What does it mean to be a UK tax resident?

If you are physically present in the UK for 183 days or more in a tax year, you will be a tax resident for that year. So, if you’re wondering, “am I a UK tax resident?” and you meet this criteria, the answer is yes.

You will have to pay:

- Income Tax

- National Insurance

- Other taxes like Capital Gains Tax (if you sell property, shares, crypto etc.)

You will pay these for income and profits made in other countries as well – here is how to pay tax on your foreign income.

Can I be a UK tax resident if I’m in the UK for under 183 days?

It is still possible for you to be resident in the UK.

HMRC will automatically consider you a UK resident if:

- You have a home in the UK, and you’re there for at least 30 days

- You work full-time in the UK for 365 days (this test usually affects two or more tax years)

If you’re “in between” these situations, then HMRC will look at where your strongest ties (family, property, etc.) are.

What if I’ve paid tax on my foreign income already?

You still need to do a Self Assessment tax return and report it.

However, you can claim Foreign Tax Credit relief for the tax you’ve paid already.

Am I a UK tax resident if I’m a foreign student?

You don’t need to worry about UK tax on your foreign income or gains, as long as you’re using them for basic things like food, rent, tuition fee, etc.

You may need to pay tax on your foreign income if you:

- Come from a country without a double-taxation agreement for students – here is the full list

- Have income that you do not bring to the UK

- Bring your income to the UK and spend it on things other than living costs and course fees

- Plan to stay in the UK permanently

Also, if you work during your studies, you do not pay tax if your country has a double taxation agreement with the UK – but you might need to pay it in your home country.

Am I a Uk tax resident if I visit the UK often?

It doesn’t matter why or how long you’re visiting.

HMRC will usually look at the total number of days you spent in a tax year in the UK.

Can I be a dual resident?

Yes.

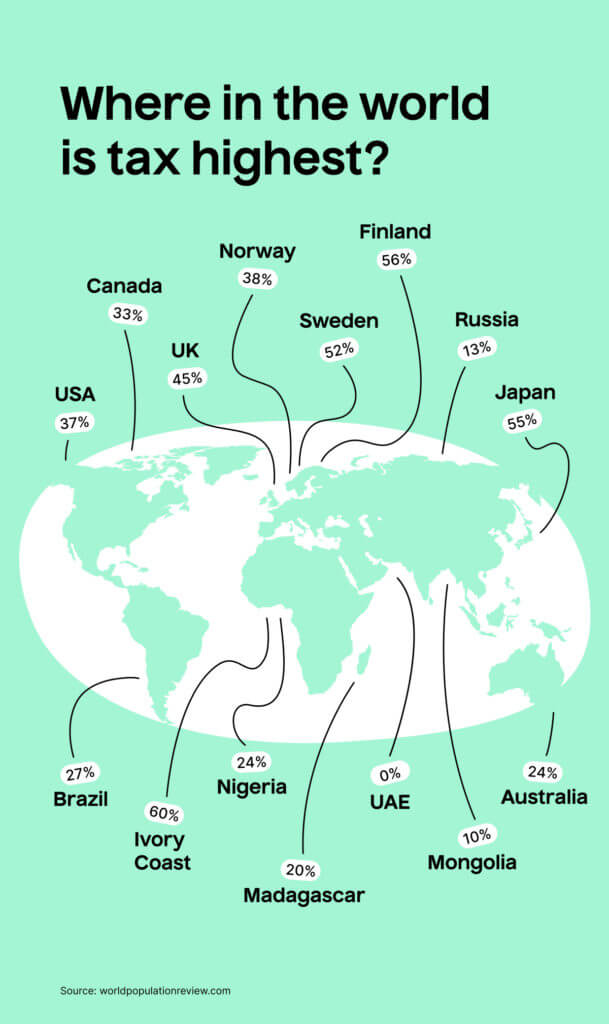

You can be a tax resident in more than one country at the same time. Check out the some of the tax rates overseas below!

Here is the full list of countries that have a double taxation agreement with the UK – we’re sure you won’t want to pay 20% in the UK as well as 38% in Norway!

If your country has a double taxation agreement with the UK and both countries tax your income, then you can claim full or partial relief on UK tax on your UK income.

If your country does not have this agreement with the UK, then you can’t claim this relief, but you can get credit for the foreign tax you pay on your overseas income.