Former UK Prime Minister Liz Truss promised some bold new changes shortly after taking office at the beginning of September – and she followed through, alright!

Little did we know that’d be followed by a swift resignation from both her and Kwasi Kwarteng, the former Chancellor of the Exchequer.

If you haven’t heard about the latest UK government “changes” (or you’re not sure what it all means) here’s a quick rundown.

But first, what is a budget?

Corporation tax ⏪

Under the original mini-budget, corporations were no longer subject to a 6% tax increase. This didn’t last very long and the plan to increase corporation tax from 19% to 25% will indeed go ahead. Sorry Liz.

Stamp duty ⏩

Calling all first-time buyers! 🔊

Not everything in the mini-budget has been reversed (yet👀).

The original mini-budget detailed plans to remove stamp duty on the first £250,000 of property’s value (a whopping £425,000 for first-time buyers).

This tax cut will remain in place in hopes that it will:

- Boost economic growth

- Stabilise the mortgage sector

- Keep the housing market flowing

So if you want to get on the housing ladder – now might just be the right time! 🏡

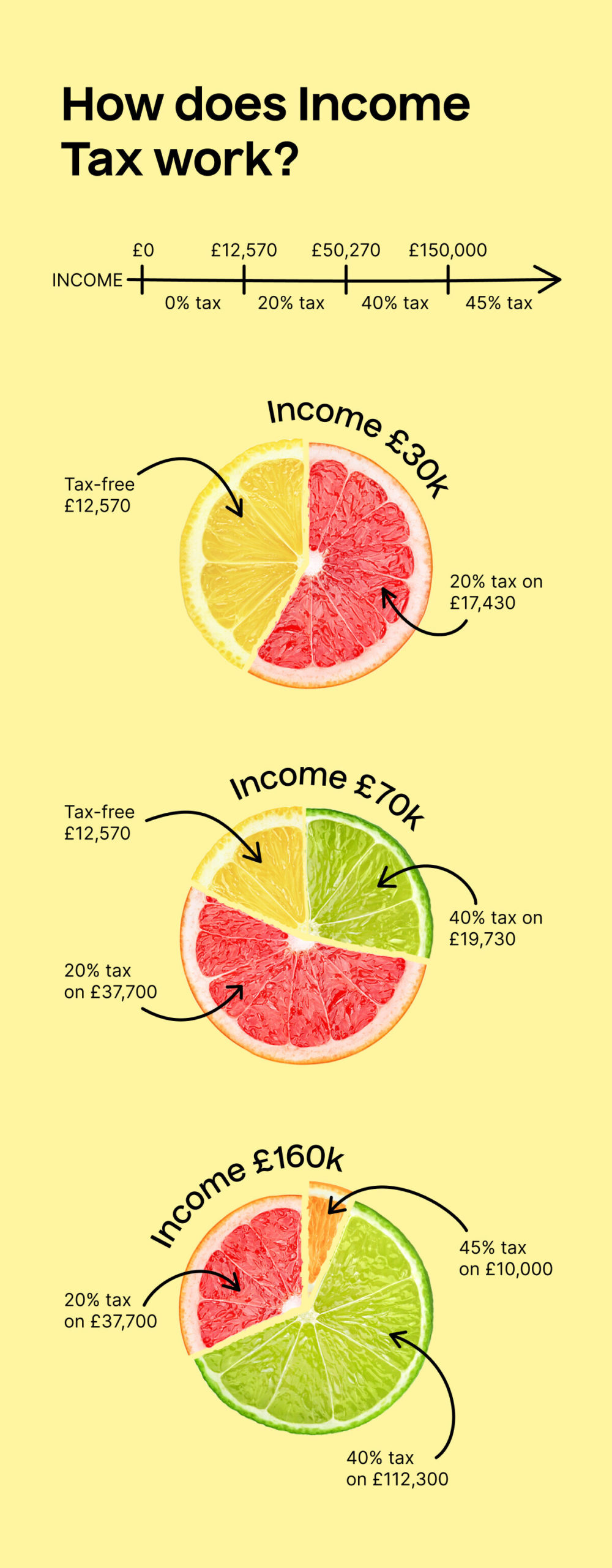

Income tax ⏪

The highlight of Kwasi Kwarteng’s six-week run as Chancellor of the Exchequer – the additional rate of income tax.

In the original mini-budget, the additional rate of income tax (which is applicable for those who earn over £150,000 and set at 45%) was to be scrapped.

Less than two weeks and a rout in the UK financial market later, Kwarteng had announced a U-turn on this move. The 45% tax band will officially remain.

But it doesn’t end there…

Plans to reduce the basic tax rate from 20% to 19% have also been axed under new Chancellor of the Exchequer, Jeremy Hunt.

We just knew it was too good to be true! 😮💨

National Insurance ⏩

If you weren’t aware, reversing the NI increase introduced by former Chancellor of the Exchequer Rishi Sunak was a key policy in Liz Truss’ PM campaign.

Now Liz may be out, but that doesn’t mean this policy is. 🎉

Dividend tax rates ⏪

In Kwasi Kwarteng’s mini-budget, the rate of dividend tax was to be reduced to its pre-April 2022 rate from 2023. This was reversed faster than the alcohol duty tax freeze!

On the bright side, you still get your £12,570 personal allowance.

VAT-free scheme ⏪

Those coming to the UK to enjoy London’s plentiful shopping districts will be disappointed to hear that the original plan to introduce VAT-free shopping for overseas visitors has now been scrapped.

Honestly, who needs VAT-free shopping to increase tourism when you have Madame Tussauds?

Alcohol duty rates ⏪

Last month, Kwarteng proposed a freeze on the planned increase for duty rates on alcohol. This was meant to come into effect in February 2023, but you can probably guess what happened..

Just as all the pubs and breweries rejoiced, it was scrapped by Hunt.

Wonder how much a pint down the pub will cost now, ay?

There’s been a lot of back and forth going on in UK politics, with Rishi Sunak just becoming the third Prime Minister in seven weeks. 😅 But as the mini-budget strikes back, the pound seems to be stabilising again, at least.