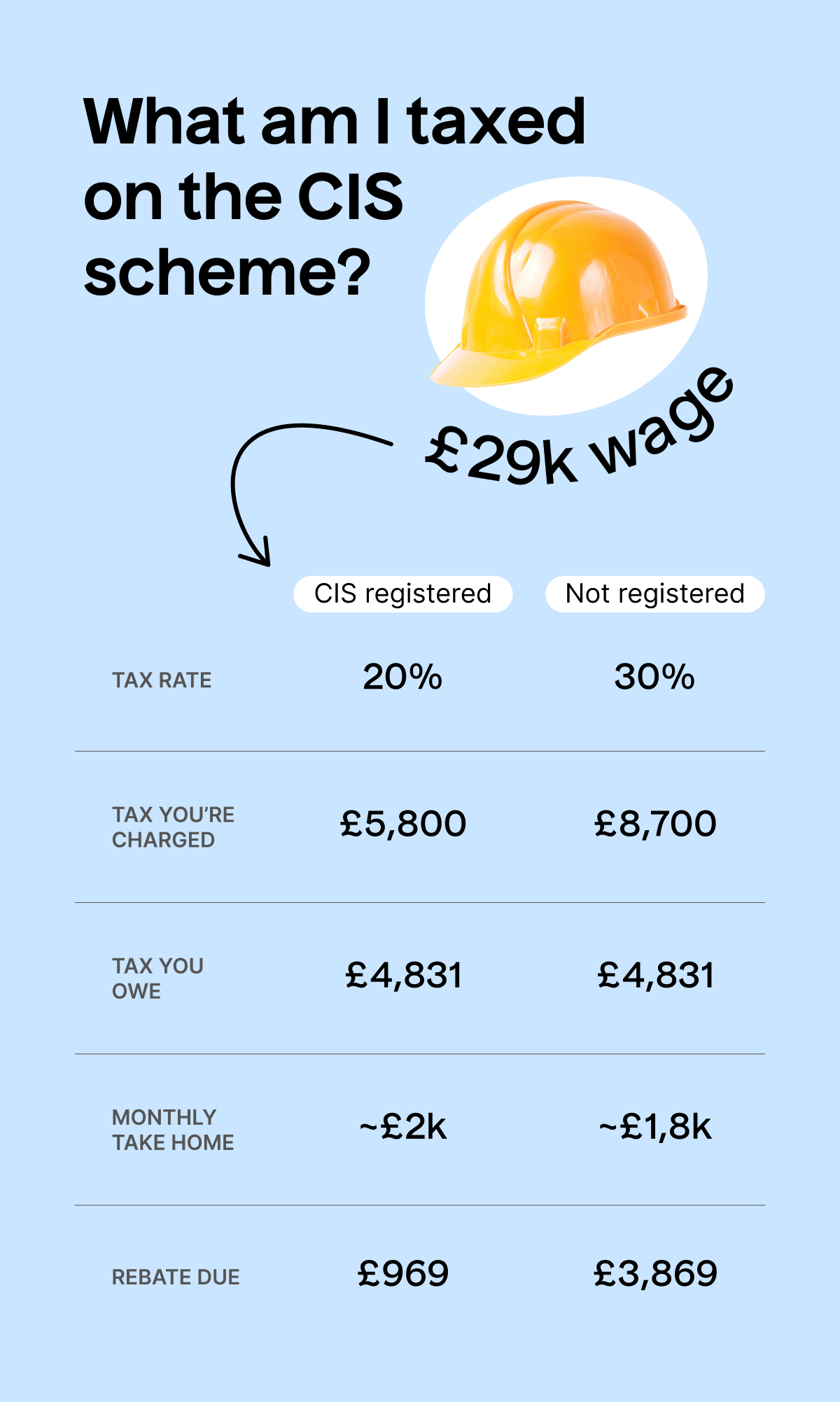

‘Why am I paying 30 percent tax?’ Do you ask yourself this every time you receive your payslip? If so, we can help you understand why subcontractors sometimes pay more in tax, and how this can be reduced to 20 percent. Just read below!

Who has to pay 30% tax?

If you work in the construction industry, and you’re hired by a contractor to carry out work (as a subcontractor), you may have to pay 30% income tax as standard.

Contractors are required to deduct tax before paying a subcontractor. They’ll send these tax deductions to HMRC on your behalf and you’ll get what is known as your ‘net pay’.

If you’re registered with the construction industry scheme (CIS), the contractor will deduct 20% of your earnings for tax, but if you’re not, they’ll have to deduct 30%.

What is the CIS?

CIS stands for construction industry scheme. This is a government scheme that was set up by HMRC as a way of collecting income tax from those who carry out construction work.

The scheme was introduced back in 1971 when HMRC became aware that a large number of workers in the construction industry weren’t paying tax on their earnings.

Contractors are required to register for CIS, but for subcontractors, it’s optional.

So, how can I pay less than 30% tax?

Luckily, if you’re paying 30% tax, there is a way you can reduce your income tax from 30% to 20%. ‘How?’ you say.

✨ By simply registering for the construction industry scheme. ✨

Sign me up! How do I register for CIS?

If 20% tax sounds better than 30% and you want to register for CIS, follow these simple steps:

- Register for HMRC’s online service and enrol for self-employment

- You’ll be sent a UTR number by post and a government gateway ID by email

- Visit www.gov.uk and select the option to register for CIS using your government ID

- Choose your CIS payment status (gross pay or net pay)

👉 For a detailed breakdown of how to register for CIS, read our full guide! 👈

After you’ve registered, any contractors who hire you will be able to verify your CIS status using your UTR and national insurance number. They’ll then withhold 20% of your earnings for tax instead of 30%.

Annoyingly, this process can and often does result in overpayment errors. But don’t worry because if you overpay tax, you can claim a CIS refund.

How do I claim my CIS refund from HMRC?

If you’ve overpaid tax, you can claim a CIS refund on your Self Assessment tax return. You’ll need to declare all of your self-employed income on your tax return.

Under ‘CIS deductions’, you’ll be asked to include any deductions a contractor has made. Using this information, HMRC will work out if you’ve paid too much tax and pay you back.

You can calculate how much tax rebate you may be due using our CIS tax rebate calculator below:

Need a hand with CIS tax? 👋

No worries, one of our accountants can sort your tax return for you! They’ll be sure to include any tax-deductible expenses along with any tax you’ve had deducted under the CIS scheme. Problem solved! ✅

Learn more about our tax return service here.