Why do I have do add additional documents?

TaxScouts can automatically connect to your HMRC account and fill in your PAYE details.

However, in many cases, this is not enough for our accountants to do your tax return.

For example, they might need:

Do I need to add all the documents in one go?

Not at all.

You can start, stop, and pick up the process any time you like. You can also upload additional documents at any point via your phone or computer.

TaxScouts will automatically save your progress.

Step 1

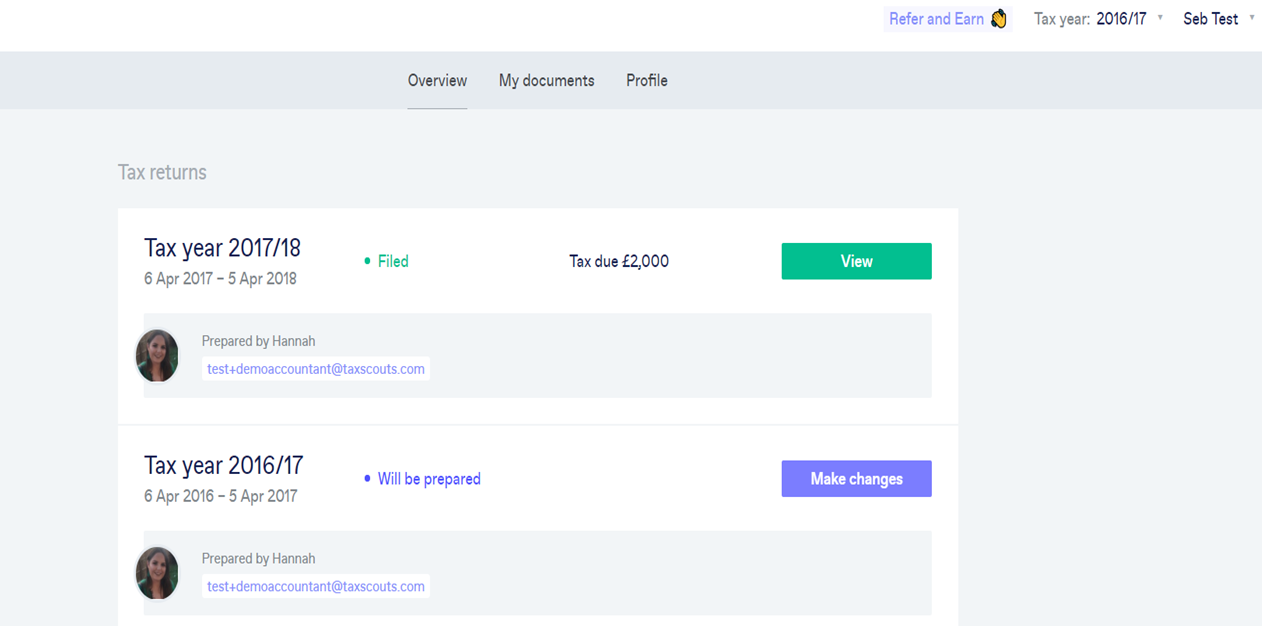

Log into your TaxScouts account and select the tax return you would like to upload documents to.

In this example, I’ll be uploading a document for my 2016/17 tax return, so I’ll click the “make changes” button next to it.

