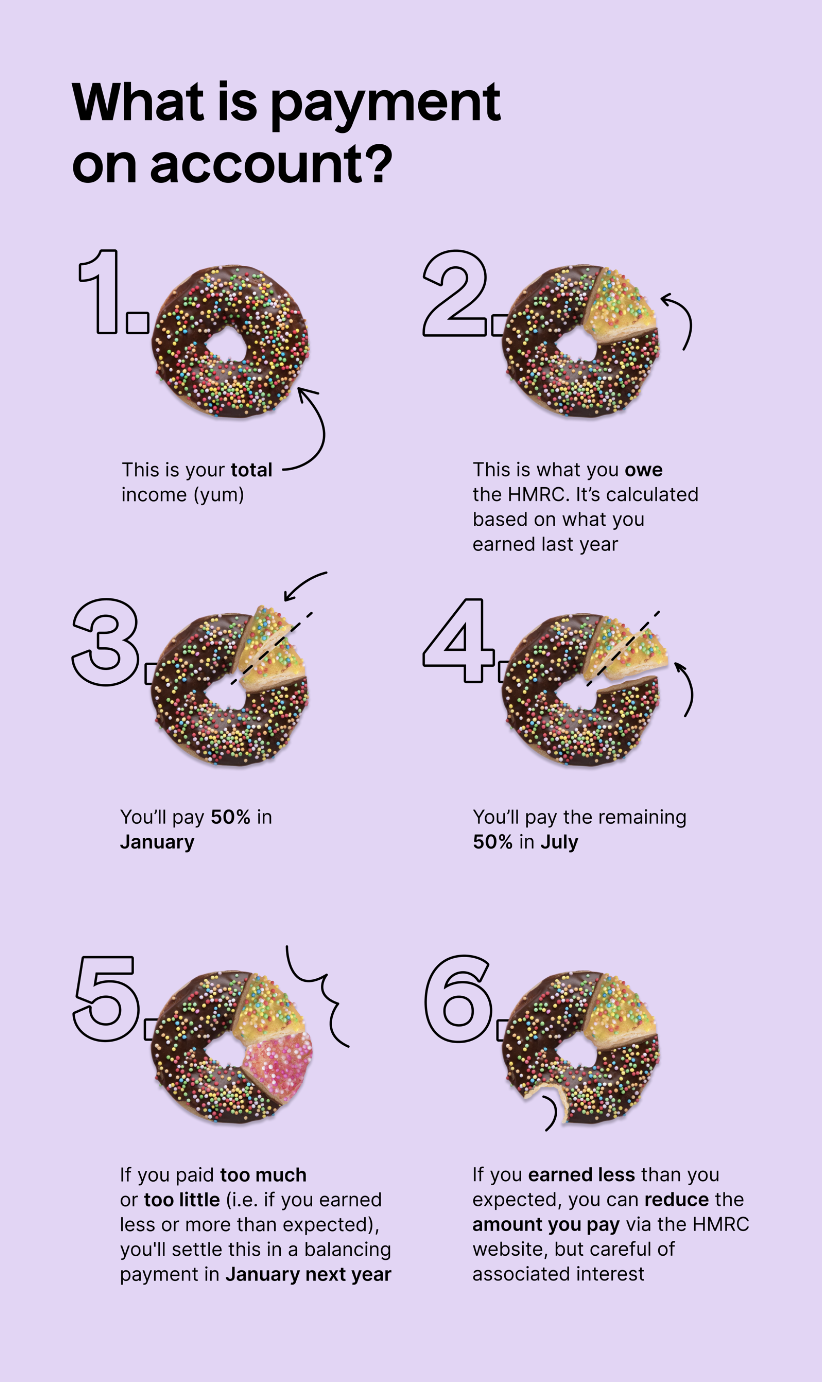

To understand why you might be overcharged, you will first need to understand Payment on Account.

OK, what’s Payment on Account?

When you’re self-employed, your tax bill is split in two across the year.

You pay the first half by 31st January and the second half in July. Sound simple? Well, it should be, but there are a few complicating factors:

- The tax year is not from Jan-Dec but from 6th April – 5th April

- When you pay your January bill, it’s owed the January after the tax year you’re paying for

- EXAMPLE:

- 2019/20 tax year = 6th April 2019 – 5th April 2020

- Payment on Account due = 50% due 31st January 2021, 50% due 31st July 2021

HMRC calculates your tax bill – due in January and July – based on your previous year’s earnings. Anything that you overpaid or underpaid (say, if you worked and earned more or less than you predicted) will be balanced out in a payment due the following January. In this example, that’s January 2022.

It’s (aptly) known as the balancing payment. Here’s a visual:

Is it different when for self-employed newbies?

Unfortunately, yes.

When you first go self-employed and you pay your first ever tax bill, you owe tax on your whole previous tax year of earnings in January, and an up-front payment for the first half of the tax year you’re currently in.

Oh, the horror – so you’ll end up paying a 150% tax bill by your first January deadline!

So what’s different in the pandemic?

As COVID-19 put many of the self-employed out of work for months on end, the Payment on Account predicted bill will invariably be inaccurate.

As it’s based on your previous year’s earnings, if you lost out on work this year you’ll likely be liable to pay more than what you actually owe. And in these uncertain times, that is less than ideal.

What can I do?

Part of the problem is that many of us just don’t know what to do in this situation. But there are ways to avoid being liable to pay tax that you don’t actually owe. Here are three things that you can do if you find yourself in hot water:

- Time to Pay

Owing to the financial strain caused by COVID-19, HMRC have launched Time to Pay, a scheme that lets you spread the cost of what you owe. They deferred Payment on Account this year to allow you to pay your July tax bill any time up to January 2021. And now, for anyone who has taken advantage of this, you can spread your July and January payments up until 31st January 2022.

To do this though, you’ll need to apply. Head over to HMRC to check out how.

- Reduce the amount you pay via HMRC

If you think that your Payment on Account bill is too high, you can amend it using the SA303 form. You can apply online via HMRC online – but you’ll need your HMRC login details.

Once you know about it, it’s quite simple to do. The catch is that there is interest associated with it, but it’s quite moderate at 2.7% so the risk isn’t too high.

Take a look at an SA303 in action example here.

- Contact HMRC

Finally, you can just call HMRC and speak to someone directly. They’ll be able to explain your options and direct you to the best place to sort everything out. Their payment support helpline is open Monday to Friday from 8am – 4pm.

Contact them on 0300 200 3835