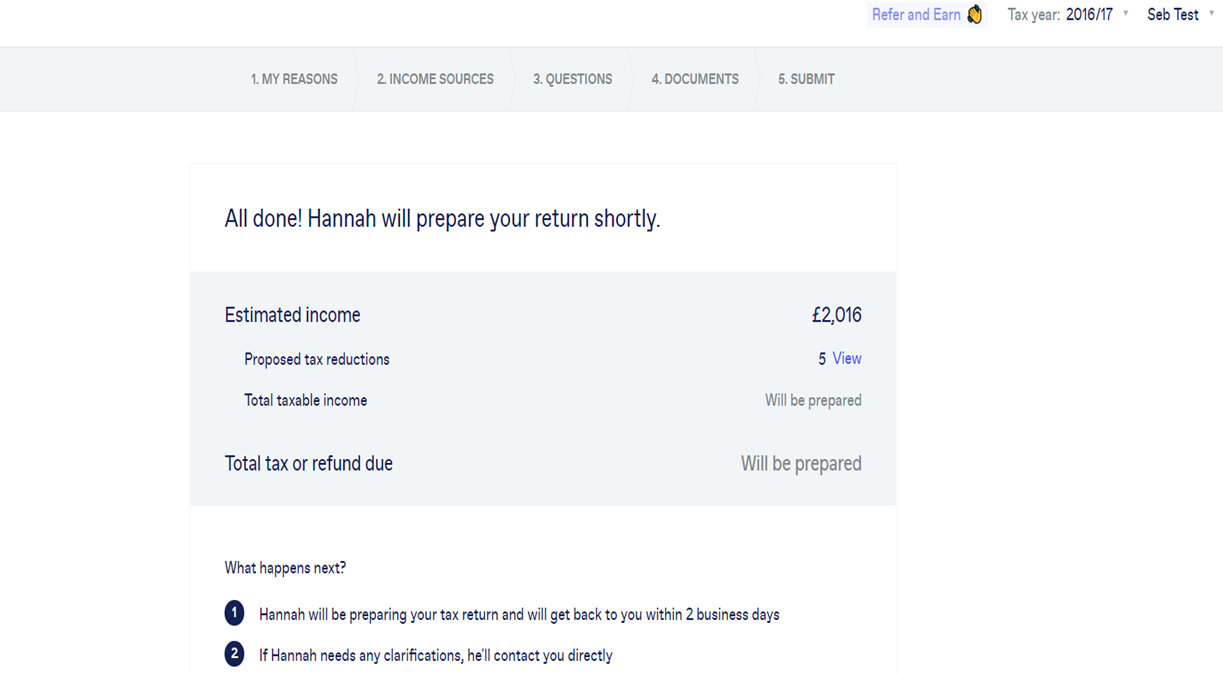

Step 2

Select “documents” on the tab above your tax return.

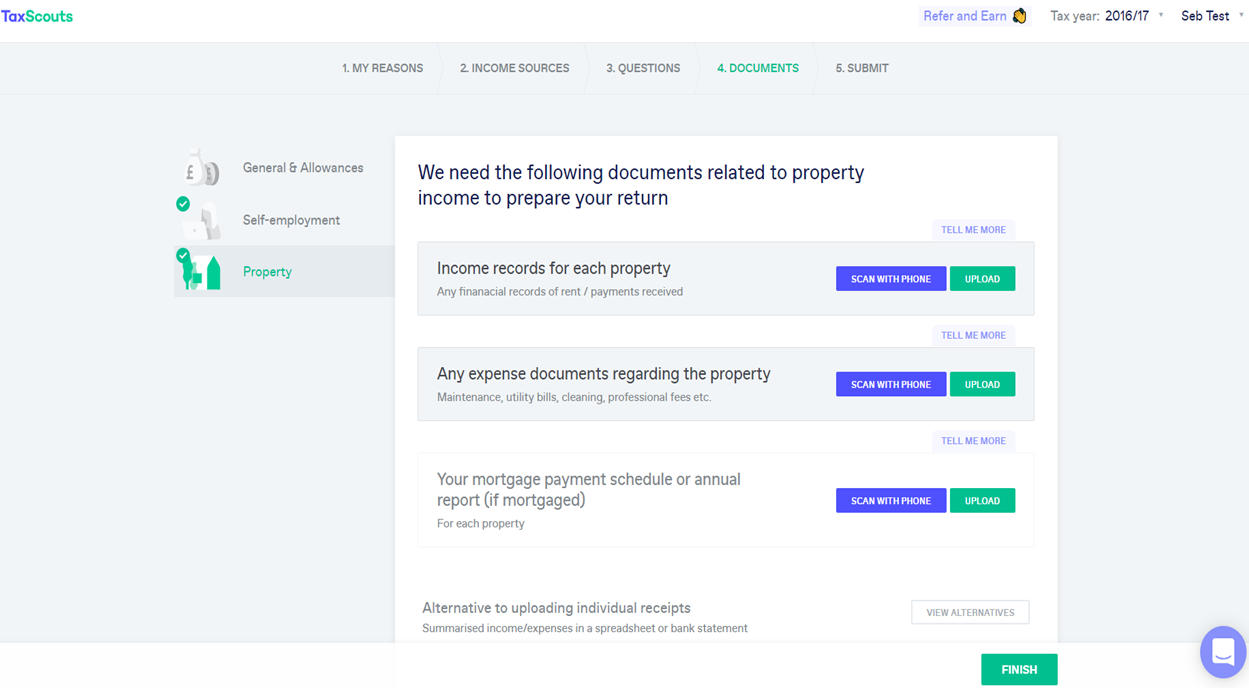

Step 3

Select which section you need to upload documents for from the tab on the left side.

In this case, I’ll upload a spreadsheet that contains income and expenses from your rental property.

Then I’ll select “upload” and navigate to where your spreadsheet is stored on my computer.

Finally, I’ll select “open” then “done” so the document will be uploaded to the profile.

Click “finish”, and it’s done!

Still need help?

If you need any help with uploading your documents, please log in to your TaxScouts account and click on the blue “Help/Chat” icon found on the bottom right side of your account.

We are always a chat away.